Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1961

Pages:91

Published On:August 2025

By Type:The segmentation by type includes various services that cater to the diverse needs of businesses in managing their supply chains effectively. The subsegments are Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), Freight Forwarding, Warehousing Services, Transportation Management, Supply Chain Consulting, Last-Mile Delivery, Inventory Management Outsourcing, and Others. Each of these subsegments plays a crucial role in enhancing operational efficiency and meeting customer demands. Third-Party Logistics (3PL) remains the largest segment, driven by the need for scalable logistics solutions and technology integration. Fourth-Party Logistics (4PL) is gaining traction among large enterprises seeking end-to-end supply chain orchestration. Freight forwarding and warehousing services are expanding due to increased cross-border trade and e-commerce fulfillment demands. Supply chain consulting, last-mile delivery, and inventory management outsourcing are increasingly adopted for specialized, value-added services .

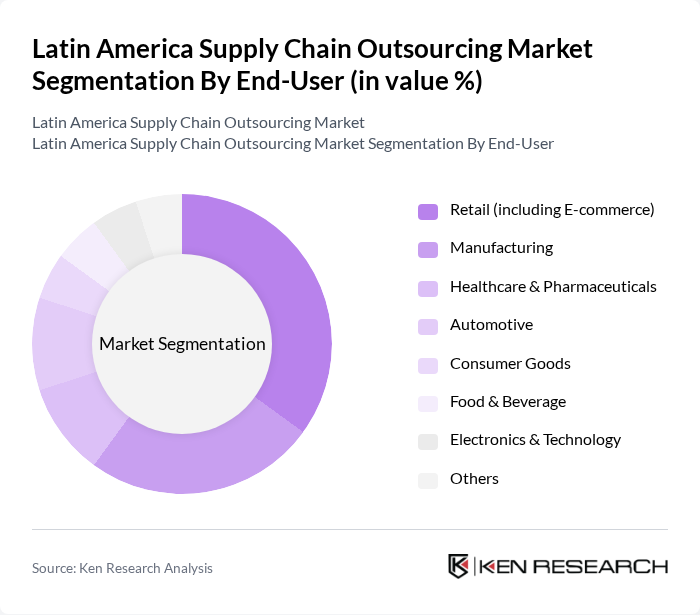

By End-User:The end-user segmentation encompasses various industries that rely on supply chain outsourcing to enhance their operational efficiency. The subsegments include Retail (including E-commerce), Manufacturing, Healthcare & Pharmaceuticals, Automotive, Consumer Goods, Food & Beverage, Electronics & Technology, and Others. Each sector has unique requirements that drive the demand for tailored supply chain solutions. Retail and e-commerce are the leading end-users, propelled by rapid urbanization and consumer demand for fast delivery. Manufacturing and automotive sectors leverage outsourcing for cost reduction and supply chain resilience, while healthcare, food & beverage, and electronics require specialized logistics for sensitive and high-value goods .

The Latin America Supply Chain Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, CEVA Logistics, Geodis, Agility Logistics, Ryder Supply Chain Solutions, Penske Logistics, SEKO Logistics, Expeditors International, J.B. Hunt Transport Services, TFI International, Kintetsu World Express, Grupo TPC, Solistica, Logística SADA, Braspress Transportes Urgentes, Servientrega contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Latin American supply chain outsourcing market appears promising, driven by ongoing digital transformation and a heightened focus on sustainability. As companies increasingly adopt advanced technologies, the demand for specialized logistics services is expected to rise. Additionally, the push for environmentally friendly practices will likely lead to innovative solutions that enhance efficiency while reducing carbon footprints. Overall, the market is poised for growth as businesses adapt to evolving consumer expectations and global supply chain dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Warehousing Services Transportation Management Supply Chain Consulting Last-Mile Delivery Inventory Management Outsourcing Others |

| By End-User | Retail (including E-commerce) Manufacturing Healthcare & Pharmaceuticals Automotive Consumer Goods Food & Beverage Electronics & Technology Others |

| By Service Type | Transportation Services Inventory Management Order Fulfillment Reverse Logistics Customs Brokerage Supply Chain Technology Solutions Others |

| By Industry Vertical | Food and Beverage Electronics Pharmaceuticals Textiles Chemicals Fashion and Lifestyle Others |

| By Geographic Scope | Brazil Mexico Argentina Chile Colombia Rest of Latin America |

| By Delivery Model | On-Demand Services Contractual Services Hybrid Services Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Optimization | 120 | Supply Chain Managers, Operations Directors |

| Retail Logistics and Distribution | 100 | Logistics Coordinators, Inventory Managers |

| Pharmaceutical Supply Chain Compliance | 80 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Food and Beverage Supply Chain Efficiency | 70 | Procurement Managers, Supply Chain Analysts |

| Technology Adoption in Logistics | 60 | IT Managers, Digital Transformation Leads |

The Latin America Supply Chain Outsourcing Market is valued at approximately USD 360 billion, driven by the demand for efficient logistics solutions, digital transformation, and the growth of e-commerce, among other factors.