Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0213

Pages:90

Published On:August 2025

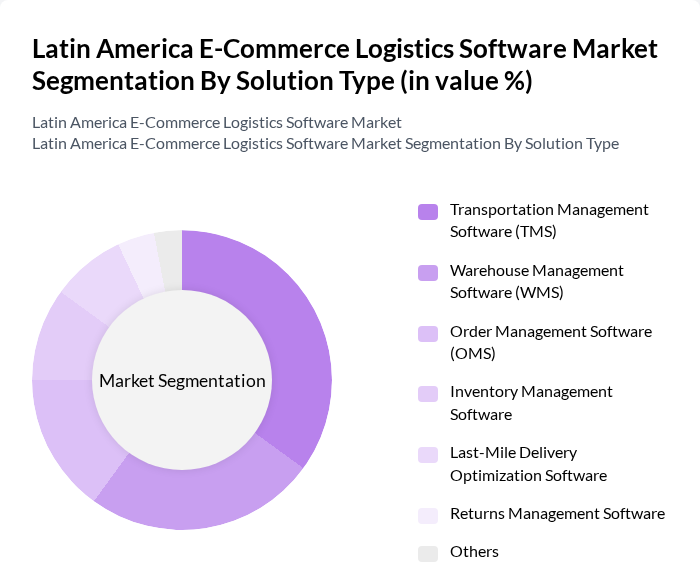

By Solution Type:The solution type segmentation includes various software solutions that cater to different aspects of logistics management. The subsegments are Transportation Management Software (TMS), Warehouse Management Software (WMS), Order Management Software (OMS), Inventory Management Software, Last-Mile Delivery Optimization Software, Returns Management Software, and Others. Among these, Transportation Management Software (TMS) is currently leading the market due to its critical role in optimizing transportation operations, enabling real-time tracking, and reducing operational costs .

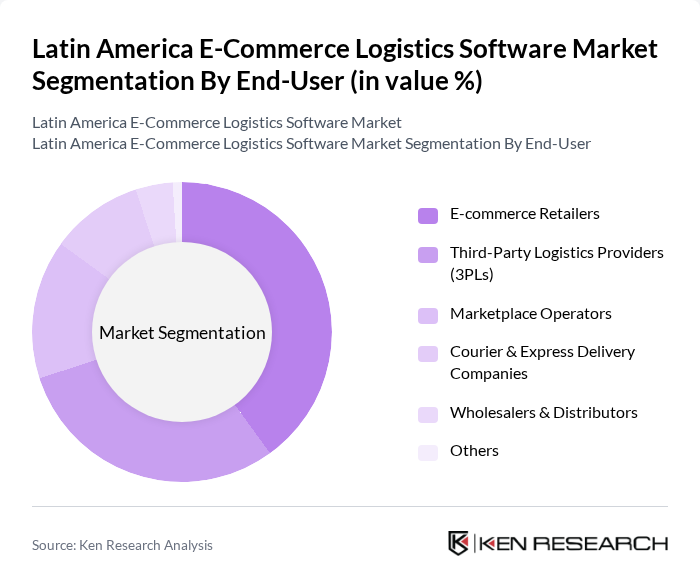

By End-User:The end-user segmentation encompasses various entities that utilize logistics software to enhance their operations. This includes E-commerce Retailers, Third-Party Logistics Providers (3PLs), Marketplace Operators, Courier & Express Delivery Companies, Wholesalers & Distributors, and Others. E-commerce Retailers are the leading end-users, driven by the need for efficient order fulfillment, real-time inventory visibility, and customer satisfaction in a highly competitive market .

The Latin America E-Commerce Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Libre (Mercado Envios), VTEX, Loggi, Intelipost, DHL Supply Chain, FedEx, UPS, Kuehne + Nagel, SAP, Oracle, TOTVS, Infracommerce, ShipStation, Cargamos, Flexport contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Latin America e-commerce logistics software market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and machine learning, logistics operations will become more efficient, enhancing delivery accuracy and speed. Additionally, the rise of omnichannel retailing will necessitate integrated logistics solutions, allowing companies to meet diverse consumer demands while optimizing their supply chains for sustainability and cost-effectiveness.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Transportation Management Software (TMS) Warehouse Management Software (WMS) Order Management Software (OMS) Inventory Management Software Last-Mile Delivery Optimization Software Returns Management Software Others |

| By End-User | E-commerce Retailers Third-Party Logistics Providers (3PLs) Marketplace Operators Courier & Express Delivery Companies Wholesalers & Distributors Others |

| By Delivery Model | Same-Day Delivery Next-Day Delivery Standard Delivery Scheduled Delivery Cross-Border Delivery Others |

| By Deployment Type | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Country | Brazil Mexico Argentina Chile Colombia Peru Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services Integration Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail E-commerce Logistics | 100 | Logistics Coordinators, E-commerce Directors |

| Food & Beverage Delivery Systems | 60 | Operations Managers, Supply Chain Analysts |

| Pharmaceutical Distribution Logistics | 50 | Compliance Officers, Distribution Managers |

| Consumer Electronics Supply Chain | 40 | Product Managers, Logistics Supervisors |

| Fashion & Apparel Returns Management | 50 | Returns Managers, Customer Experience Leads |

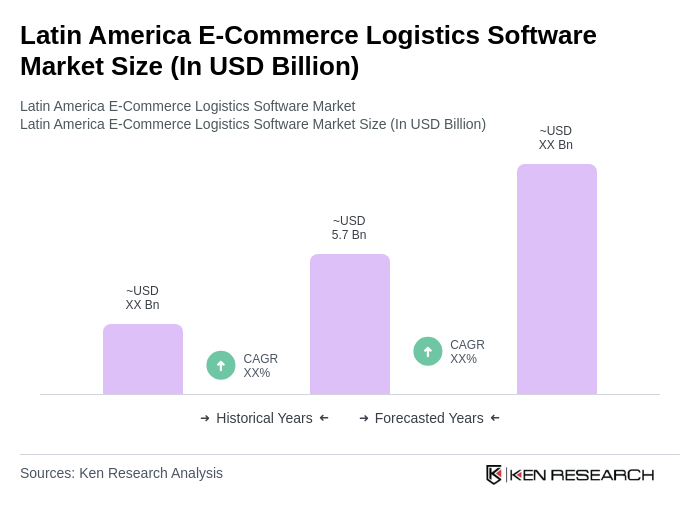

The Latin America E-Commerce Logistics Software Market is valued at approximately USD 5.7 billion, reflecting significant growth driven by the rapid expansion of e-commerce activities and increasing consumer demand for efficient logistics solutions across the region.