Region:Central and South America

Author(s):Shubham

Product Code:KRAA1045

Pages:80

Published On:August 2025

By Type:The freight automation market can be segmented into Freight Management Systems, Transportation Management Systems, Warehouse Management Systems, Fleet Management Solutions, Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs), Robotics Process Automation (RPA) & AI-based Solutions, Yard Management Systems, and Others. These segments are integral to enhancing operational efficiency, improving visibility, and reducing costs in logistics operations .

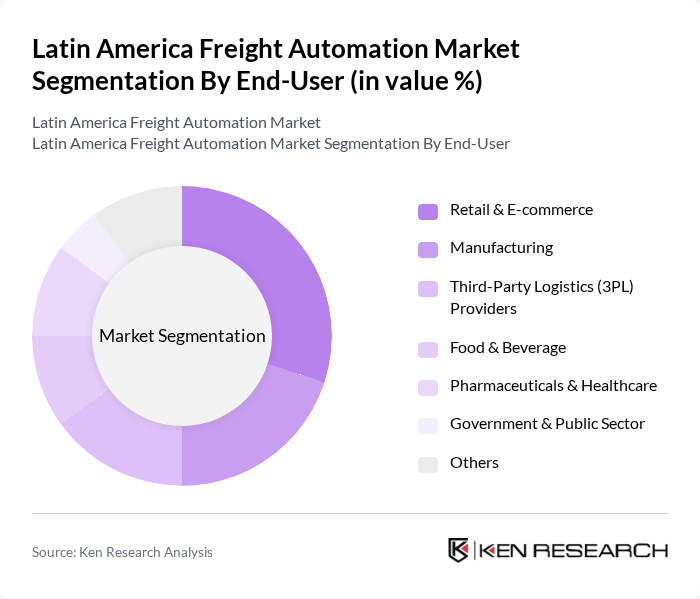

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Third-Party Logistics (3PL) Providers, Food & Beverage, Pharmaceuticals & Healthcare, Government & Public Sector, and Others. Each sector presents specific logistics challenges and operational requirements, driving the adoption of freight automation solutions to improve accuracy, traceability, and efficiency .

The Latin America Freight Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., ABB Ltd., Oracle Corporation, SAP SE, Manhattan Associates, Descartes Systems Group, Trimble Inc., C.H. Robinson Worldwide, XPO Logistics, Project44, FourKites, TOTVS S.A., Grupo TPC (Brazil), Solistica (Mexico), Locus.sh, CargoX (Brazil), FreteBras (Brazil) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the freight automation market in Latin America appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace automation, the integration of AI and IoT will enhance operational capabilities. Additionally, government investments in infrastructure will facilitate smoother logistics operations. However, addressing challenges such as workforce skills and initial costs will be crucial for sustained growth. Overall, the market is poised for significant transformation, with automation becoming a key driver of competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Management Systems Transportation Management Systems Warehouse Management Systems Fleet Management Solutions Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs) Robotics Process Automation (RPA) & AI-based Solutions Yard Management Systems Others |

| By End-User | Retail & E-commerce Manufacturing Third-Party Logistics (3PL) Providers Food & Beverage Pharmaceuticals & Healthcare Government & Public Sector Others |

| By Application | Freight Transportation (Road, Rail, Air, Sea) Inventory & Warehouse Management Order Fulfillment & Last-Mile Delivery Supply Chain Visibility & Tracking Predictive Analytics & Optimization Others |

| By Distribution Mode | Direct Sales Online Sales & Platforms System Integrators & VARs Third-Party Distributors Others |

| By Pricing Strategy | Cost-Plus Pricing Value-Based Pricing Subscription/Usage-Based Pricing Competitive Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups & Tech-Driven Firms Others |

| By Region | Brazil Mexico Argentina Chile Colombia Peru Rest of Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Automation in Retail | 100 | Logistics Managers, Supply Chain Executives |

| Manufacturing Supply Chain Automation | 80 | Operations Managers, Production Supervisors |

| Agricultural Freight Solutions | 70 | Procurement Managers, Logistics Coordinators |

| Technology Adoption in Freight Services | 90 | IT Managers, Technology Officers |

| Cross-border Freight Automation | 60 | Customs Brokers, Trade Compliance Managers |

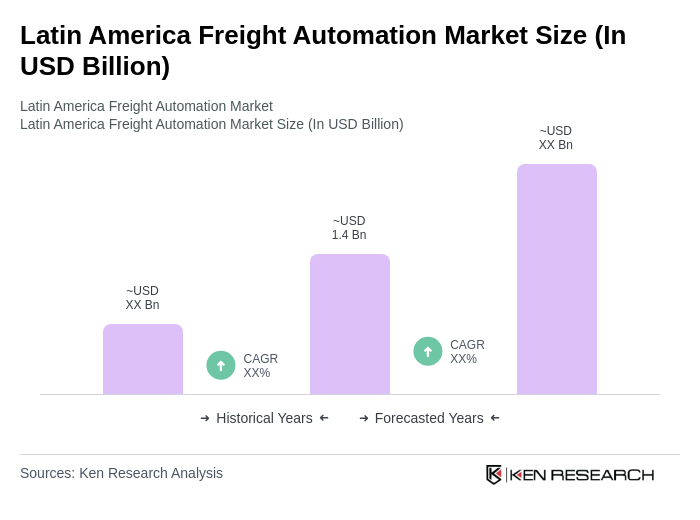

The Latin America Freight Automation Market is valued at approximately USD 1.4 billion, driven by the increasing demand for efficient logistics solutions and technological advancements in automation across various industries.