Region:Middle East

Author(s):Shubham

Product Code:KRAD1042

Pages:93

Published On:November 2025

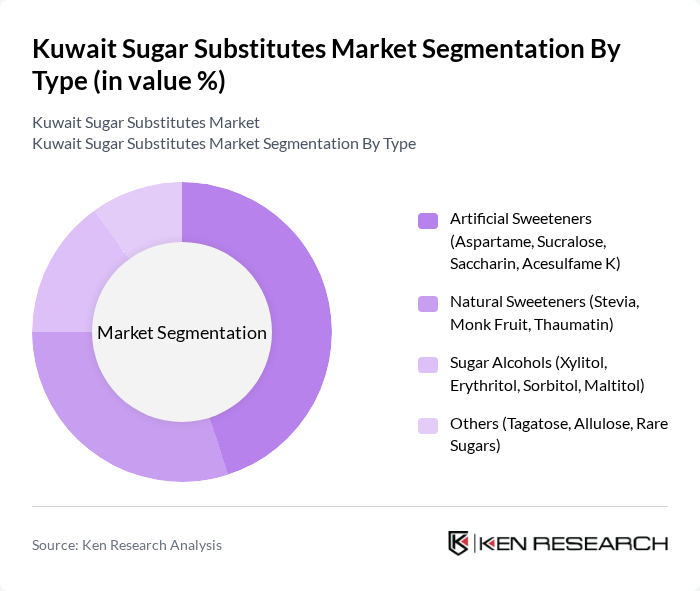

By Type:The market is segmented into various types of sugar substitutes, including artificial sweeteners, natural sweeteners, sugar alcohols, and others. Each type addresses distinct consumer preferences and dietary requirements. Artificial sweeteners, such as aspartame and sucralose, are widely used in processed foods and beverages due to their high sweetness intensity and low-calorie content. Natural sweeteners like stevia and monk fruit are gaining popularity among health-conscious consumers seeking plant-based and organic options. Sugar alcohols, such as xylitol and erythritol, are favored for their lower glycemic index, making them suitable for diabetic and calorie-conscious consumers .

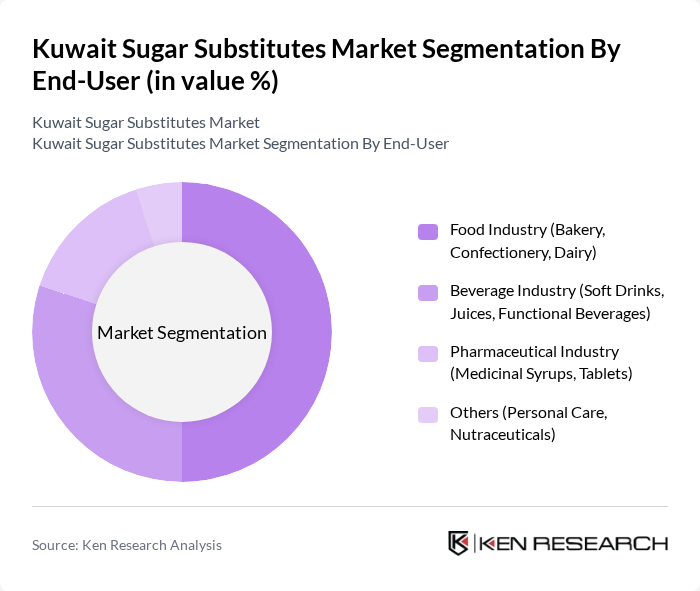

By End-User:The sugar substitutes market serves various end-user industries, including food, beverages, pharmaceuticals, and personal care. The food industry, particularly bakery and confectionery, is the largest consumer of sugar substitutes, driven by the demand for low-calorie and sugar-free products. The beverage industry follows closely, with soft drinks and functional beverages increasingly incorporating sugar substitutes to cater to health-conscious consumers. The pharmaceutical sector also utilizes sugar substitutes in medicinal syrups and tablets, enhancing palatability without adding calories. Personal care and nutraceuticals segments are emerging, reflecting the growing use of sugar substitutes in oral care and dietary supplements .

The Kuwait Sugar Substitutes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tate & Lyle PLC, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Roquette Frères, PureCircle (a subsidiary of Ingredion), GLG Life Tech Corporation, Stevia First Corp., NutraSweet Company, Ajinomoto Co., Inc., Merisant Company, Whole Earth Brands, Sunwin Stevia International, SweeGen Inc., and Kerry Group plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait sugar substitutes market appears promising, driven by increasing health consciousness and government initiatives aimed at reducing sugar intake. As consumer preferences shift towards healthier options, the market is likely to see a rise in innovative product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater access to sugar substitutes, allowing consumers to explore a wider range of products. This evolving landscape presents significant opportunities for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Artificial Sweeteners (Aspartame, Sucralose, Saccharin, Acesulfame K) Natural Sweeteners (Stevia, Monk Fruit, Thaumatin) Sugar Alcohols (Xylitol, Erythritol, Sorbitol, Maltitol) Others (Tagatose, Allulose, Rare Sugars) |

| By End-User | Food Industry (Bakery, Confectionery, Dairy) Beverage Industry (Soft Drinks, Juices, Functional Beverages) Pharmaceutical Industry (Medicinal Syrups, Tablets) Others (Personal Care, Nutraceuticals) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores (Health Food Stores, Pharmacies) Others (Direct Sales, Institutional Sales) |

| By Formulation | Liquid Form Powder Form Granular Form Others (Tablets, Sachets) |

| By Application | Bakery Products Dairy Products Confectionery Others (Beverages, Pharmaceuticals) |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Health-Conscious Consumers Diabetic Consumers Others (Fitness Enthusiasts, Weight Management) |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others (Single-Serve, Institutional Packs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturers | 90 | Product Development Managers, Quality Assurance Managers |

| Health and Wellness Experts | 60 | Nutritionists, Dietitians, Health Coaches |

| Retail Sector Insights | 70 | Store Managers, Category Buyers |

| Consumer Preferences | 110 | General Consumers, Health-Conscious Shoppers |

| Market Analysts | 40 | Market Research Analysts, Industry Consultants |

The Kuwait Sugar Substitutes Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increasing health consciousness and a shift towards low-calorie diets among consumers.