Region:Middle East

Author(s):Rebecca

Product Code:KRAD2706

Pages:97

Published On:November 2025

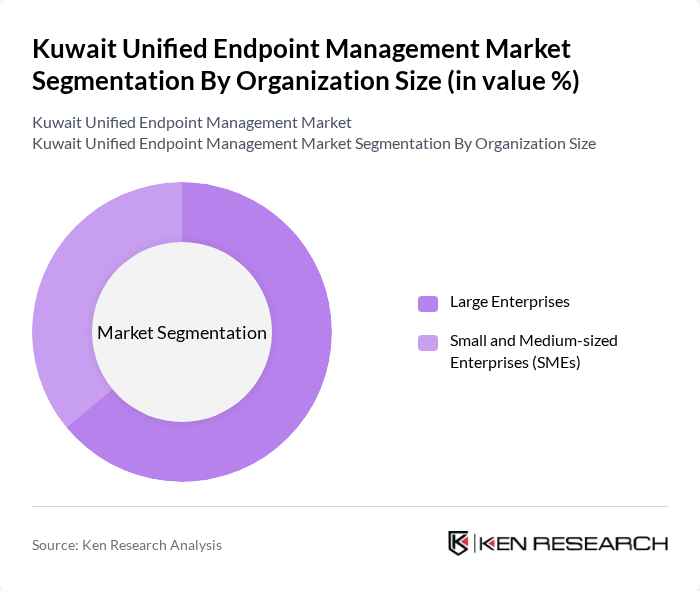

By Organization Size:

The Kuwait Unified Endpoint Management Market is segmented by organization size into two main categories: Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large enterprises hold a significant share of the market due to their extensive IT infrastructure, complex compliance requirements, and higher technology budgets. These organizations require comprehensive endpoint management to secure a vast number of devices and ensure regulatory compliance. SMEs are increasingly adopting UEM solutions, driven by the need for cost-effective, scalable management tools, but often face budget and resource constraints that can limit investment in advanced features .

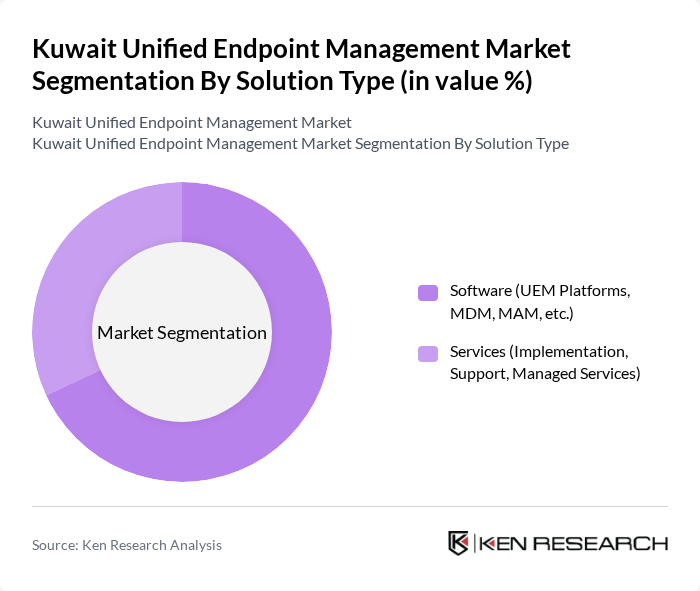

By Solution Type:

The market is also segmented by solution type into Software and Services. Software solutions—including UEM platforms, Mobile Device Management (MDM), and Mobile Application Management (MAM)—hold the largest share, driven by the need for centralized, automated management of diverse endpoints. Services, such as implementation, integration, technical support, and managed services, are increasingly important as organizations seek to optimize their UEM strategies and ensure seamless integration with existing IT systems. The growing complexity of endpoint environments and the need for ongoing compliance and security support are fueling demand for both solution types .

The Kuwait Unified Endpoint Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft, VMware, IBM, Citrix Systems, Ivanti, ManageEngine (Zoho Corporation), SOTI, Cisco Systems, BlackBerry, Jamf, Sophos, Check Point Software Technologies, Trend Micro, Micro Focus, and Huawei contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Unified Endpoint Management market appears promising, driven by technological advancements and increasing digital transformation initiatives. Organizations are expected to prioritize investments in UEM solutions to enhance security and streamline operations. The integration of artificial intelligence and machine learning into UEM platforms will further optimize device management, while the growing emphasis on data privacy will compel businesses to adopt robust compliance measures. As remote work continues to evolve, UEM solutions will play a pivotal role in ensuring secure and efficient operations across diverse environments.

| Segment | Sub-Segments |

|---|---|

| By Organization Size | Large Enterprises Small and Medium-sized Enterprises (SMEs) |

| By Solution Type | Software (UEM Platforms, MDM, MAM, etc.) Services (Implementation, Support, Managed Services) |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Device Type | Smartphones Tablets Laptops Desktops IoT Devices |

| By Industry Vertical | IT & Telecommunications Government & Public Sector Healthcare Education Banking, Financial Services & Insurance (BFSI) Retail Manufacturing |

| By Region | Kuwait City & Central Region Southern Kuwait Northern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Sector UEM Adoption | 60 | IT Managers, Compliance Officers |

| Financial Services UEM Implementation | 50 | Security Analysts, IT Directors |

| Education Sector Device Management | 40 | Network Administrators, Educational Technologists |

| Retail Industry Endpoint Security | 45 | Operations Managers, IT Support Staff |

| Government UEM Strategies | 40 | Policy Makers, IT Governance Officers |

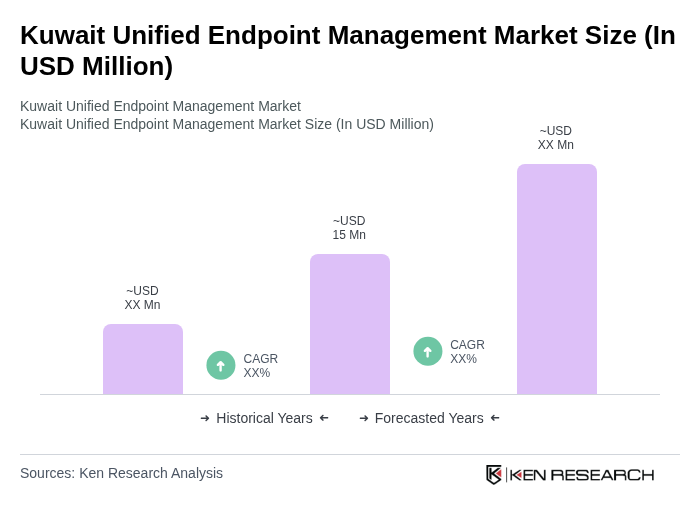

The Kuwait Unified Endpoint Management Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of mobile devices and the expansion of IoT technologies.