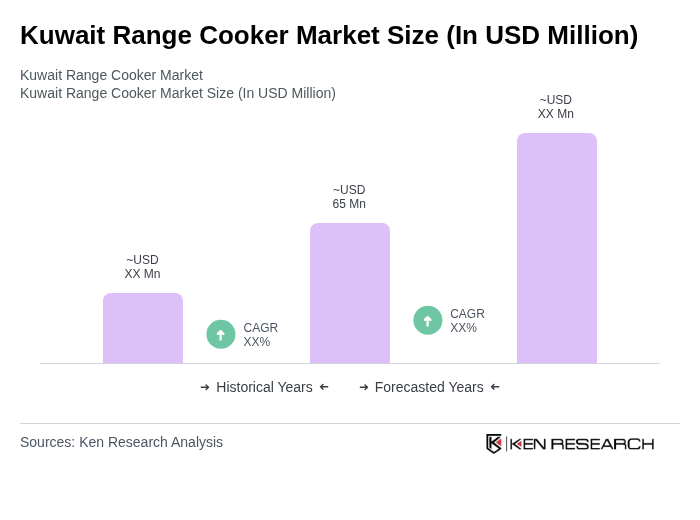

Kuwait Range Cooker Market Overview

- The Kuwait Range Cooker Market is valued at USD 65 million, based on a five-year historical analysis and triangulation from the gas hobs and kitchen appliances segments. This growth is primarily driven by increasing consumer demand for modern kitchen appliances, rising disposable income, and urbanization. The market is experiencing a shift towards energy-efficient, multifunctional, and smart cooking solutions, with consumers showing greater preference for appliances featuring digital controls, induction technology, and modular designs. The adoption of smart kitchen appliances and IoT-enabled features is also accelerating, reflecting evolving consumer lifestyles and a focus on convenience and sustainability .

- Kuwait City remains the dominant hub for range cooker sales, attributed to its high population density, concentration of retail outlets, and affluent consumer base. Other notable areas include Hawalli and Salmiya, where premium kitchen appliances are in demand among urban households. The urban lifestyle, coupled with a growing trend towards home cooking and kitchen renovations, continues to drive demand for advanced range cookers in these regions .

- In 2023, the Kuwaiti government introduced the “Kuwait Energy Efficiency Labeling and Standards for Electrical Appliances, 2023” issued by the Public Authority for Industry. This regulation mandates that all new range cookers and other major kitchen appliances sold in Kuwait must comply with minimum energy performance standards and display official energy efficiency labels. The regulation covers product testing, certification, and labeling requirements, aiming to reduce national energy consumption and promote sustainable living. Manufacturers and importers are required to obtain compliance certification prior to market entry .

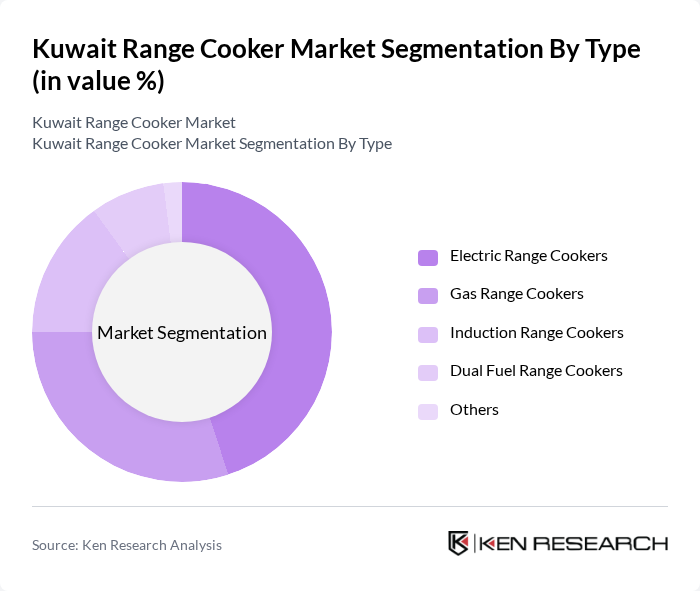

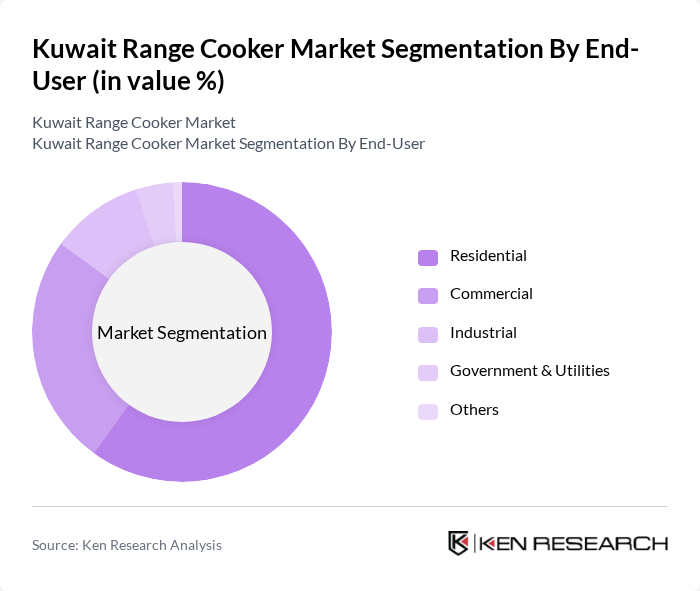

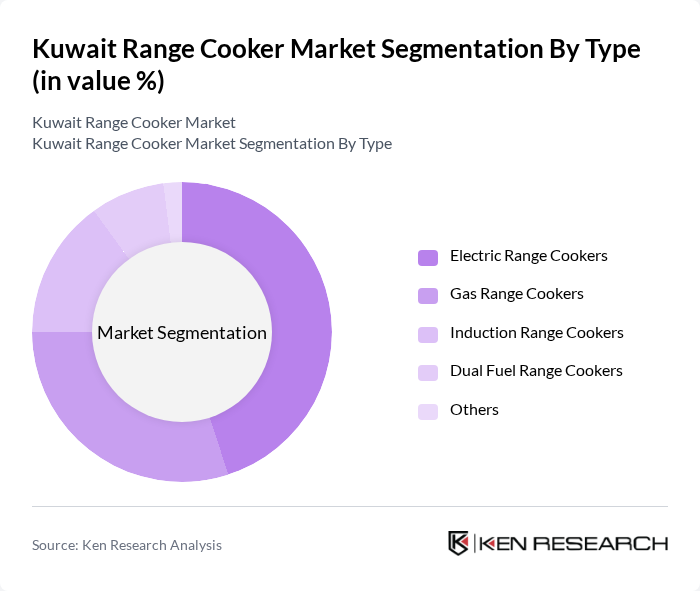

Kuwait Range Cooker Market Segmentation

By Type:The market is segmented into Electric Range Cookers, Gas Range Cookers, Induction Range Cookers, Dual Fuel Range Cookers, and Others. Electric Range Cookers lead the market due to their convenience, ease of use, and increasing integration of smart features. Gas Range Cookers remain popular among consumers who prefer traditional cooking methods and immediate heat control. Induction Range Cookers are gaining market share, driven by their energy efficiency, safety, and rapid heating capabilities. Dual Fuel Range Cookers are increasingly favored for combining the benefits of both gas and electric cooking, appealing to consumers seeking versatility and performance. The “Others” segment includes specialty and compact models tailored for small urban kitchens and niche applications .

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is the largest, driven by the rising number of households, urbanization, and the trend toward home cooking and kitchen modernization. Commercial establishments, such as restaurants, hotels, and catering services, contribute significantly to demand due to their need for high-performance and durable cooking appliances. The Industrial segment, while smaller, is expanding as food processing and institutional kitchens invest in efficient, large-capacity cooking solutions. Government and utility sectors are also adopting modern cooking technologies to improve operational efficiency and meet energy-saving targets .

Kuwait Range Cooker Market Competitive Landscape

The Kuwait Range Cooker Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Industries, M.H. Alshaya Co., Al-Futtaim Group, Carrefour Kuwait, Lulu Hypermarket, Sharaf DG, Home Centre, IKEA Kuwait, Emax Electronics, Xcite by Alghanim Electronics, Al-Manshar Group, United Electronics Company, Al-Bahar Group, Al-Muhalab Group, Al-Sayer Group contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Range Cooker Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Energy-Efficient Appliances:The demand for energy-efficient appliances in Kuwait is surging, driven by rising electricity costs, which reached approximately 0.03 KWD per kWh in future. Consumers are increasingly prioritizing energy savings, with energy-efficient range cookers projected to reduce energy consumption by up to 30%. This shift is supported by government initiatives promoting energy conservation, aiming for a 20% reduction in national energy consumption in future, further fueling market growth.

- Rising Disposable Income and Urbanization:Kuwait's GDP per capita is expected to reach around 32,000 KWD in future, reflecting a growing disposable income among consumers. This economic growth, coupled with urbanization rates of approximately 100%, is leading to increased spending on home appliances, including range cookers. As more households move to urban areas, the demand for modern cooking solutions that cater to busy lifestyles is expected to rise significantly, enhancing market prospects.

- Technological Advancements in Cooking Appliances:The Kuwait range cooker market is witnessing rapid technological advancements, with smart cooking technologies gaining traction. In future, it is estimated that 40% of new range cookers will feature smart capabilities, such as app connectivity and automated cooking settings. This trend is driven by consumer interest in convenience and efficiency, as well as the increasing availability of IoT-enabled devices, which are projected to enhance user experience and drive sales.

Market Challenges

- High Initial Investment Costs:One of the significant challenges facing the Kuwait range cooker market is the high initial investment costs associated with advanced cooking appliances. Premium range cookers can cost upwards of 500 KWD, which may deter price-sensitive consumers. This challenge is exacerbated by the economic climate, where inflation rates are projected to hover around 3.7% in future, impacting consumer purchasing power and limiting market growth.

- Intense Competition from Local and International Brands:The Kuwait range cooker market is characterized by intense competition, with numerous local and international brands vying for market share. In future, it is estimated that over 50 brands will compete in this space, leading to price wars and aggressive marketing strategies. This saturation can make it challenging for new entrants to establish a foothold, as established brands leverage brand loyalty and distribution networks to maintain their market positions.

Kuwait Range Cooker Market Future Outlook

The future of the Kuwait range cooker market appears promising, driven by technological innovations and changing consumer preferences. As smart home technology continues to evolve, consumers are likely to seek appliances that offer enhanced connectivity and functionality. Additionally, the growing emphasis on sustainability will push manufacturers to develop eco-friendly products. With the expansion of e-commerce platforms, consumers will have greater access to a variety of range cookers, further stimulating market growth and diversification in product offerings.

Market Opportunities

- Expansion of E-commerce Platforms:The rise of e-commerce in Kuwait presents a significant opportunity for the range cooker market. With online retail sales projected to reach 1 billion KWD in future, brands can leverage digital platforms to reach a broader audience. This shift allows for enhanced customer engagement and the ability to showcase product features effectively, driving sales and brand visibility.

- Introduction of Smart Cooking Technologies:The integration of smart cooking technologies into range cookers offers a lucrative opportunity for manufacturers. As consumer interest in smart home devices grows, the demand for range cookers with features like remote control and recipe guidance is expected to increase. This trend aligns with the projected 25% growth in smart appliance sales in Kuwait in future, indicating a favorable market environment for innovation.