Region:Middle East

Author(s):Shubham

Product Code:KRAC4328

Pages:87

Published On:October 2025

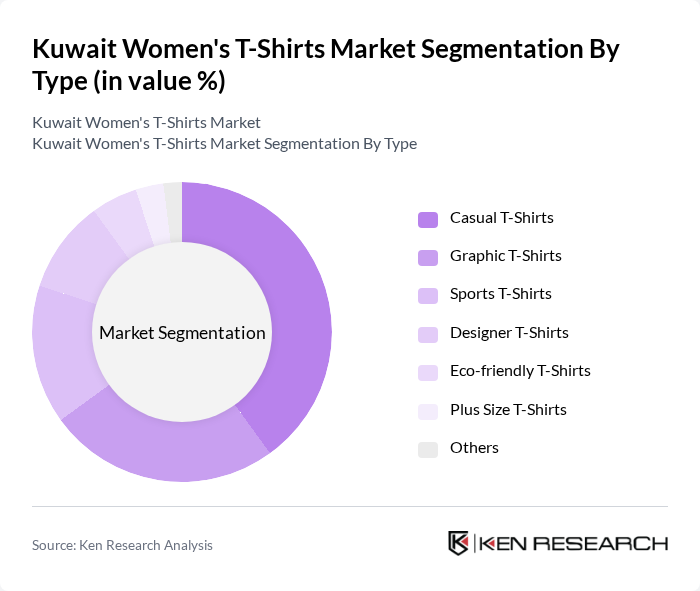

By Type:The market is segmented into various types of T-shirts, including Casual T-Shirts, Graphic T-Shirts, Sports T-Shirts, Designer T-Shirts, Eco-friendly T-Shirts, Plus Size T-Shirts, and Others. Among these, Casual T-Shirts dominate the market due to their versatility and comfort, appealing to a wide range of consumers. Graphic T-Shirts also see significant demand, particularly among younger demographics who favor expressive designs. The trend towards Eco-friendly T-Shirts is gaining traction as consumers become more environmentally conscious .

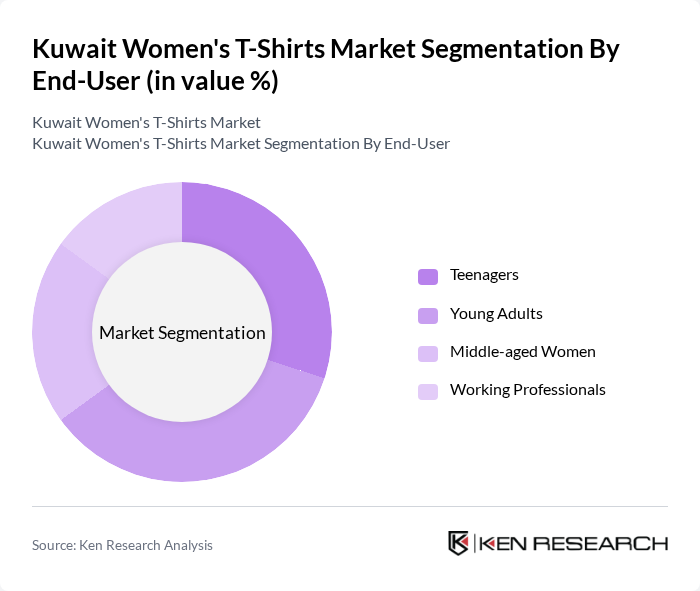

By End-User:The end-user segmentation includes Teenagers, Young Adults, Middle-aged Women, and Working Professionals. The Young Adults segment is the most significant contributor to the market, driven by fashion trends and social media influence. Teenagers also represent a substantial portion of the market, often seeking trendy and affordable options. Middle-aged women and working professionals are increasingly opting for comfortable yet stylish T-shirts, reflecting a shift in workplace attire norms .

The Kuwait Women's T-Shirts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alshaya Group (operates H&M, American Eagle, and other brands), Landmark Group (operates Splash, Max Fashion), Azadea Group (operates Bershka, Pull&Bear, Zara, Stradivarius), Apparel Group (operates R&B, Aeropostale, Tommy Hilfiger), Al-Futtaim Group (operates Marks & Spencer, Ted Baker), LC Waikiki, Centrepoint (Landmark Group), Next PLC, Mango, OVS, Max Fashion (Landmark Group), H&M (Alshaya Group), American Eagle (Alshaya Group), Zara (Azadea Group), Bershka (Azadea Group) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait women's t-shirt market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to invest in eco-friendly materials and production methods. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement. With the continued rise of social media influence, brands that effectively leverage these platforms will likely capture a larger share of the market, appealing to the fashion-conscious female demographic.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual T-Shirts Graphic T-Shirts Sports T-Shirts Designer T-Shirts Eco-friendly T-Shirts Plus Size T-Shirts Others |

| By End-User | Teenagers Young Adults Middle-aged Women Working Professionals |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores Specialty Stores |

| By Price Range | Budget Mid-range Premium |

| By Fabric Type | Cotton Polyester Blends Organic Fabrics |

| By Design | Printed Plain Embroidered |

| By Occasion | Casual Wear Sports Activities Formal Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Women's T-Shirt Retailers | 80 | Store Owners, Retail Managers |

| Female Consumers | 120 | Women aged 18-45, Fashion Enthusiasts |

| Fashion Influencers | 40 | Social Media Influencers, Fashion Bloggers |

| Market Analysts | 40 | Industry Experts, Market Researchers |

| E-commerce Platforms | 50 | eCommerce Managers, Digital Marketing Specialists |

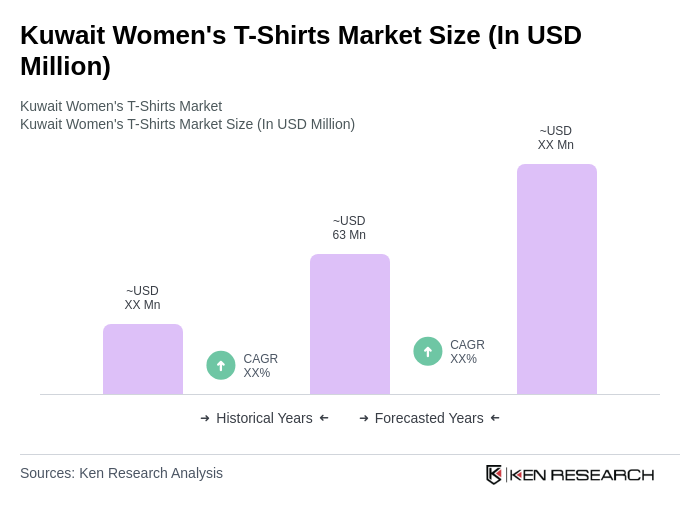

The Kuwait Women's T-Shirts Market is valued at approximately USD 63 million, reflecting a significant growth trend driven by increasing fashion consciousness, rising disposable incomes, and the influence of social media on shopping behaviors.