Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9212

Pages:94

Published On:November 2025

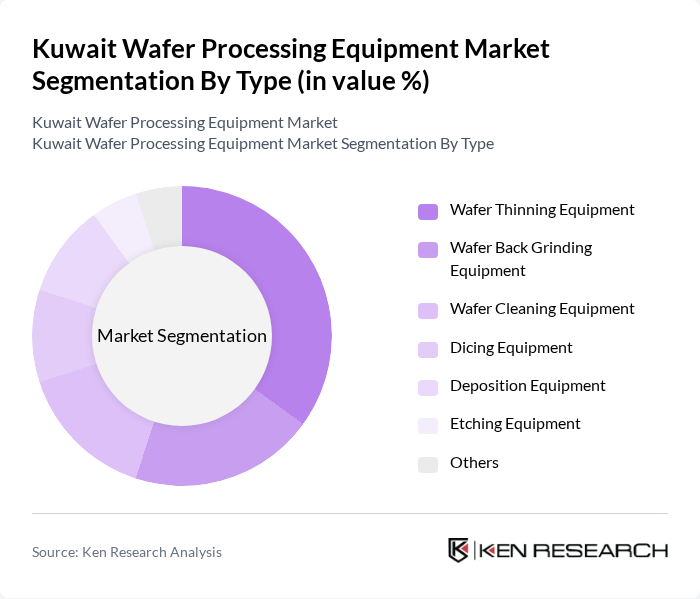

By Type:The market is segmented into Wafer Thinning Equipment, Wafer Back Grinding Equipment, Wafer Cleaning Equipment, Dicing Equipment, Deposition Equipment, Etching Equipment, and Others. Wafer Thinning Equipment remains the leading sub-segment, reflecting its critical role in enabling the production of thinner, higher-performance semiconductor devices. The demand for thinner wafers continues to rise, particularly in consumer electronics, automotive, and next-generation applications such as 5G and AI, where device miniaturization and power efficiency are paramount .

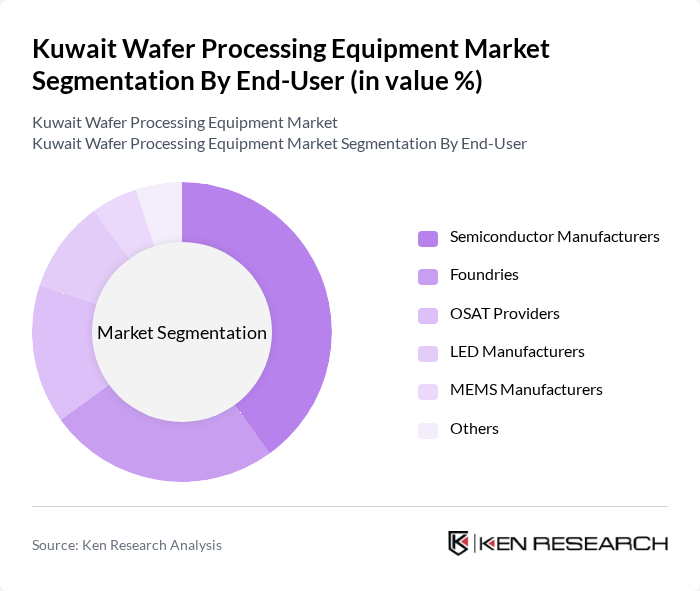

By End-User:The end-user segmentation includes Semiconductor Manufacturers, Foundries, OSAT (Outsourced Semiconductor Assembly and Test) Providers, LED Manufacturers, MEMS Manufacturers, and Others. Semiconductor Manufacturers dominate this segment, driven by the increasing demand for integrated circuits and microchips in consumer electronics, automotive, and telecommunications. The expansion of the electronics industry in Kuwait, supported by government incentives and investment in advanced manufacturing, has led to a surge in semiconductor production, reinforcing the leadership of this sub-segment .

The Kuwait Wafer Processing Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Applied Materials, Inc., Lam Research Corporation, Tokyo Electron Limited, ASML Holding N.V., KLA Corporation, Hitachi High-Tech Corporation, Nikon Corporation, Teradyne, Inc., Advantest Corporation, Ultratech (Veeco Instruments Inc.), SPTS Technologies Ltd. (a KLA company), Chroma ATE Inc., Cohu, Inc., DISCO Corporation, Plasma-Therm LLC, EV Group (EVG), Suzhou Delphi Laser Co., Ltd., Advanced Dicing Technologies Ltd., Tokyo Seimitsu Co., Ltd., Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait wafer processing equipment market appears promising, driven by ongoing technological advancements and government support for local manufacturing. As the demand for semiconductor devices continues to rise, local manufacturers are likely to invest in automation and eco-friendly processing technologies. Additionally, collaborations with international technology firms may enhance knowledge transfer and innovation, positioning Kuwait as a competitive player in the global semiconductor landscape while addressing sustainability concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Wafer Thinning Equipment Wafer Back Grinding Equipment Wafer Cleaning Equipment Dicing Equipment Deposition Equipment Etching Equipment Others |

| By End-User | Semiconductor Manufacturers Foundries OSAT (Outsourced Semiconductor Assembly and Test) Providers LED Manufacturers MEMS Manufacturers Others |

| By Application | Consumer Electronics Automotive Electronics Industrial Automation Medical Devices Telecommunications Others |

| By Material Type | Silicon Gallium Nitride (GaN) Silicon Carbide (SiC) Others |

| By Technology | Photolithography Etching (Dry, Wet, Plasma) Deposition (CVD, PVD, ALD) Dicing (Laser, Mechanical, Stealth) Cleaning (Wet, Dry, Plasma) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing Firms | 100 | Production Managers, Quality Control Engineers |

| Wafer Processing Equipment Suppliers | 60 | Sales Directors, Product Managers |

| Research Institutions and Universities | 45 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-User Industries (e.g., Electronics, Automotive) | 85 | Operations Managers, Supply Chain Analysts |

The Kuwait Wafer Processing Equipment Market is valued at approximately USD 15 million, reflecting its share in the global wafer processing equipment industry, which is driven by the increasing demand for semiconductor devices across various sectors.