Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9055

Pages:95

Published On:November 2025

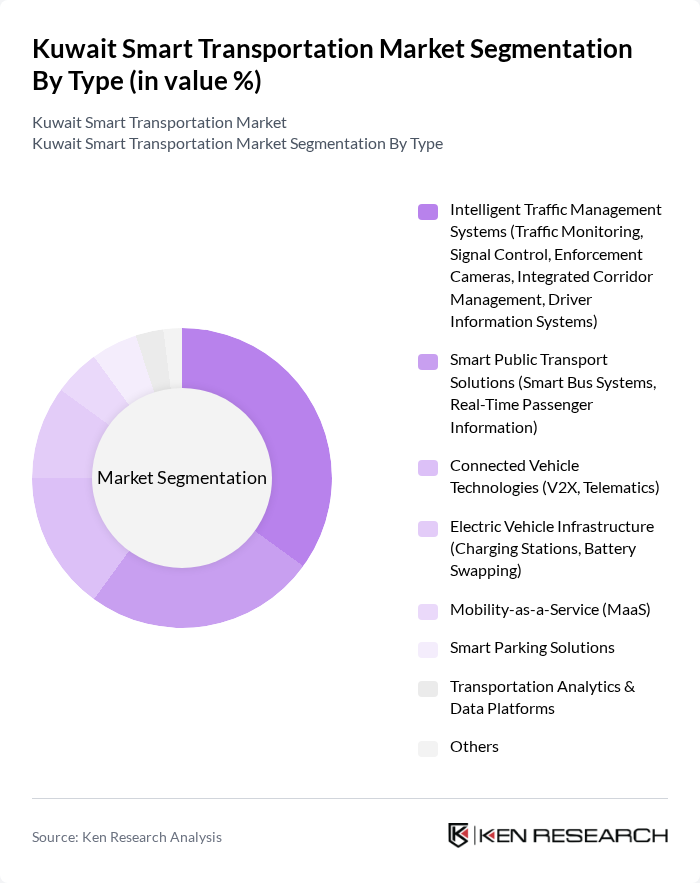

By Type:The market can be segmented into various types, including Intelligent Traffic Management Systems, Smart Public Transport Solutions, Connected Vehicle Technologies, Electric Vehicle Infrastructure, Mobility-as-a-Service, Smart Parking Solutions, Transportation Analytics & Data Platforms, and Others. Among these,Intelligent Traffic Management Systemsare leading due to the increasing need for efficient traffic flow and safety measures in urban areas. The demand for real-time data and analytics is driving the adoption of these systems, making them essential for modern transportation networks. The segment is further supported by the rapid establishment of smart cities and the deployment of advanced monitoring and enforcement technologies .

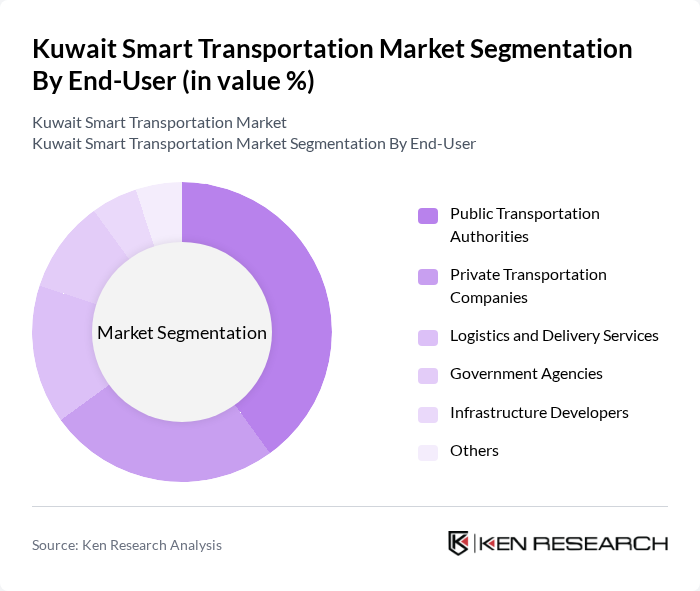

By End-User:The end-user segmentation includes Public Transportation Authorities, Private Transportation Companies, Logistics and Delivery Services, Government Agencies, Infrastructure Developers, and Others.Public Transportation Authoritiesare the leading segment, driven by the need for efficient public transport systems and the increasing investment in smart transportation solutions. The focus on enhancing public transport services, reducing traffic congestion, and implementing digital ticketing and fleet management systems has made this segment a priority for both government and private stakeholders .

The Kuwait Smart Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Public Transport Company (KPTC), KGL Transportation Company, Agility Logistics, Alghanim Industries, Zain Group, Gulf Bank, National Petroleum Services Company (NAPESCO), Kuwait Investment Authority, Kuwait Airways, Kuwait Oil Company, Al-Mazaya Holding, Al-Sayer Group, KIPCO (Kuwait Projects Company Holding), Thales Group, Siemens AG, TomTom NV, Q-Free ASA, TransCore, Cubic Corporation, Atkins (SNC-Lavalin Group), Kapsch Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait smart transportation market appears promising, driven by ongoing urbanization and government support for smart city initiatives. As the population continues to grow, the demand for efficient and sustainable transportation solutions will increase. The integration of electric and autonomous vehicles, along with advancements in IoT technologies, will play a crucial role in shaping the market. Additionally, the focus on sustainable practices will likely lead to innovative solutions that enhance urban mobility while reducing environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Intelligent Traffic Management Systems (Traffic Monitoring, Signal Control, Enforcement Cameras, Integrated Corridor Management, Driver Information Systems) Smart Public Transport Solutions (Smart Bus Systems, Real-Time Passenger Information) Connected Vehicle Technologies (V2X, Telematics) Electric Vehicle Infrastructure (Charging Stations, Battery Swapping) Mobility-as-a-Service (MaaS) Smart Parking Solutions Transportation Analytics & Data Platforms Others |

| By End-User | Public Transportation Authorities Private Transportation Companies Logistics and Delivery Services Government Agencies Infrastructure Developers Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Technology | IoT Solutions AI and Machine Learning Applications Cloud Computing Solutions Blockchain Technology G & V2X Communication Others |

| By Application | Public Transport Systems Freight and Logistics Personal Mobility Emergency Services Smart Parking Traffic Management Others |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships (PPP) International Aid and Grants Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks Public Awareness Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Users | 120 | Commuters, Public Transport Authorities |

| Logistics and Freight Operators | 60 | Logistics Managers, Supply Chain Managers |

| Smart Technology Providers | 40 | Product Managers, Business Development Leads |

| Urban Planners and Policy Makers | 50 | City Planners, Transportation Policy Analysts |

| Private Vehicle Owners | 70 | Car Owners, Fleet Managers |

The Kuwait Smart Transportation Market is valued at approximately USD 100 million, reflecting a five-year historical analysis. This growth is driven by urbanization, government initiatives, and the demand for efficient traffic management solutions.