Region:Asia

Author(s):Shubham

Product Code:KRAC0689

Pages:94

Published On:August 2025

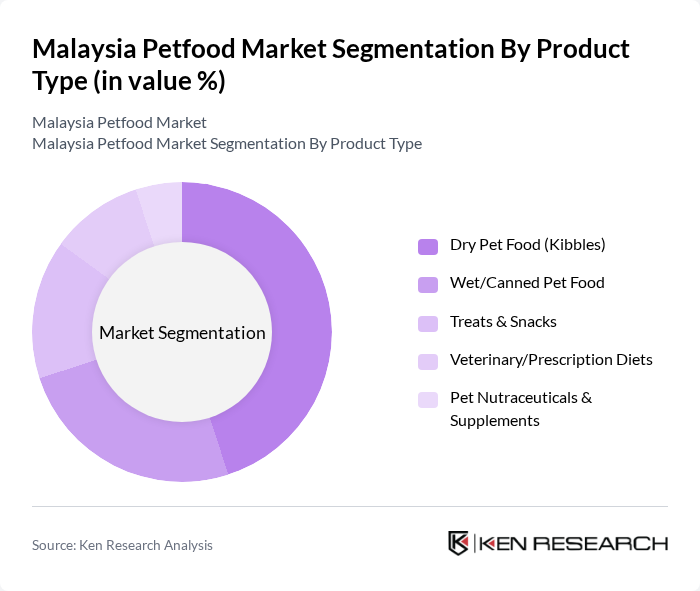

By Product Type:The product type segmentation of the pet food market includes various categories such as dry pet food, wet/canned pet food, treats & snacks, veterinary/prescription diets, and pet nutraceuticals & supplements. Among these, dry pet food (kibbles) is the leading sub-segment due to its convenience, longer shelf life, and cost-effectiveness. Consumers increasingly opt for premium and functional diets across dry and wet formats, while e-commerce and specialty retail broaden access to treats and supplements .

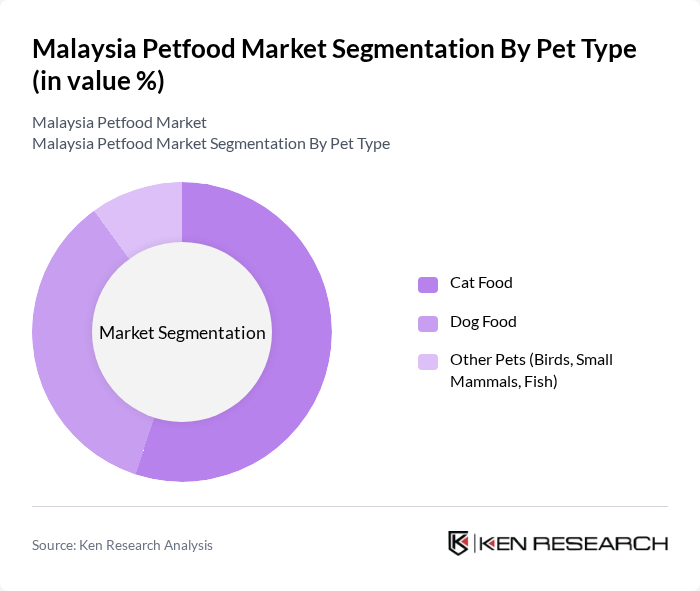

By Pet Type:The pet type segmentation includes cat food, dog food, and food for other pets such as birds, small mammals, and fish. Cat food is a leading sub-segment in Malaysia’s retail pet food, aligned with the country’s larger cat population and share in sales reported by industry trackers; growth in premium cat nutrition and functional formulations continues alongside dog food premiumization .

The Malaysia Petfood Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Purina PetCare (Malaysia), Mars Petcare (Royal Canin Malaysia, Pedigree, Whiskas), Hill's Pet Nutrition (Malaysia), Brighthill Synergy Sdn Bhd (ProDiet, ProBalance), Pet World Nutritions Sdn Bhd (Equilibrio distributor), Pet Lovers Centre Malaysia Sdn Bhd (in-house brands), Pet World Marketing Sdn Bhd (bloop, Probi+; distributor/retail), SmartHeart Malaysia (Perfect Companion Group), Monge & C. S.p.A. (Malaysia operations), Unicharm Corporation (pet care brands; Malaysia presence), WellPet LLC (Wellness, Core; Malaysia distributor), Thai Union Group (i-Tail PetCare; Sheba distributor relationships), Pet2Go Sdn Bhd (local e-commerce/private label), MISH Mash Sdn Bhd (Mish cat food), BROWNIE Pet Food Sdn Bhd (local brand/manufacturer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia petfood market appears promising, driven by evolving consumer preferences and increasing pet ownership. As disposable incomes rise, there is a growing inclination towards premium and specialized petfood products. Additionally, the expansion of e-commerce platforms is expected to facilitate greater access to diverse petfood options. Innovations in pet nutrition, including functional foods and natural ingredients, will likely shape product offerings, catering to health-conscious consumers and enhancing market growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dry Pet Food (Kibbles) Wet/Canned Pet Food Treats & Snacks Veterinary/Prescription Diets Pet Nutraceuticals & Supplements |

| By Pet Type | Cat Food Dog Food Other Pets (Birds, Small Mammals, Fish) |

| By Distribution Channel | Supermarkets/Hypermarkets Pet Specialty Stores Veterinary Clinics Online/E-commerce Convenience & Other Channels |

| By Price Tier | Economy Mid-Range Premium & Super-Premium |

| By Ingredient/Nutrition Focus | Animal-derived Ingredients Plant-based Ingredients Functional/Added-Health Ingredients (Omega-3, Probiotics, Vitamins & Minerals) |

| By Packaging Type | Bags/Sacks Cans Pouches Tubs/Trays |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owner Insights | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Retailer Perspectives | 100 | Pet Store Managers, Retail Buyers |

| Veterinary Insights | 80 | Veterinarians, Animal Nutritionists |

| Online Shopping Behavior | 120 | eCommerce Shoppers, Pet Product Reviewers |

| Market Trend Analysis | 90 | Industry Analysts, Market Researchers |

The Malaysia Petfood Market is valued at approximately USD 340 million, reflecting a significant growth trend driven by rising pet ownership, urbanization, and a shift towards premium pet food products among consumers.