Region:Asia

Author(s):Dev

Product Code:KRAB0408

Pages:83

Published On:August 2025

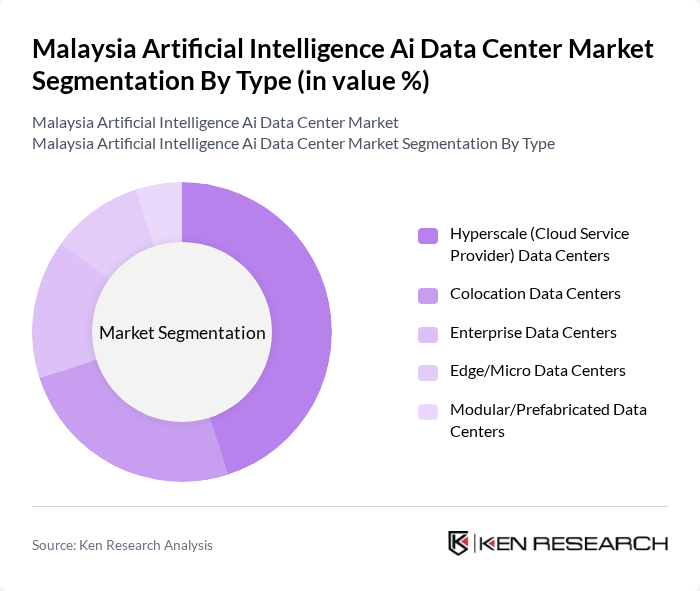

By Type:The market is segmented into various types of data centers, including Hyperscale (Cloud Service Provider) Data Centers, Colocation Data Centers, Enterprise Data Centers, Edge/Micro Data Centers, and Modular/Prefabricated Data Centers. Among these, Hyperscale Data Centers are leading due to the increasing demand for cloud services and the need for scalable infrastructure to support AI workloads. The trend towards digital transformation across industries is driving enterprises to adopt hyperscale solutions for enhanced efficiency and performance.

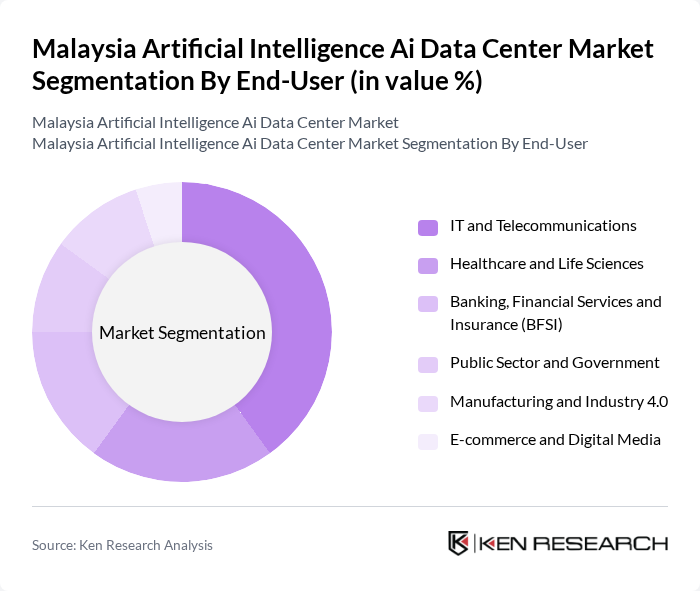

By End-User:The end-user segmentation includes IT and Telecommunications, Healthcare and Life Sciences, Banking, Financial Services and Insurance (BFSI), Public Sector and Government, Manufacturing and Industry 4.0, and E-commerce and Digital Media. The IT and Telecommunications sector is the dominant end-user, driven by the increasing reliance on cloud services and data analytics. The rapid digitalization of businesses and the growing need for data storage and processing capabilities are propelling this sector's growth.

The Malaysia Artificial Intelligence Ai Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as AIMS Data Centre (AIMS DC, a DigitalBridge company), NTT Global Data Centers (Malaysia), Keppel Data Centres (Malaysia), Bridge Data Centres (BDx Indonesia/Bridge, Malaysia), YTL Power Data Center (YTL Green Data Center Park, Kulai, Johor), GDS Holdings (Malaysia), Equinix (Malaysia), Digital Realty (Malaysia), TM One (Telekom Malaysia Berhad), TIME dotCom Berhad (AIMS partner, network and DC), Khazna Data Centers (Malaysia), Princeton Digital Group (PDG) Malaysia, EdgeConneX (Malaysia), Google Cloud (Malaysia cloud region and infrastructure), Amazon Web Services (AWS) Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI data center market in Malaysia appears promising, driven by technological advancements and increasing digitalization across various sectors. As organizations prioritize data-driven strategies, the integration of AI into data management processes will become more prevalent. Furthermore, the government's commitment to enhancing digital infrastructure will likely facilitate the growth of innovative solutions, positioning Malaysia as a competitive player in the regional AI landscape. Continued investment in talent development will also be crucial for sustaining this momentum.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale (Cloud Service Provider) Data Centers Colocation Data Centers Enterprise Data Centers Edge/Micro Data Centers Modular/Prefabricated Data Centers |

| By End-User | IT and Telecommunications Healthcare and Life Sciences Banking, Financial Services and Insurance (BFSI) Public Sector and Government Manufacturing and Industry 4.0 E-commerce and Digital Media |

| By Application (AI Workload) | AI Training (GPU/Accelerator High-Density Racks) AI Inference Big Data Analytics Cloud-Native/Hybrid Cloud Workloads IoT/Edge Analytics |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants and Incentives |

| By Policy Support | Tax Incentives and Pioneer Status Renewable and Low-Carbon Energy Incentives Data Sovereignty and PDPA Compliance Green Building and Energy Efficiency Standards |

| By Location Cluster | Cyberjaya (Selangor) Johor (Sedenak/Kulaiso/Tebrau) Greater Kuala Lumpur/Klang Valley Penang and Northern Corridor |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Managed and Professional Services |

| By Power and Cooling Density | Standard Density Racks (?10 kW/rack) High Density Racks (10–30 kW/rack) Extreme Density/AI Racks (?30 kW/rack, incl. liquid cooling) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Data Center Operations | 110 | Data Center Managers, IT Infrastructure Directors |

| Cloud Computing Services | 85 | Cloud Architects, Service Delivery Managers |

| Big Data Analytics | 75 | Data Scientists, Business Intelligence Analysts |

| Machine Learning Applications | 65 | AI Researchers, Product Development Leads |

| Regulatory Compliance in AI | 55 | Compliance Officers, Legal Advisors in Tech |

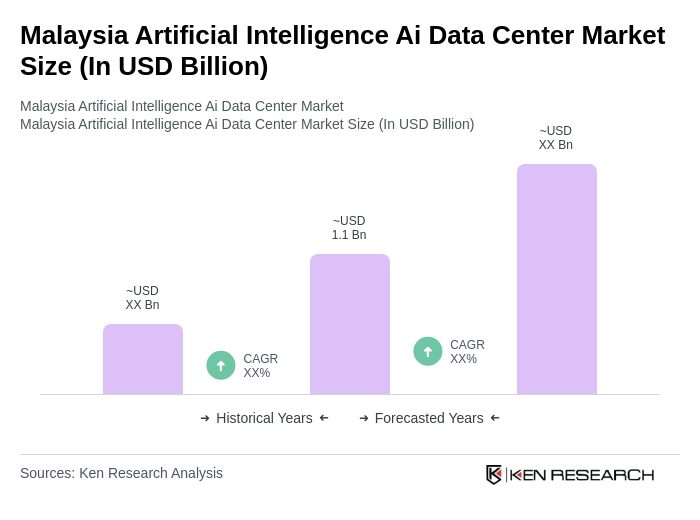

The Malaysia Artificial Intelligence Ai Data Center Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the establishment of AI-ready and hyperscale facilities across the country.