Region:Middle East

Author(s):Rebecca

Product Code:KRAD4277

Pages:85

Published On:December 2025

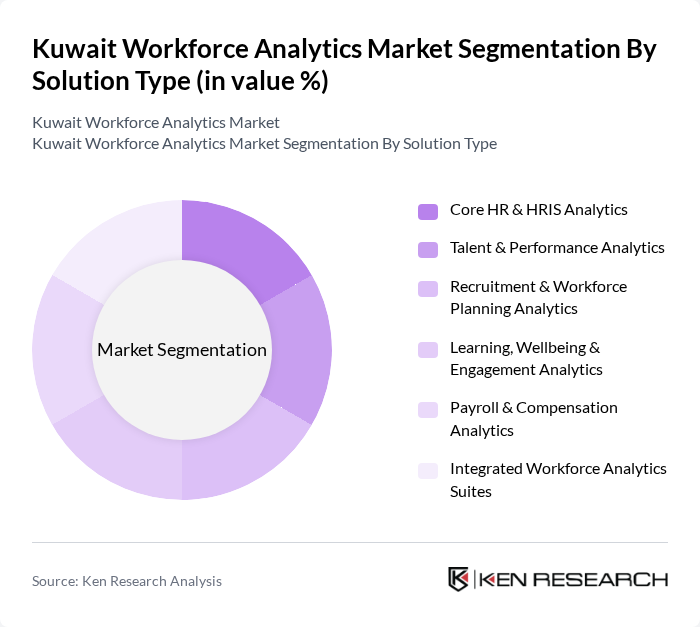

By Solution Type:The Kuwait Workforce Analytics Market is segmented into Core HR & HRIS Analytics, Talent & Performance Analytics, Recruitment & Workforce Planning Analytics, Learning, Wellbeing & Engagement Analytics, Payroll & Compensation Analytics, and Integrated Workforce Analytics Suites. Global and regional HR technology trends indicate that performance management, employee experience, and integrated HCM suites attract a growing share of analytics-related spend; however, there are no publicly available Kuwait-specific statistics that precisely confirm the percentage market shares listed below, so these figures should be treated as indicative estimates rather than validated market-measured values. Talent & Performance Analytics can reasonably be considered one of the leading sub-segments, supported by strong focus on performance management, employee engagement, and retention in GCC organizations adopting modern HCM platforms.

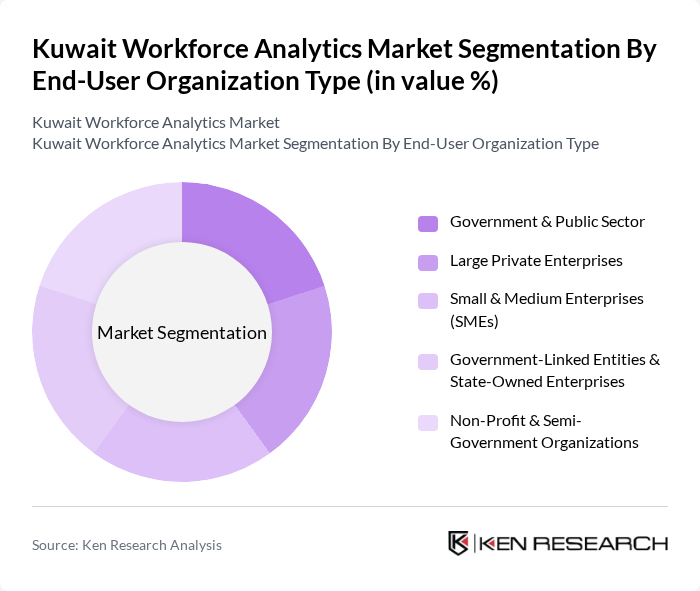

By End-User Organization Type:The market is also segmented by end-user organization type, which includes Government & Public Sector, Large Private Enterprises, Small & Medium Enterprises (SMEs), Government-Linked Entities & State-Owned Enterprises, and Non-Profit & Semi-Government Organizations. Reliable public sources confirm strong digital transformation and e-government agendas in Kuwait, including modernization of HR systems in ministries and public agencies, which supports the assertion that government and public sector bodies are major adopters of HR technology and analytics in the country. However, there are no disaggregated Kuwait-specific market share statistics by end-user type in the public domain, so the percentage distribution below should be treated as an analytical segmentation rather than a directly sourced quantitative breakdown.

The Kuwait Workforce Analytics Market is characterized by a dynamic mix of regional and international players that provide HR suites, workforce management platforms, business intelligence, and specialized workforce analytics solutions. Leading global participants such as SAP SE, Oracle Corporation, Microsoft Corporation, IBM Corporation, Workday, Inc., ADP, Inc., Ceridian HCM Holding Inc., UKG Inc. (Ultimate Kronos Group), Cornerstone OnDemand, Inc., Visier Inc., QlikTech International AB, Tableau Software, LLC (Salesforce), Infor, Inc., and Zoho Corporation Pvt. Ltd. have an established presence in the GCC through partners or regional offices, and many of their HCM and analytics offerings are deployed in Kuwait via local system integrators and resellers. Regional firms such as Bayzat Ltd. and local technology service providers like Gulf Business Machines (GBM Kuwait) and Kuwait Computer Services Co. (KCSC) play an important role in implementation, customization, and support, particularly for cloud-based HR, analytics, and workforce management projects.

The future of the Kuwait workforce analytics market appears promising, driven by technological advancements and a growing emphasis on data utilization. As organizations increasingly recognize the value of analytics in enhancing employee engagement and operational efficiency, investments in advanced technologies are expected to rise. Furthermore, the integration of AI and machine learning will likely transform workforce analytics, enabling real-time insights and predictive capabilities. This evolution will foster a more data-centric culture within organizations, ultimately leading to improved workforce management strategies.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Core HR & HRIS Analytics Talent & Performance Analytics Recruitment & Workforce Planning Analytics Learning, Wellbeing & Engagement Analytics Payroll & Compensation Analytics Integrated Workforce Analytics Suites |

| By End-User Organization Type | Government & Public Sector Large Private Enterprises Small & Medium Enterprises (SMEs) Government-Linked Entities & State-Owned Enterprises Non-Profit & Semi-Government Organizations |

| By Industry Vertical | Oil & Gas and Petrochemicals Banking, Financial Services & Insurance (BFSI) Government, Public Administration & Defense Healthcare & Life Sciences Retail, Hospitality & Travel IT, Telecom & Professional Services Construction, Real Estate & Infrastructure Education & Training |

| By Deployment Mode | On-Premises Public Cloud Private Cloud Hybrid |

| By Analytics Capability | Descriptive & Diagnostic Analytics Predictive Analytics Prescriptive & Scenario Modeling Real-Time & Streaming Workforce Analytics |

| By Organization Size | Large Enterprises (1000+ employees) Medium Enterprises (250–999 employees) Small Enterprises (<250 employees) |

| By Buyer Type & Budget | CHRO / HR Leadership-Led Transformation Programs IT-Led HR Digitalization Projects Line-of-Business / Departmental Initiatives Low-Budget SaaS & Subscription Deployments Enterprise-Wide Strategic Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Workforce Analytics | 100 | HR Managers, Data Analysts |

| Financial Services Workforce Management | 80 | Operations Managers, Compliance Officers |

| Retail Sector Employee Analytics | 70 | Store Managers, HR Directors |

| Manufacturing Workforce Optimization | 60 | Production Managers, Workforce Planners |

| Technology Sector Talent Analytics | 90 | Recruitment Specialists, Talent Acquisition Managers |

The Kuwait Workforce Analytics Market is valued at approximately USD 150 million, reflecting a five-year historical analysis of the HR and employee experience software landscape in Kuwait, driven by the adoption of digital HR platforms and data-driven decision-making.