Region:Central and South America

Author(s):Shubham

Product Code:KRAC0734

Pages:82

Published On:August 2025

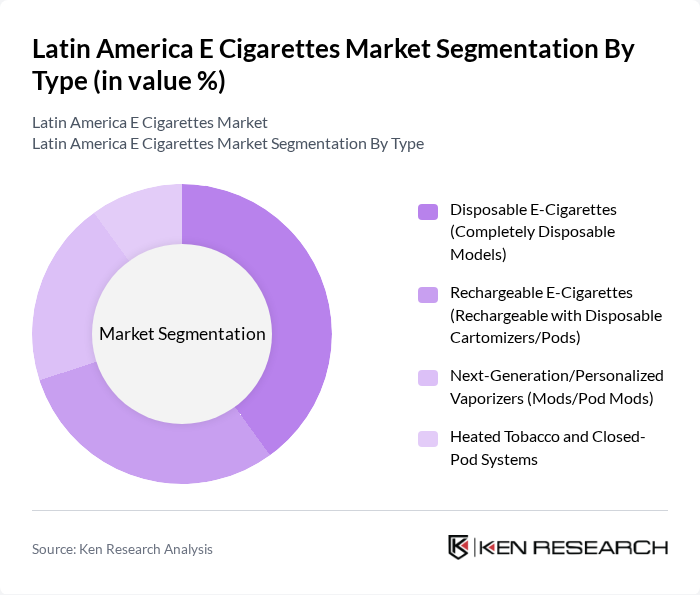

By Type:The market is segmented into various types of e-cigarettes, including disposable, rechargeable, next-generation vaporizers, and heated tobacco systems. Each type caters to different consumer preferences and usage patterns. Disposable e-cigarettes are popular for their convenience, while rechargeable models appeal to users looking for cost-effectiveness and customization. Next-generation vaporizers are gaining traction among tech-savvy consumers seeking advanced features .

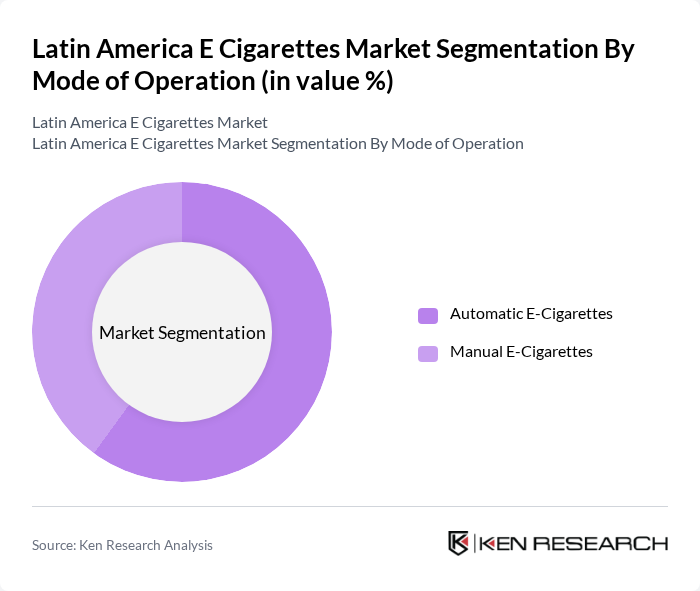

By Mode of Operation:The e-cigarette market is also categorized by mode of operation, which includes automatic and manual e-cigarettes. Automatic e-cigarettes are favored for their ease of use, appealing to beginners and casual users. In contrast, manual e-cigarettes attract experienced users who prefer a more hands-on approach to vaping, allowing for customization and control over their experience .

The Latin America E Cigarettes Market is characterized by a dynamic mix of regional and international players. Leading participants such as British American Tobacco (Vuse, glo), Philip Morris International (IQOS), Imperial Brands (blu), Japan Tobacco International (Logic, Ploom), JUUL Labs, RELX Technology, SMOORE (VAPORESSO), Shenzhen Smoore Technology Co., Ltd. (FEELM), Shenzhen IVPS Technology Co., Ltd. (SMOK), Innokin Technology, Joyetech, Eleaf, Geekvape, OXVA, Elf Bar (Heaven Gifts Technology/IVESTA Group) contribute to innovation, geographic expansion, and service delivery in this space. Product and channel trends in the region show stronger presence for automatic devices and specialist vape shops where permitted, with varying legality across markets .

The future of the e-cigarette market in Latin America appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, more individuals are likely to transition from traditional smoking to vaping in future. Additionally, the expansion of online sales channels is expected to enhance accessibility, particularly in rural areas. Companies that focus on product innovation and sustainability will likely capture a larger market share, aligning with consumer demand for eco-friendly options and personalized experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable E-Cigarettes (Completely Disposable Models) Rechargeable E-Cigarettes (Rechargeable with Disposable Cartomizers/Pods) Next-Generation/Personalized Vaporizers (Mods/Pod Mods) Heated Tobacco and Closed-Pod Systems |

| By Mode of Operation | Automatic E-Cigarettes Manual E-Cigarettes |

| By Distribution Channel | Specialist E-Cigarette/Vape Shops Online Supermarkets and Hypermarkets Tobacconists |

| By Flavor | Tobacco Menthol/Mint Fruit Sweet/Dessert & Beverage |

| By Price Range | Budget Mid-Range Premium |

| By Geography | Brazil Mexico Argentina Colombia Chile Peru Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail E-Cigarette Sales | 140 | Store Managers, Retail Buyers |

| Consumer Usage Patterns | 150 | Vapers, Potential Users |

| Distribution Channel Insights | 100 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Policy Makers |

| Market Trend Analysis | 120 | Market Analysts, Industry Experts |

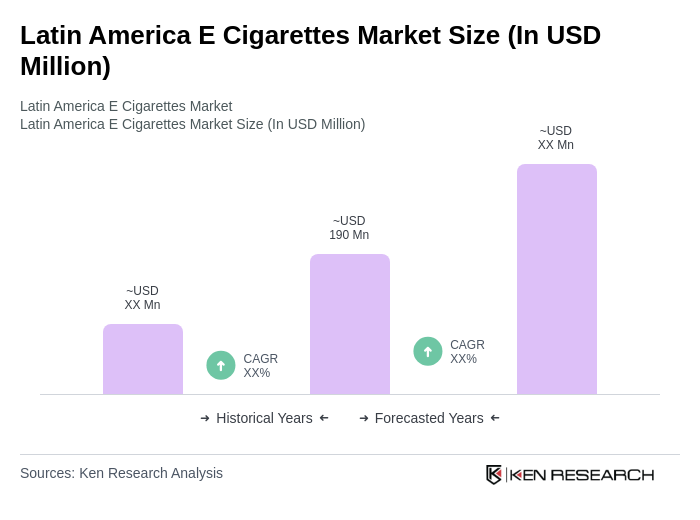

The Latin America E Cigarettes Market is valued at approximately USD 190 million, reflecting a measured adoption of e-cigarettes amid varying regulations across the region. This valuation is based on a five-year historical analysis of market trends.