Region:Asia

Author(s):Shubham

Product Code:KRAB6216

Pages:91

Published On:October 2025

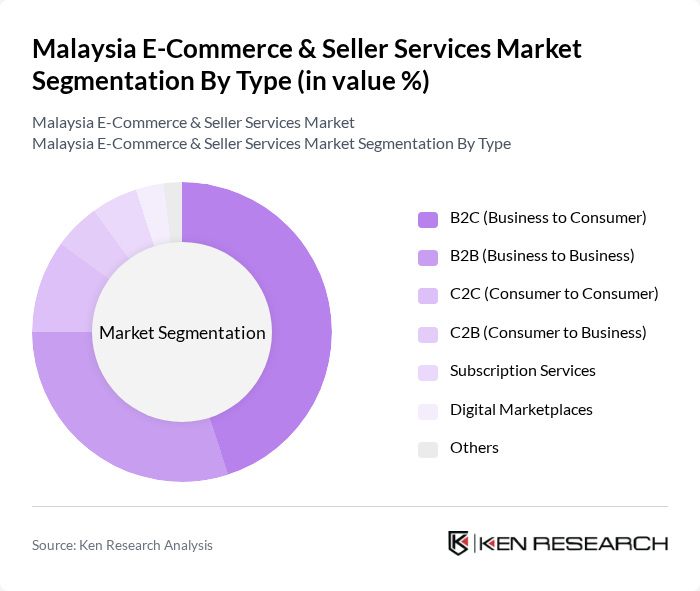

By Type:

The B2C (Business to Consumer) segment is the dominant force in the market, driven by the increasing preference for online shopping among consumers. The convenience of purchasing goods from home, coupled with a wide variety of products available at competitive prices, has led to a surge in B2C transactions. Additionally, the rise of social media marketing and influencer partnerships has further propelled this segment, making it a key player in the e-commerce landscape.

By End-User:

Retail consumers represent the largest end-user segment, accounting for a significant portion of the market. This is largely due to the growing trend of online shopping, where consumers seek convenience and a broader selection of products. The increasing adoption of e-commerce platforms by SMEs also contributes to the market, as they leverage online channels to reach a wider audience and enhance their sales capabilities.

The Malaysia E-Commerce & Seller Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lazada Malaysia, Shopee Malaysia, Zalora Malaysia, Lelong.my, 11street Malaysia, PG Mall, Carousell Malaysia, Foodpanda Malaysia, GrabMart, Fave, Qoo10 Malaysia, Mydin, Tesco Malaysia, Senheng, Watsons Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Malaysia's e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As digital payment solutions become more integrated, the ease of transactions will likely enhance consumer confidence. Additionally, the rise of social commerce and personalized shopping experiences will reshape how businesses engage with customers. Companies that adapt to these trends and invest in innovative technologies will be well-positioned to capture emerging market opportunities and drive sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) C2B (Consumer to Business) Subscription Services Digital Marketplaces Others |

| By End-User | Retail Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Sales Channel | Online Marketplaces Direct-to-Consumer Websites Social Media Platforms Mobile Applications |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers Cash on Delivery |

| By Product Category | Electronics Fashion and Apparel Home and Living Health and Beauty Groceries Digital Goods Others |

| By Customer Demographics | Age Groups Income Levels Urban vs Rural |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect Same-Day Delivery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers | 150 | E-commerce Managers, Business Owners |

| Logistics and Fulfillment Services | 100 | Operations Managers, Logistics Coordinators |

| Digital Payment Solutions | 80 | Product Managers, Financial Analysts |

| Consumer Electronics Sellers | 70 | Sales Directors, Marketing Managers |

| Fashion and Apparel E-commerce | 90 | Brand Managers, Supply Chain Directors |

The Malaysia E-Commerce & Seller Services Market is valued at approximately USD 30 billion, driven by increased internet penetration, mobile device usage, and a shift in consumer behavior towards online shopping.