Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0185

Pages:94

Published On:August 2025

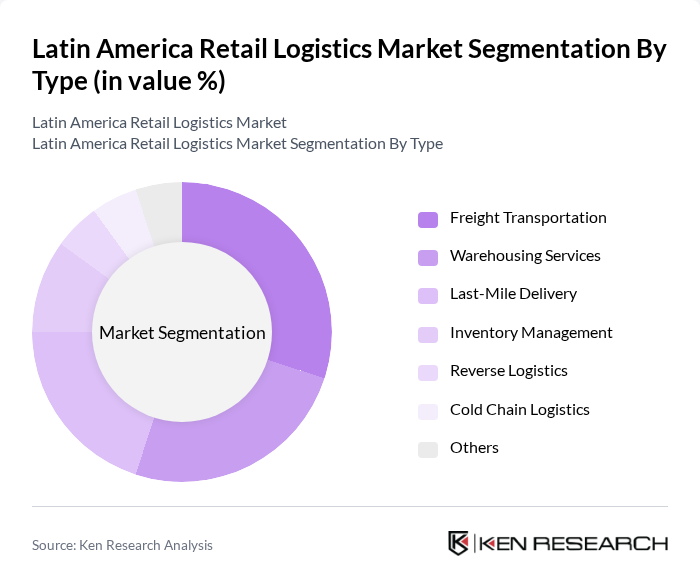

By Type:The retail logistics market can be segmented into various types, including Freight Transportation, Warehousing Services, Last-Mile Delivery, Inventory Management, Reverse Logistics, Cold Chain Logistics, and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, addressing the needs of efficient goods movement, storage, temperature-sensitive product handling, and the growing demand for rapid last-mile delivery in urban and peri-urban areas .

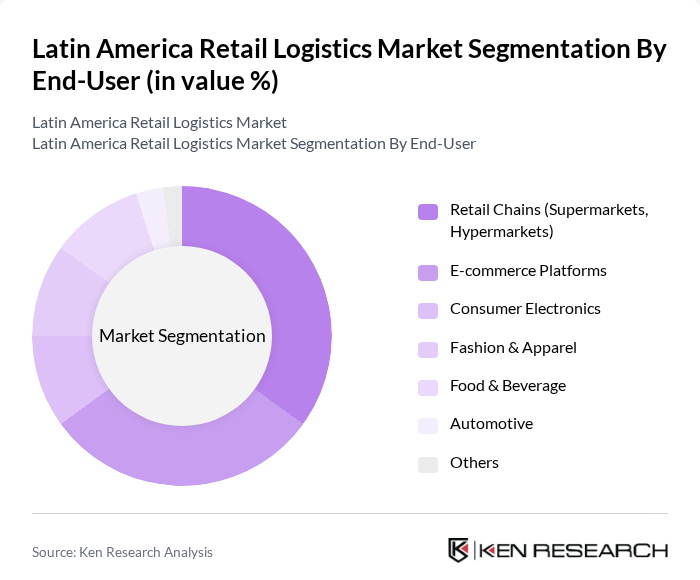

By End-User:The end-user segmentation of the retail logistics market includes Retail Chains (Supermarkets, Hypermarkets), E-commerce Platforms, Consumer Electronics, Fashion & Apparel, Food & Beverage, Automotive, and Others. This segmentation highlights the diverse applications of logistics services across various retail sectors, with e-commerce platforms and large retail chains driving the majority of logistics demand due to high order volumes and the need for rapid fulfillment .

The Latin America Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, FedEx Logistics, UPS Supply Chain Solutions, DB Schenker, CEVA Logistics, Geodis, Loggi, Mercado Libre (Mercado Envios), B2W Digital (Americanas Entrega), Rappi, Jadlog, Correios (Brazilian Post and Telegraph Company), Total Express, C.H. Robinson contribute to innovation, geographic expansion, and service delivery in this space .

The future of retail logistics in Latin America is poised for transformation, driven by the integration of technology and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt automation and AI to streamline operations. Additionally, sustainability initiatives will gain traction, with companies focusing on reducing their carbon footprint. The emphasis on omnichannel retailing will further shape logistics strategies, requiring seamless integration across various sales channels to meet consumer expectations for convenience and speed.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing Services Last-Mile Delivery Inventory Management Reverse Logistics Cold Chain Logistics Others |

| By End-User | Retail Chains (Supermarkets, Hypermarkets) E-commerce Platforms Consumer Electronics Fashion & Apparel Food & Beverage Automotive Others |

| By Region | Brazil Mexico Argentina Chile Colombia Peru Others |

| By Service Type | Transportation Services Logistics Management Freight Forwarding Supply Chain Consulting Value-Added Services (Packaging, Labeling, etc.) Others |

| By Delivery Model | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Click & Collect Others |

| By Technology Utilization | Automated Warehousing IoT in Logistics Blockchain for Supply Chain Transparency AI and Machine Learning Applications Route Optimization Software Others |

| By Customer Segment | B2B B2C C2C Government Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Managers, Supply Chain Executives |

| E-commerce Fulfillment Strategies | 80 | E-commerce Managers, Operations Managers |

| Last-Mile Delivery Solutions | 60 | Delivery Managers, Urban Logistics Coordinators |

| Inventory Management Practices | 50 | Warehouse Managers, Inventory Analysts |

| Cross-Border Logistics Challenges | 40 | Trade Compliance Officers, Logistics Consultants |

The Latin America Retail Logistics Market is valued at approximately USD 6.3 billion, driven by the rapid growth of e-commerce and increasing consumer demand for efficient logistics services across the region.