Region:Middle East

Author(s):Geetanshi

Product Code:KRAA8986

Pages:94

Published On:November 2025

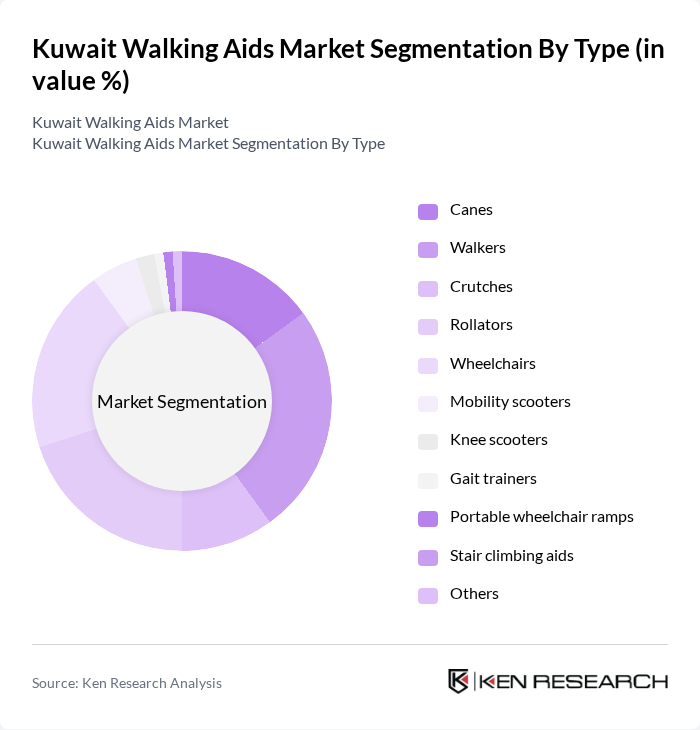

By Type:The walking aids market can be segmented into various types, including canes, walkers, crutches, rollators, wheelchairs, mobility scooters, knee scooters, gait trainers, portable wheelchair ramps, stair climbing aids, and others. Among these, wheelchairs and walkers are the most popular due to their widespread use in both home care and clinical settings. The increasing prevalence of mobility impairments among the elderly population significantly drives the demand for these products. Additionally, innovations in design and functionality, including lightweight materials and smart technology integration, have made these aids more appealing to consumers, further boosting their market presence.

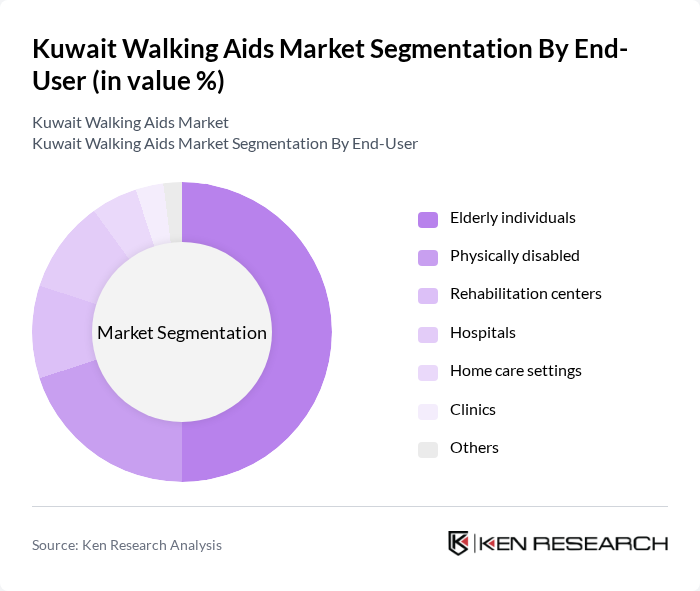

By End-User:The end-user segmentation includes elderly individuals, physically disabled persons, rehabilitation centers, hospitals, home care settings, clinics, and others. The elderly population is the largest segment, driven by the increasing number of senior citizens requiring mobility assistance. Rehabilitation centers and hospitals also represent significant end-users, as they provide essential services for recovery and mobility enhancement. The growing trend of home care services further supports the demand for walking aids among elderly individuals living independently.

The Kuwait Walking Aids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Invacare Corporation, Sunrise Medical, Drive DeVilbiss Healthcare, Ottobock, Medline Industries, Karman Healthcare, Pride Mobility Products, TGA Mobility, Permobil, Meyra GmbH, Carex Health Brands, Nova Medical Products, Essential Medical Supply, Reham Medical Equipment (Kuwait), Al Essa Medical & Scientific Equipment Co. (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the walking aids market in Kuwait appears promising, driven by demographic shifts and technological innovations. As the elderly population continues to grow, the demand for mobility solutions will likely increase. Additionally, the integration of smart technology into walking aids is expected to enhance user experience and attract a broader consumer base. With ongoing government support for healthcare initiatives, the market is poised for expansion, fostering a more inclusive environment for individuals with mobility challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Canes Walkers Crutches Rollators Wheelchairs Mobility scooters Knee scooters Gait trainers Portable wheelchair ramps Stair climbing aids Others |

| By End-User | Elderly individuals Physically disabled Rehabilitation centers Hospitals Home care settings Clinics Others |

| By Distribution Channel | Online retail Pharmacies Medical supply stores Hospitals Direct sales E-commerce platforms Others |

| By Material | Aluminum Steel Plastic Carbon fiber Composite materials Others |

| By Price Range | Low-cost Mid-range Premium Others |

| By Brand | Local brands International brands Private labels Others |

| By User Demographics | Age group Gender Income level Urban vs. rural Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 60 | Physiotherapists, Occupational Therapists |

| Elderly Users of Walking Aids | 50 | Senior Citizens, Caregivers |

| Retailers of Mobility Aids | 40 | Store Managers, Sales Representatives |

| Healthcare Policy Makers | 40 | Government Officials, Health Administrators |

| Insurance Providers | 40 | Claims Adjusters, Policy Analysts |

The Kuwait Walking Aids Market is valued at approximately USD 18 million, reflecting a significant growth trend driven by an increasing elderly population, rising awareness of mobility solutions, and advancements in product technology.