Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0235

Pages:100

Published On:August 2025

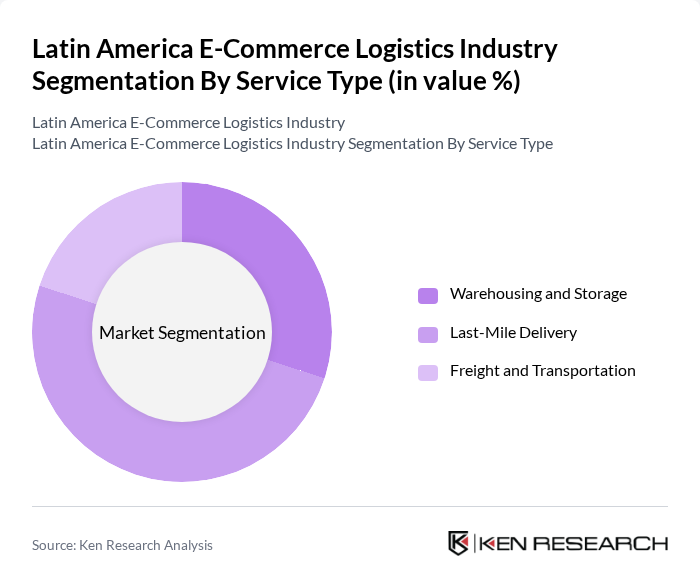

By Service Type:The service type segmentation includes Warehousing and Storage, Last-Mile Delivery, and Freight and Transportation. Among these, Last-Mile Delivery is the leading sub-segment, driven by the increasing demand for quick and efficient delivery services from consumers. The rise of e-commerce has made last-mile logistics a critical focus for companies aiming to enhance customer satisfaction and retention. Warehousing and Storage also play a vital role, as businesses require efficient inventory management to meet the growing online demand .

By Technology:The technology segmentation encompasses Automated Logistics Solutions and Digital Platforms and Software. Automated Logistics Solutions are gaining traction as companies seek to enhance operational efficiency and reduce costs through automation. Digital Platforms and Software are also crucial, enabling businesses to manage logistics operations effectively and provide real-time tracking to customers. The integration of technology in logistics is essential for meeting the demands of the rapidly evolving e-commerce landscape .

The Latin America E-Commerce Logistics Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Libre, DHL Express, FedEx Corporation, UPS, Correios (Brazil), Grupo Logístico Andreani, DB Schenker, Kuehne + Nagel, Rappi, Loggi, Geopost (DPDgroup), Estafeta, B2W Digital (now Americanas S.A.), Jadlog, Blue Express contribute to innovation, geographic expansion, and service delivery in this space.

The Latin American e-commerce logistics industry is poised for significant transformation as it adapts to evolving consumer preferences and technological advancements. In future, the integration of AI and machine learning in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the rise of sustainable logistics practices will likely gain traction, driven by consumer demand for environmentally friendly solutions. As the market matures, collaboration among logistics providers, retailers, and technology firms will be crucial for navigating challenges and seizing growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Warehousing and Storage Last-Mile Delivery Freight and Transportation |

| By Technology | Automated Logistics Solutions Digital Platforms and Software |

| By End-User | B2C B2B C2C |

| By Delivery Method | Ground Transportation Air Freight Sea Freight |

| By Packaging Type | Standard Packaging Custom Packaging Eco-Friendly Packaging |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border |

| By Customer Segment | Small and Medium Enterprises Large Enterprises Individual Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 80 | Customer Experience Managers, Operations Directors |

| Warehouse Automation Technologies | 60 | Warehouse Operations Managers, IT Specialists |

| Cross-Border E-commerce Logistics | 50 | International Trade Managers, Compliance Officers |

| Supply Chain Sustainability Practices | 70 | Sustainability Managers, Procurement Specialists |

The Latin America E-Commerce Logistics Industry is valued at approximately USD 5.7 billion, driven by the rapid expansion of online retail, increased internet penetration, and the demand for efficient delivery services.