Region:Middle East

Author(s):Dev

Product Code:KRAD6408

Pages:97

Published On:December 2025

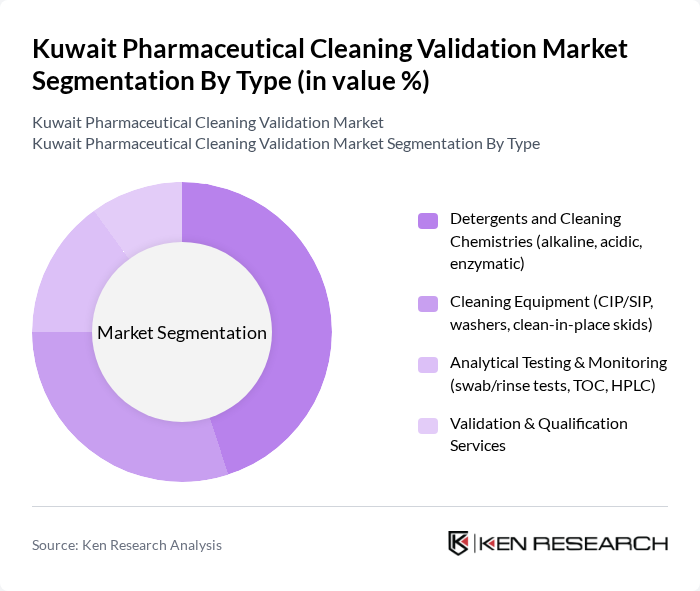

By Type:The market is segmented into various types, including Detergents and Cleaning Chemistries, Cleaning Equipment, Analytical Testing & Monitoring, and Validation & Qualification Services. This structure aligns with global pharmaceutical cleaning validation offerings, where cleaning agents, process/equipment solutions, testing, and services form the core value chain. Among these, Detergents and Cleaning Chemistries are leading due to their essential role in maintaining cleanliness and preventing cross-contamination in pharmaceutical manufacturing and hospital compounding processes. The demand for specialized cleaning agents, particularly enzymatic and alkaline detergents formulated for removal of potent APIs, proteins, and excipients, is on the rise as manufacturers seek to comply with stringent GMP and cleaning validation standards and to support multi-product and highly potent drug manufacturing.

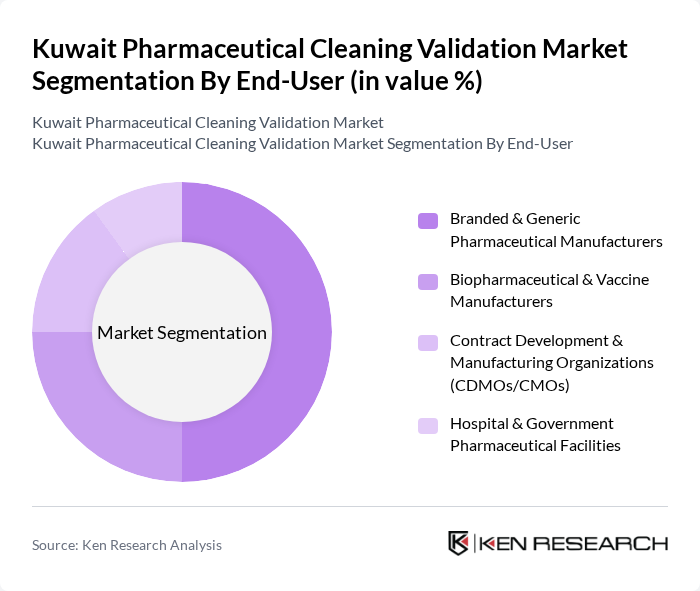

By End-User:The end-user segmentation includes Branded & Generic Pharmaceutical Manufacturers, Biopharmaceutical & Vaccine Manufacturers, Contract Development & Manufacturing Organizations (CDMOs/CMOs), and Hospital & Government Pharmaceutical Facilities. This mix is consistent with global demand patterns, where originator and generic manufacturers, biologics producers, outsourced manufacturers, and institutional pharmacies all drive the need for robust cleaning validation. The Branded & Generic Pharmaceutical Manufacturers segment dominates the market, driven by the increasing production of solid oral, sterile, and specialty formulations, which necessitates rigorous cleaning validation processes to ensure product safety, minimize cross-contamination between high-potency or sensitizing products, and maintain compliance with GCC GMP and WHO GMP expectations.

The Kuwait Pharmaceutical Cleaning Validation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Kuwait Pharmaceutical & Medical Industries Company (KPMI), Gulf Pharmaceutical Industries (Julphar), Hikma Pharmaceuticals PLC, New Mowasat Hospital Pharmacy & Compounding Services, Dar Al Shifa Hospital Pharmacy Services, Ecolab Inc., STERIS Corporation, Merck KGaA (MilliporeSigma), 3M Company, Thermo Fisher Scientific Inc., Avantor, Inc. (VWR International), Getinge AB, Fedegari Autoclavi S.p.A., Local Validation & GMP Consulting Firms (Kuwait- and GCC-based) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait pharmaceutical cleaning validation market appears promising, driven by ongoing advancements in technology and increasing regulatory scrutiny. As companies adapt to these changes, the integration of automation and digital solutions will likely enhance efficiency and compliance. Furthermore, the expansion of biopharmaceutical production facilities will necessitate robust cleaning validation processes. Companies that invest in innovative cleaning technologies and skilled workforce development will be better positioned to capitalize on emerging opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Detergents and Cleaning Chemistries (alkaline, acidic, enzymatic) Cleaning Equipment (CIP/SIP, washers, clean-in-place skids) Analytical Testing & Monitoring (swab/rinse tests, TOC, HPLC) Validation & Qualification Services |

| By End-User | Branded & Generic Pharmaceutical Manufacturers Biopharmaceutical & Vaccine Manufacturers Contract Development & Manufacturing Organizations (CDMOs/CMOs) Hospital & Government Pharmaceutical Facilities |

| By Application | Injectable & Parenteral Products Oral Solid Dosage & Oral Liquids Topical, Ophthalmic & Inhalation Products Highly Potent APIs (HPAPIs) and Hazardous Drugs |

| By Service Type | Cleaning Risk Assessment & Protocol Development Cleaning Validation Execution & Sampling Analytical Method Development & Documentation Periodic Revalidation & Audit Support |

| By Region | Al Asimah (Kuwait City & Suburbs) Al Ahmadi & Southern Industrial Zones Farwaniya, Hawalli & Jahra Free Zones and Other Industrial Areas |

| By Technology | Manual Cleaning & Visual Inspection Automated CIP/SIP and Machine-Assisted Cleaning Single-Use & Disposable Cleaning Solutions Digital & PAT-Enabled Cleaning Validation |

| By Compliance Level | EU-GMP / PIC/S-Compliant Facilities cGMP-Compliant Local Producers Partially Compliant / Under-Upgrade Facilities Non-GMP & Pilot / R&D Facilities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Facilities | 90 | Quality Assurance Managers, Production Supervisors |

| Cleaning Validation Service Providers | 70 | Service Managers, Technical Directors |

| Regulatory Compliance Departments | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Research and Development Labs | 55 | Lab Managers, R&D Directors |

| Industry Associations and Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

The Kuwait Pharmaceutical Cleaning Validation Market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This valuation is influenced by the increasing demand for high-quality pharmaceutical products and stringent regulatory requirements.