Region:Middle East

Author(s):Rebecca

Product Code:KRAA9326

Pages:88

Published On:November 2025

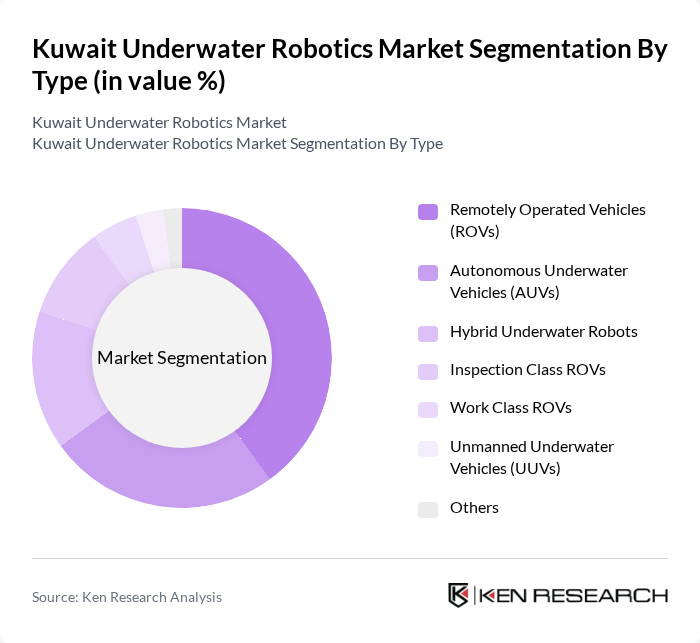

By Type:The underwater robotics market can be segmented into various types, including Remotely Operated Vehicles (ROVs), Autonomous Underwater Vehicles (AUVs), Hybrid Underwater Robots, Inspection Class ROVs, Work Class ROVs, Unmanned Underwater Vehicles (UUVs), and Others. Among these, ROVs are particularly dominant due to their versatility and widespread application in oil and gas exploration, underwater inspections, and maintenance tasks. The increasing complexity of underwater operations has led to a growing preference for ROVs, which offer real-time control and high maneuverability. Global market data indicates that ROVs captured approximately 62% of the underwater robotics market share, reflecting their critical role in deepwater operations.

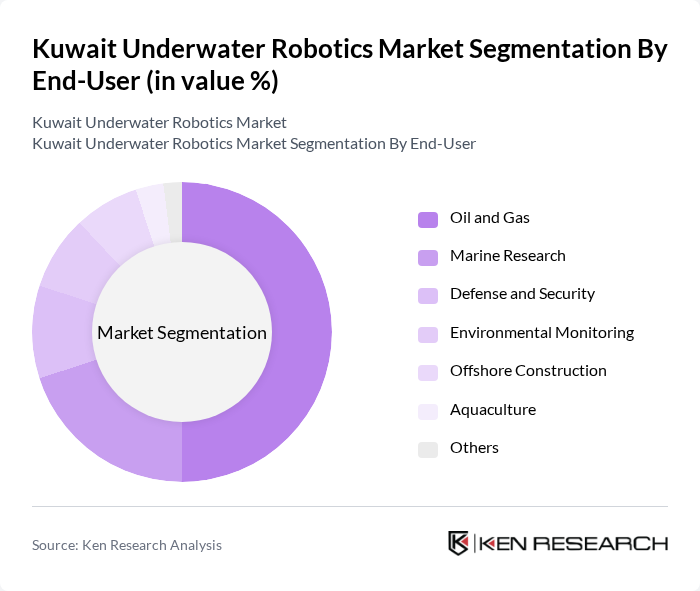

By End-User:The end-user segmentation includes Oil and Gas, Marine Research, Defense and Security, Environmental Monitoring, Offshore Construction, Aquaculture, and Others. The Oil and Gas sector is the leading end-user, driven by the need for efficient underwater inspections, maintenance, and exploration activities. The increasing investments in offshore oil fields and the necessity for environmental compliance have further solidified the oil and gas industry's dominance in the underwater robotics market.

The Kuwait Underwater Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kongsberg Maritime, Oceaneering International, Teledyne Marine, Saab Seaeye, Schilling Robotics (a TechnipFMC company), Bluefin Robotics (a General Dynamics company), ECA Group, Forum Energy Technologies, Deep Ocean Engineering, Hydroid (a Huntington Ingalls Industries company), iRobot (Maritime Division), Ocean Infinity, ROV Planet, Subsea 7, Triton Submarines, Fugro, TechnipFMC, Deep Trekker, VideoRay, Seatronics (an Acteon company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait underwater robotics market appears promising, driven by technological advancements and increasing demand for marine exploration. As the government continues to invest in underwater infrastructure and environmental monitoring, the integration of AI and autonomous systems will likely enhance operational efficiency. Furthermore, public-private partnerships are expected to foster innovation and reduce costs, making underwater robotics more accessible to various sectors, including oil and gas, research, and tourism.

| Segment | Sub-Segments |

|---|---|

| By Type | Remotely Operated Vehicles (ROVs) Autonomous Underwater Vehicles (AUVs) Hybrid Underwater Robots Inspection Class ROVs Work Class ROVs Unmanned Underwater Vehicles (UUVs) Others |

| By End-User | Oil and Gas Marine Research Defense and Security Environmental Monitoring Offshore Construction Aquaculture Others |

| By Application | Underwater Inspection Surveying and Mapping Maintenance and Repair Data Collection Search and Salvage Archaeology and Exploration Others |

| By Payload Capacity | Light Payload Medium Payload Heavy Payload Extra Large Payload Others |

| By Technology | Electric Propulsion Hydraulic Propulsion Hybrid Systems AI-Enabled Systems Others |

| By Market Segment | Commercial Government Research Institutions Military Others |

| By Region | Northern Kuwait Southern Kuwait Central Kuwait Offshore Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Sector Robotics | 90 | Operations Managers, Technology Directors |

| Marine Research Institutions | 60 | Research Scientists, Program Coordinators |

| Environmental Monitoring Applications | 50 | Environmental Analysts, Project Managers |

| Commercial Underwater Services | 40 | Business Development Managers, Service Engineers |

| Educational Institutions and Universities | 40 | Professors, Graduate Research Assistants |

The Kuwait Underwater Robotics Market is valued at approximately USD 165 million, reflecting significant growth driven by advancements in underwater exploration technologies, particularly in the oil and gas sector and marine research initiatives.