Region:Asia

Author(s):Geetanshi

Product Code:KRAA7855

Pages:96

Published On:September 2025

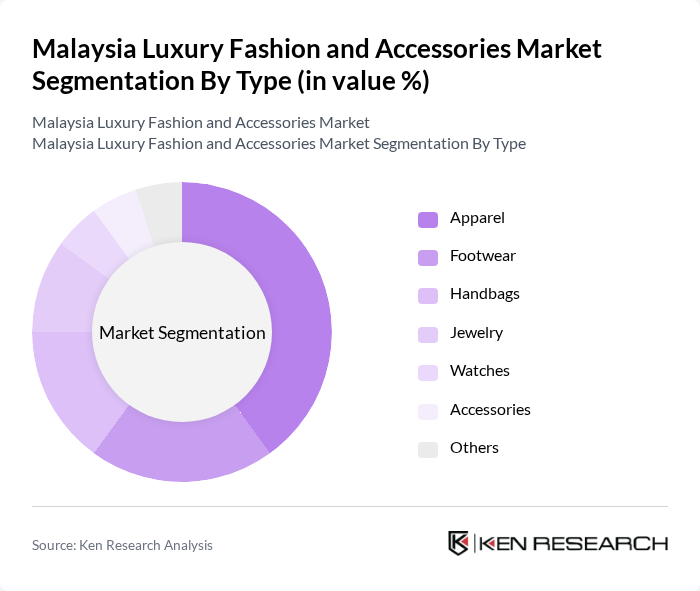

By Type:The luxury fashion and accessories market is segmented into various types, including apparel, footwear, handbags, jewelry, watches, accessories, and others. Among these, apparel is the leading sub-segment, driven by the increasing demand for high-quality clothing and designer wear. Consumers are increasingly inclined towards luxury apparel that reflects their status and personal style, leading to a significant market share for this category.

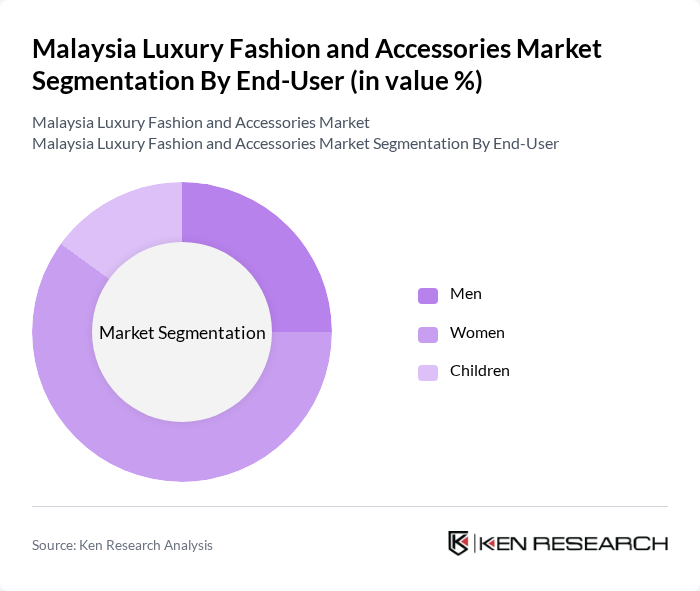

By End-User:The market is segmented by end-user into men, women, and children. The women’s segment dominates the market, driven by a higher propensity to spend on luxury fashion and accessories. Women are more likely to invest in high-end apparel, handbags, and jewelry, reflecting their desire for personal expression and status through fashion.

The Malaysia Luxury Fashion and Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton Malaysia, Gucci Malaysia, Chanel Malaysia, Prada Malaysia, Hermès Malaysia, Burberry Malaysia, Versace Malaysia, Fendi Malaysia, Salvatore Ferragamo Malaysia, Bvlgari Malaysia, Tiffany & Co. Malaysia, Valentino Malaysia, Dolce & Gabbana Malaysia, Michael Kors Malaysia, Coach Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury fashion and accessories market in Malaysia appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract a growing segment of environmentally conscious consumers. Additionally, the integration of augmented reality and virtual try-on technologies in e-commerce platforms is expected to enhance the shopping experience, making luxury products more accessible and appealing to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Handbags Jewelry Watches Accessories Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Department Stores Specialty Stores Luxury Boutiques |

| By Price Range | Premium High-End Ultra-Luxury |

| By Brand Origin | Local Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Occasion | Casual Wear Formal Wear Special Events Everyday Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Buyers | 100 | Luxury Brand Loyalists, Trendsetters |

| Luxury Footwear Consumers | 80 | Fashion Retail Managers, Style Influencers |

| Online Luxury Shoppers | 120 | E-commerce Managers, Digital Marketing Experts |

| Luxury Market Analysts | 60 | Market Researchers, Industry Consultants |

The Malaysia Luxury Fashion and Accessories Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising demand for premium products among consumers.