Region:Central and South America

Author(s):Shubham

Product Code:KRAA1101

Pages:84

Published On:August 2025

By Type:The market is segmented into various consulting types, including Cold Chain Strategy Consulting, Regulatory Compliance Consulting, Technology Implementation Consulting (IoT, Automation, Monitoring), Facility Design & Optimization Consulting, Sustainability & Green Logistics Consulting, and Others. Each of these segments plays a crucial role in addressing the unique challenges faced by businesses in the cold chain sector. Technology Implementation Consulting is increasingly prominent, driven by the adoption of IoT, automation, and advanced monitoring solutions to enhance operational visibility and efficiency. Regulatory Compliance Consulting is also critical as evolving food safety and pharmaceutical regulations require expert guidance for adherence and risk mitigation .

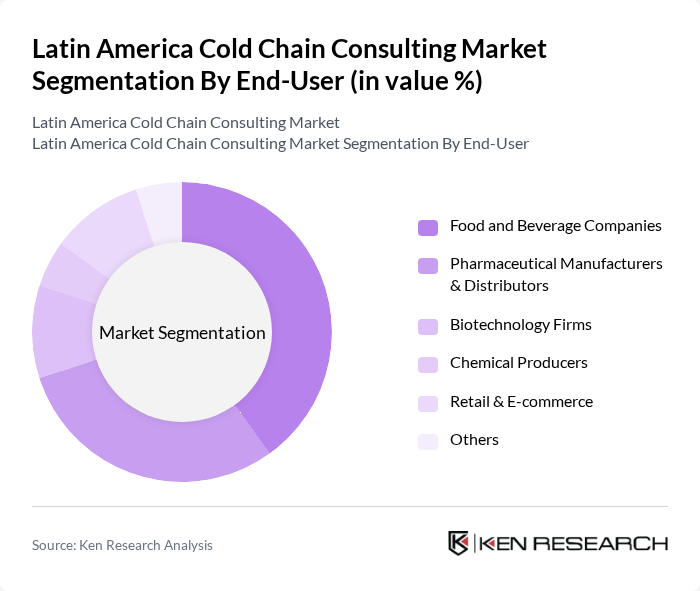

By End-User:The end-user segmentation includes Food and Beverage Companies, Pharmaceutical Manufacturers & Distributors, Biotechnology Firms, Chemical Producers, Retail & E-commerce, and Others. Each segment has distinct requirements and challenges that cold chain consulting services aim to address. Food and Beverage Companies and Pharmaceutical Manufacturers & Distributors are the primary end-users, reflecting the region’s high demand for perishable food products and the expansion of pharmaceutical distribution networks. The growth of e-commerce and retail chains is also fueling demand for cold chain solutions that ensure product integrity during last-mile delivery .

The Latin America Cold Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Maersk, CEVA Logistics, Lineage Logistics, Americold Logistics, Cold Chain Technologies, Emergent Cold Latin America, SuperFrio Logística (Brazil), Friozem Armazéns Frigoríficos (Brazil), Friopuerto (Mexico, Uruguay, Peru), Agro Merchants Group, BioStorage Technologies, and Solistica contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain consulting market in Latin America appears promising, driven by technological advancements and increasing consumer expectations for food safety. The adoption of automation and IoT technologies is expected to enhance operational efficiency, while the focus on sustainability will lead to the development of eco-friendly cold chain solutions. As regulatory frameworks evolve, businesses will need to adapt, creating opportunities for consulting firms to provide specialized guidance and support in navigating these changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Chain Strategy Consulting Regulatory Compliance Consulting Technology Implementation Consulting (IoT, Automation, Monitoring) Facility Design & Optimization Consulting Sustainability & Green Logistics Consulting Others |

| By End-User | Food and Beverage Companies Pharmaceutical Manufacturers & Distributors Biotechnology Firms Chemical Producers Retail & E-commerce Others |

| By Distribution Mode | Direct Consulting (In-house Projects) Third-Party Consulting Firms Digital/Remote Consulting Platforms Others |

| By Application | Cold Storage Facility Planning Cold Chain Transportation Optimization Regulatory & Quality Compliance Technology Integration (IoT, Data Analytics) Risk Management & Business Continuity Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Multilateral Development Banks Others |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Cold Chain Operators Grants for Technology Adoption Regulatory Streamlining Initiatives Others |

| By Service Type | Market Entry & Feasibility Consulting Training and Development Maintenance & Operations Consulting Digital Transformation Consulting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Networks | 120 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Operations | 90 | Quality Assurance Managers, Operations Directors |

| Retail Cold Storage Facilities | 60 | Warehouse Managers, Inventory Control Specialists |

| Technology Providers for Cold Chain Solutions | 50 | Product Managers, Business Development Executives |

| Logistics Regulatory Compliance | 40 | Compliance Officers, Regulatory Affairs Managers |

The Latin America Cold Chain Consulting Market is valued at approximately USD 5.0 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, as well as the need for efficient logistics solutions to minimize spoilage.