Australia Facility Management Market Outlook to 2023

By Single, Bundled and Integrated Services, By Soft (Cleaning, Security and Other services) and Hard Services (Electromechanical, Operations and Maintenance, Fire and Safety), By End User Sectors

Region:Asia

Product Code:KR773

April 2019

96

About the Report

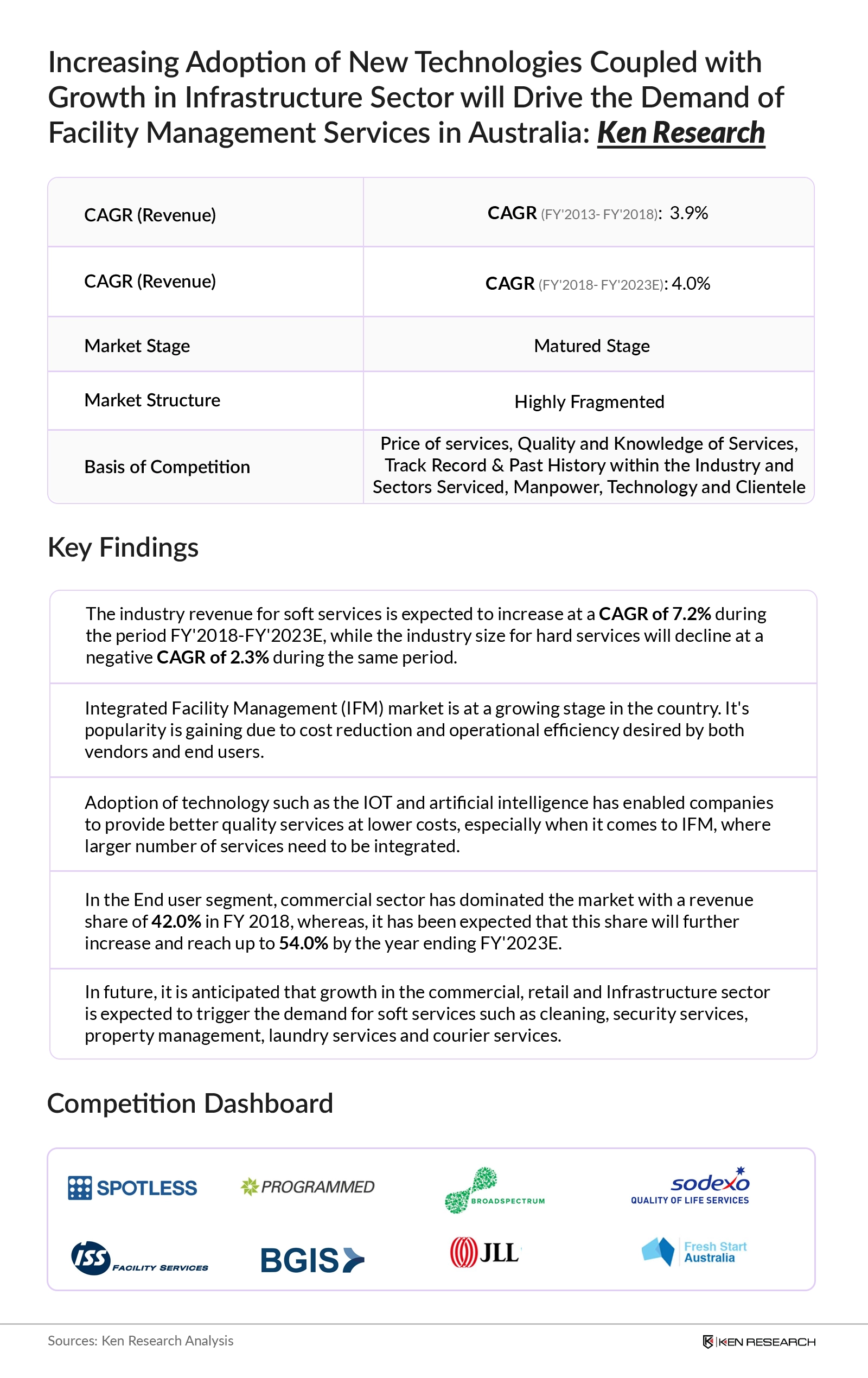

The Integrated Facility management market is relatively at a growing stage in the country and its popularity is increasing due to greater outsourcing of services and an aim to achieve cost and operational efficiency, for both clients and vendors. Facility management services are used by both local companies and MNCs in the country. However, the local companies usually prefer single or bundled services due to their small scale of operations whereas the MNCs prefer integrated facility management (IFM) services in Australia.

Australia Facility Management Market Segmentation

By Type of Services: Bundled services contributed a major share in terms of generating revenues for the industry in FY’2018. Bundled services are largely demanded by retail and commercial private sectors. This was followed by Single and integrated services.

By End User Sectors: Commercial sector contributed the highest revenue share in the overall facility management industry in Australia in the FY’2018. This was followed by the residential sector, retail, industrial, infrastructure and other sectors respectively. Infrastructure sector was largely driven by government expenditure on maintaining and developing roadways, rails and airports.

By Personnel Type: The facility management market in Australia in FY’2018 was dominated by services which were outsourced to the other companies in the market. It accounted more than half share in total revenue in the FM market, the remaining share accounted by in-house personnel.

By Soft Services (Housekeeping, Security, Landscaping and others): Cleaning services was the largest contributor to the soft services industry in FY’2018 followed by Security Services and other soft services including property services, mail delivery services and other services. Growth in residential, commercial and retail spaces had spiked the demand for cleaning services in the country.

By Hard Services (Electromechanical services, Operations and Maintenance Services, Fire Safety and Security Systems): Electromechanical services (including HVAC) have dominated the hard services market in Australia followed by operational and maintenance services and fire safety and security systems during FY’2018 in terms of revenue. Electromechanical services had the highest share resulting from implementation of better technology and a greater focus on indoor thermal comfort by improving air movement mechanisms in air conditioned and naturally ventilated buildings.

Competitive Landscape: The Australian Facility Management services market is highly fragmented. Spotless Group is the market leader and has the highest market share in the Facility Management market in Australia on the basis of revenue in FY’2018. This was followed by Programmed Maintenance, Serco, Broadspectrum, ISS Australia and others. These market players compete in the FM market in Australia on the basis of price of services, quality and knowledge of services, track record and past history within the industry and sectors serviced, skilled workforce, and established client relationships.

Australia Facility Management Future Outlook: In future, it is anticipated that Australia facility management market in terms of revenue will increase at a positive CAGR during the period FY’2018 – FY’2023. In Australia, it is expected that the demand for both soft and hard services will be further augmented largely due to growth in the Government outsourcing through Public Private Partnerships (PPP). Moreover, increasing demand from multinational clients is likely to drive future demand for Integrated Facility Management (IFM) services in Australia with commercial office buildings and infrastructure sector being the future penetration sectors for IFM services. The growth in supply/ new projects pipeline in Residential, retail, commercial and infrastructure sectors in the country will further increase the demand of FM services.

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- Introduction on Australia Facility Management Market

- Australia Facility Management Market Size by Revenue (FY’2013-FY’2018)

- Australia Facility Management Market Segmentation

- Australia Facility Management Market Segmentation by Soft and Hard Services

- Australia Facility Management Market by type of services (Single Services, Bundled Services and

Integrated Services) - Australia Facility Management Market by End User Sectors

- Australia Facility Management Market by Personnel Type

- Trends and Developments in the Facility Management Market

- Issues and Challenges in the Facility Management Market

- Government Regulations in Australia Facility Management Market

- SWOT Analysis of Australia Facility Management Market

- Competitive Scenario in Australia Facility Management Market

- Shares and Company Profiles of Major Players in the Market

- Vendor Selection Process in Australia Facility Management Market

- Australia Facility Management Market Future Outlook and Projections (FY’2018-FY’2023)

- Analyst Recommendations in Australia Facility Management Market

Products

Key Target Audience

Facility Management Companies

Real Estate Construction Companies

Hospitality Sector

Time Period Captured in the Report:

Historical Period: 2013-2018

Forecast Period: 2018-2023

Companies

Key Segments Covered

By Soft Services and Hard Services

Soft Services

Cleaning services

Security Services

Others

Hard Services

Electromechanical Services (including HVAC)

Operational and Maintenance Services

Fire Safety and Security Systems

By Type of Services

Single Services

Bundled Services

Integrated Facility Services

By End User Sectors

Commercial sector

Residential sector

Retail Sector

Industrial sector

Hospital Sector

Infrastructure and others

Companies Covered:

Spotless Group

Programmed Maintenance

Serco

Broadspectrum

ISS Australia

Sodexo

BGIS

JLL Inc.

GJK

Fresh Start Australia

Table of Contents

1. Executive Summary

2. Research Methodology

2.1 Market Definitions

2.2. Abbreviations

2.3. Consolidated Research Approach

2.4. Variables (Dependent and Independent)

2.5. Correlation Matrix

2.6. Regression Matrix

2.7. Limitations and Conclusion

3. Australia Facility Management Market – Overview and Market Size

3.1 Market Overview and Genesis

3.2 Business Acquisition Process

3.3 Australia Facility Management Market Size by Revenue (FY’2013-FY’2018)

4. Australia Facility Management Market Segmentation (FY’2013-FY’2018)

4.1. By Soft and Hard Services, FY’2013-FY’2018

4.1.1 By Soft Services (Cleaning, Security and Other services - property management/building management, environmental management, courier services, laundry services and pantry services), FY’2013-FY’2018

4.1.2 By Hard Services (Electromechanical, Operations and Maintenance, Fire and Safety) FY’2013-FY’2018

4.2 By Integrated, Bundled and Single Services, FY’2013-FY’2018

4.3 By End User Sectors (Commercial, Residential, Retail, Industrial, Hospitals, Infrastructure and Others) FY’2013-FY’2018

4.3.1. Commercial Sector

4.3.2 Residential Sector

4.3.3. Infrastructure

4.3.4. Healthcare

4.4 By Personnel Type (Outsourced, In-House Personnel), FY’2013-FY’2018

5. Vendor Selection Process

5.1 Vendor Selection Parameters

5.2 Vendor Selection Procurement Methodology

6. Trends and developments in Australia Facility Management Market

7. Issues and challenges in Australia Facility Management Market

8. Regulatory Framework in Australia Facility Management Market

9. Mergers and Acquisitions in the Australian Facility Market

10. Types of Contracts in Facility Management Market

11. SWOT Analysis in Australia Facility Management Market

12. Service Matrix Company Wise

13. Market Share of Major Facility Management Players in Australia (Competitive Parameters)

14. Profiles of Major Facility Management Companies (Company Overview, Service Portfolio, Regional Presence, Market Share, Revenue from facility management, Recent Developments, Major Clientele, Strengths, Number of Employees, Major Sectors Served and Business Strategy)

14.1. Spotless Group

14.2. Programmed Maintenance services Limited

14.3. Serco Limited

14.4. Broadspectrum Pty. Ltd.

14.5. ISS Australia

14.6. Sodexo

14.7. BGIS

14.8. JLL

14.9. GJK

14.10. Fresh Start Australia

15. Australia Facility Management Market Future Outlook and Projections, FY’2018-FY’2023

16. Australia Facility Management Market Segmentation (FY’2018-FY’2023)

16.1. By Soft and Hard Services, FY’2018-FY’2023

16.1.1 By Soft Services (Cleaning, Security and Other services - property management/building management, environmental management, courier services, laundry services and pantry services), FY’2018-FY’2023

16.1.2 By Hard Services (Electromechanical, Operations and Maintenance, Fire and Safety) FY’2018-FY’2023

16.2 By Integrated, Bundled and Single Services, FY’2018-FY’2023

16.3 By End User Sectors (Commercial, Residential, Retail, Industrial, Hospitals, Infrastructure and Others), FY’2018-FY’2023

16.3.1 Commercial Sector (Future Supply and Projects)

16.3.2 Residential Sector (Future Supply and Projects)

16.3.3. Infrastructure (Future Projects)

16.4 By Personnel Type (Outsourced, In-House Personnel), FY’2018-FY’2023

17. Australia Facility Management Market- Analyst Recommendations

Disclaimer

Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.