Region:Central and South America

Author(s):Shubham

Product Code:KRAA1730

Pages:87

Published On:August 2025

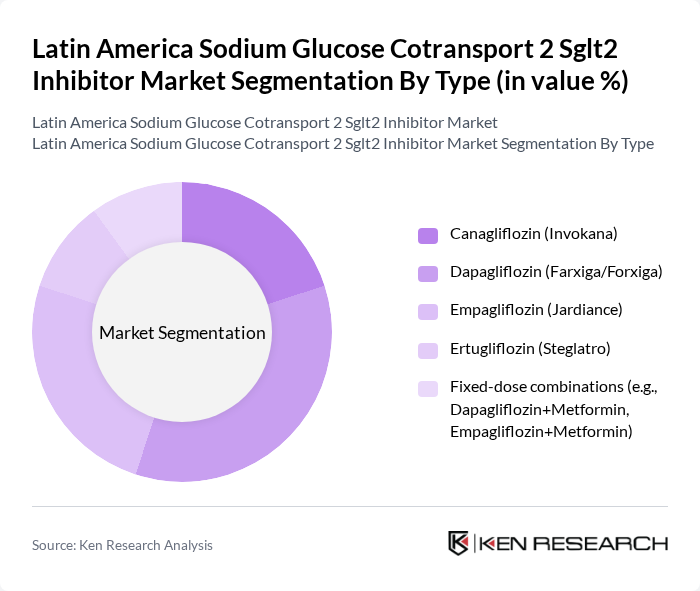

By Type:The market can be segmented into various types of SGLT2 inhibitors, which include Canagliflozin (Invokana), Dapagliflozin (Farxiga/Forxiga), Empagliflozin (Jardiance), Ertugliflozin (Steglatro), and fixed-dose combinations such as Dapagliflozin+Metformin and Empagliflozin+Metformin. Among these, Dapagliflozin and Empagliflozin are widely promoted and adopted across Latin America given extensive cardio-renal evidence and active commercialization by their originators. The increasing preference for fixed-dose combinations is also notable, as they offer convenience and improved adherence for patients managing diabetes and are commonly positioned alongside metformin in regional formularies and private sector protocols.

By End-User:The end-user segmentation includes hospitals (public and private), specialty diabetes/endocrinology clinics, primary care and outpatient centers, and homecare/retail-managed therapy. Hospitals are the primary end-users due to their capacity to provide comprehensive diabetes management, multi-specialty cardio-renal care, and access to a larger patient base. Specialty clinics are also gaining traction as they offer tailored treatment plans and specialized care, which is crucial for managing complex diabetes and comorbid heart failure or CKD cases.

The Latin America Sodium Glucose Cotransport 2 Sglt2 Inhibitor Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca (Farxiga/Forxiga; Dapagliflozin), Boehringer Ingelheim (Jardiance; Empagliflozin), Eli Lilly and Company (Jardiance partner; Empagliflozin), Janssen Pharmaceuticals (Johnson & Johnson) (Invokana; Canagliflozin), Merck & Co., Inc. (MSD in Latin America; Steglatro partner; Ertugliflozin), Pfizer Inc. (Steglatro partner; Ertugliflozin), Astellas Pharma Inc. (regional SGLT2 presence via partnerships), Bristol Myers Squibb (historical dapagliflozin developer; legacy assets), Sanofi (diabetes portfolio; regional commercialization capabilities), Novo Nordisk (diabetes leader; combination strategies and competition), Bayer AG (cardio-renal market presence; complementary portfolio), Takeda Pharmaceutical Company Limited, GlaxoSmithKline plc, Abbott Laboratories (diagnostics; ecosystem partnerships), Roche (diagnostics; diabetes care partnerships) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SGLT2 inhibitor market in Latin America appears promising, driven by ongoing advancements in diabetes management and increasing healthcare investments. As the prevalence of diabetes continues to rise, the demand for effective treatments will grow. Additionally, the integration of telemedicine and personalized medicine approaches is expected to enhance patient engagement and adherence. Collaborations between pharmaceutical companies and local healthcare providers will further facilitate access to innovative therapies, ensuring that more patients benefit from SGLT2 inhibitors in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Canagliflozin (Invokana) Dapagliflozin (Farxiga/Forxiga) Empagliflozin (Jardiance) Ertugliflozin (Steglatro) Fixed-dose combinations (e.g., Dapagliflozin+Metformin, Empagliflozin+Metformin) |

| By End-User | Hospitals (public and private) Specialty diabetes/endocrinology clinics Primary care and outpatient centers Homecare/retail-managed therapy |

| By Distribution Channel | Retail pharmacies Online/e-pharmacies Hospital/institutional pharmacies Government tenders and public procurement |

| By Region | Brazil Mexico Argentina Colombia Chile Rest of Latin America |

| By Patient Demographics | Age groups Gender Socioeconomic status Comorbidities (e.g., heart failure, chronic kidney disease) |

| By Treatment Stage | Newly diagnosed Ongoing treatment Treatment-resistant or therapy switch |

| By Pricing Tier | Premium (innovator brands) Mid-range (discounted brands/managed access) Budget (public reimbursement/low-cost programs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists in Major Cities | 90 | Healthcare Providers, Diabetes Specialists |

| Pharmaceutical Sales Representatives | 80 | Sales Managers, Territory Representatives |

| Diabetes Patients on SGLT2 Inhibitors | 120 | Patients, Caregivers |

| Healthcare Policy Makers | 60 | Health Economists, Government Officials |

| Pharmacy Managers | 70 | Pharmacists, Inventory Managers |

The Latin America Sodium Glucose Cotransport 2 (SGLT2) Inhibitor Market is valued at approximately USD 300 million, driven by the rising prevalence of diabetes and increasing healthcare expenditures in the region.