MEA Active Pharmaceutical Ingredients (API) Market Outlook to 2030

Region:Global

Author(s):Meenakshi Bisht

Product Code:KROD1279

December 2024

93

About the Report

MEA Active Pharmaceutical Ingredients (API) Market Overview

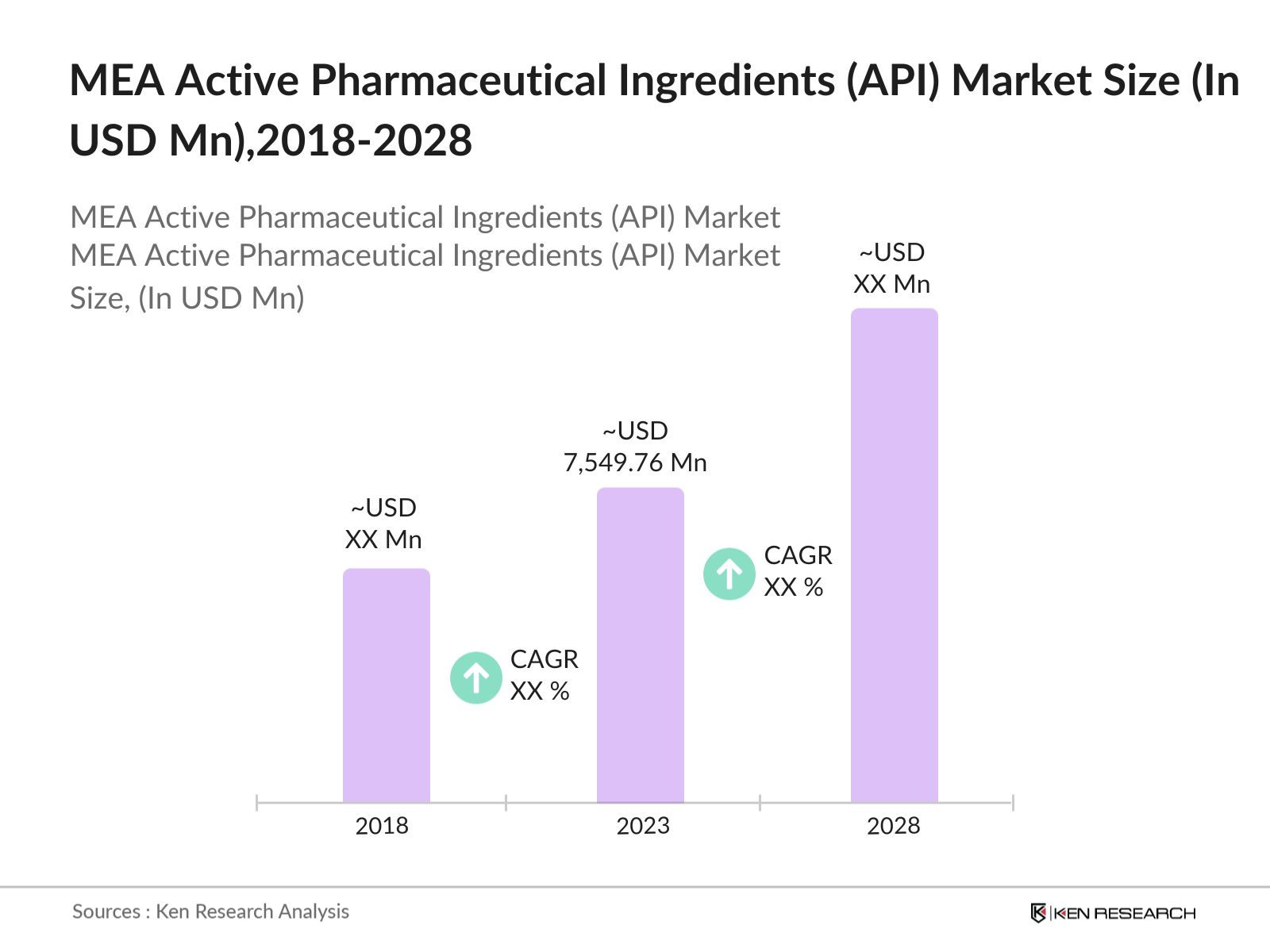

- The MEA Pharmaceutical Ingredients (API) was valued at USD 7,549.76 million in 2023. This growth is driven by the increasing demand for pharmaceutical products in the region, supported by rising healthcare expenditure, a growing population, and advancements in healthcare infrastructure.

- The market is dominated by both local and international pharmaceutical companies. Key players include Hikma Pharmaceuticals, Julphar, Tabuk Pharmaceuticals, Saudi Pharmaceutical Industries, and AstraZeneca. These companies have established strong distribution networks and manufacturing capabilities, enabling them to cater to the growing demand for APIs in the region.

- In 2023, Hikma Pharmaceuticals reported strong financial performance, with double-digit growth in both revenue and operating profit. The company achieved an impressive core EBITDA margin of 28%, driven by the success of all three of its business segments. Hikma continued to expand its portfolio, particularly in complex areas such as oncology, through new product launches and partnerships. The company also focused on strengthening its infrastructure and evolving its strategy, positioning itself for future growth opportunities across its diversified global businesses.

- Dubai was dominating the market in 2023 due to its strategic location, advanced infrastructure, and the presence of the Dubai Science Park (DSP), a major hub for pharmaceutical companies. DSP offers cutting-edge facilities and a supportive business environment, attracting leading global players. Additionally, Dubai's robust logistics network, including Jebel Ali Port and Dubai International Airport, facilitates efficient trade, making it the central hub for pharmaceutical production and distribution in the region.

MEA Active Pharmaceutical Ingredients (API) Market Segmentation

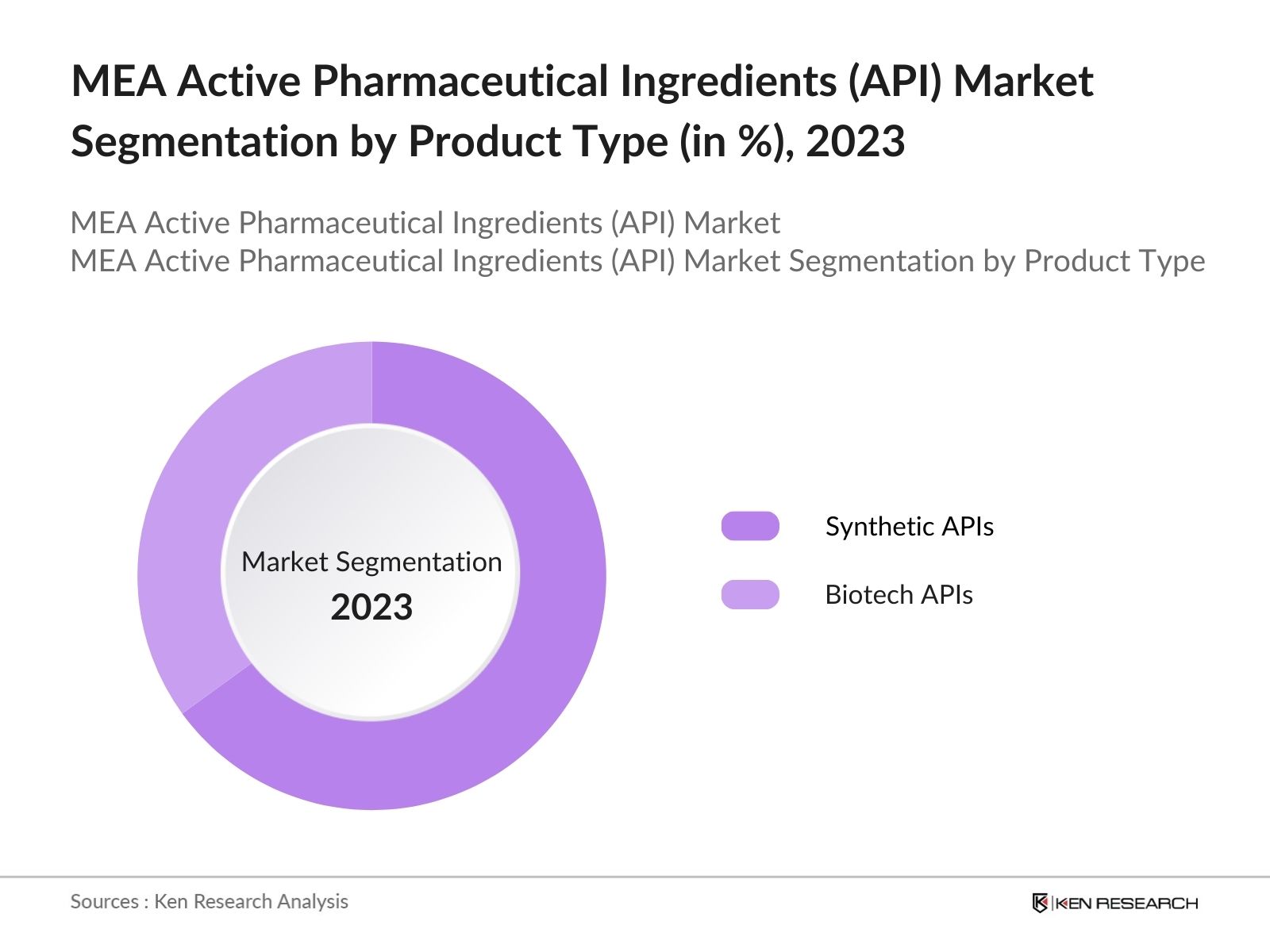

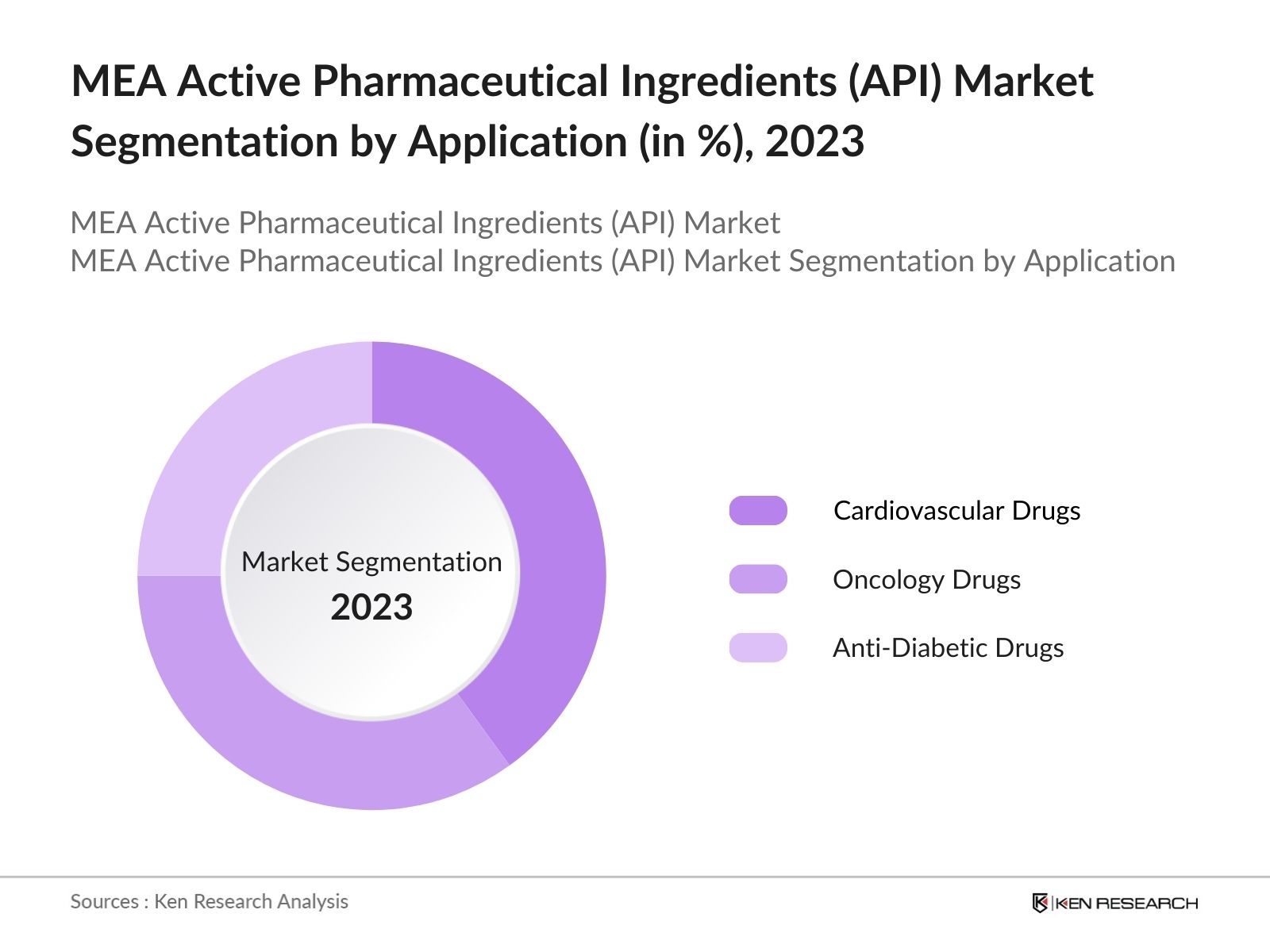

The MEA Active Pharmaceutical Ingredients (API) Market is segmented into different factors like by product type, by application and region.

By Product Type: The market is segmented by product type into Synthetic APIs and Biotech APIs. In 2023, Synthetic APIs dominated the market due to their widespread use in the production of generic drugs, which are in high demand due to their cost-effectiveness and widespread availability. Generic drugs play a crucial role in meeting the healthcare needs of the Middle Easts growing population, especially in countries with developing healthcare systems.

By Region: The market is segmented by region into Israel, United Arab Emirates (UAE), Jordan, Morocco, South Africa, and Rest of MEA. In 2023, the United Arab Emirates (UAE) dominated the market driven by its strategic investments in pharmaceutical infrastructure, government support for local manufacturing, and its position as a key hub for pharmaceutical exports in the Middle East. The presence of Dubai Science Park, which houses several leading pharmaceutical companies, has significantly contributed to the UAE's leadership in the API market. The UAE's favorable business environment, coupled with its strategic location, has attracted significant foreign direct investment (FDI) in the pharmaceutical sector, further solidifying its dominant position in the API market.

By Application: The market is segmented by application into Cardiovascular Drugs, Oncology Drugs, and Anti-Diabetic Drugs. In 2023, Cardiovascular Drugs dominated the market, driven by the high prevalence of cardiovascular diseases in the Middle East, which are among the leading causes of mortality in the region. The regions sedentary lifestyle, coupled with increasing rates of obesity and diabetes, has led to a growing demand for effective cardiovascular treatments. This has, in turn, fueled the demand for APIs used in the production of cardiovascular drugs. Pharmaceutical companies are focusing on developing innovative APIs that can be used in advanced cardiovascular therapies, which are expected to drive further growth in this segment.

MEA Active Pharmaceutical Ingredients (API) Market Competitive Landscape

MEA Active Pharmaceutical Ingredients (API) Market Major Players

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Hikma Pharmaceuticals |

1978 |

Amman, Jordan |

|

Julphar |

1980 |

Ras Al Khaimah, UAE |

|

Tabuk Pharmaceuticals |

1994 |

Tabuk, Saudi Arabia |

|

Saudi Pharmaceutical Industries |

1986 |

Riyadh, Saudi Arabia |

|

AstraZeneca |

1999 |

Cambridge, United Kingdom |

- Julphar: In May 2023, Julphar signed a landmark agreement with Sunshine Lake Pharma to pioneer the manufacturing of insulin biosimilars in the MENA region. This strategic partnership includes the licensing and technology transfer of Insulin Glargine and Insulin Aspart, enabling Julphar to become the first company to localize the production of modern insulin analogues in the region. This move aligns with the UAE's "Make It in the Emirates" initiative, enhancing Julphar's capabilities and regional presence in diabetes treatment.

- AstraZeneca: In 2024, AstraZeneca is investing $300 million in a new facility in Rockville, Maryland, aimed at supporting critical cancer trials and launching commercial cell therapy platforms. This facility will focus on next-generation cell therapy discovery and development, rather than a new API for oncology treatments.

MEA Active Pharmaceutical Ingredients (API) Market Analysis

MEA Active Pharmaceutical Ingredients (API) Market Growth Drivers

- Increasing Prevalence of Chronic Diseases: In 2024, the Middle East is expected to see a significant rise in the number of patients suffering from chronic diseases such as diabetes and cardiovascular disorders. In the MENA region 73 million adult people live with Diabetes affecting 16.2% of total adult population with a treatment cost estimated at USD33 billion annually. This growing patient base drives the demand for Active Pharmaceutical Ingredients (APIs) used in chronic disease management, as healthcare providers seek effective treatments to address this escalating health crisis. The increase in chronic disease cases directly boosts the production and consumption of APIs in the region, thereby driving market growth.

- Rising Healthcare Expenditure: Saudi Arabia accounts for 60 percent of the Gulf Cooperation Council (GCC) countries healthcare expenditure, and the sector remains a top priority for the Saudi Arabian Government. In 2023, it will spend $50.4 billion on healthcare and social development 16.96 percent of its 2023 budget and the second largest line item with education. in 2024, including investments in pharmaceutical development. This surge in healthcare funding is expected to drive the demand for APIs, as more resources are allocated to the development and procurement of essential drugs and treatments.

- Technological Advancements in API Production Advances in pharmaceutical technology, particularly in the areas of biotechnology and precision medicine, are driving the development of new, more effective APIs. As companies invest in R&D to innovate and improve API formulations, the market is experiencing growth driven by the introduction of high-value, complex APIs tailored to specific medical needs.

MEA Active Pharmaceutical Ingredients (API) Market Challenges

- Supply Chain Vulnerabilities: The Middle East API market is heavily reliant on global supply chains for raw materials and finished products. Disruptions in these supply chains, whether due to geopolitical tensions, transportation issues, or global market fluctuations, can severely impact the availability of APIs in the region. Such vulnerabilities make it difficult for local manufacturers to ensure a consistent and reliable supply of APIs, posing a risk to the overall stability of the market.

- Shortage of Skilled Workforce: The API industry in the Middle East faces a significant shortage of skilled professionals, particularly in specialized roles such as pharmaceutical chemists, quality control experts, and regulatory compliance officers. This shortage hinders the ability of companies to maintain high production standards and innovate in API development. The lack of a well-trained workforce also limits the region's capacity to expand its pharmaceutical manufacturing capabilities and meet the growing demand for APIs.

MEA Active Pharmaceutical Ingredients (API) Market Government Initiatives

- Saudi Arabia's Vision 2030 Pharmaceutical Strategy: Under Vision 2030, the Saudi Arabian Government intends to invest more than $65 billion to enhance the nations healthcare infrastructure, restructure and privatize health services and insurance, establish 21 health clusters nationwide, and broaden e-health service offerings. The plan also seeks to boost private sector involvement from 40 percent to 65 percent by 2030, aiming to privatize 290 hospitals and 2,300 primary health centers. This presents substantial commercial opportunities for U.S. companies in Saudi Arabias evolving healthcare market.

- UAE's National Strategy for Advanced Pharmaceuticals: In 2023, the UAE government has announced plans to establish 30 new industrial units as part of its strategy to boost the manufacturing sector's contribution to the GDP. This initiative is aligned with the "Operation 300bn" strategy, which aims to enhance the country's industrial capabilities and reduce reliance on imports by increasing local production. The government is focusing on sectors such as pharmaceuticals, petrochemicals, and advanced technologies to drive economic diversification and create job opportunities, further strengthening the UAE's industrial base.

MEA Active Pharmaceutical Ingredients (API) Market Future Outlook

The Middle East API Market is projected to grow exponentially by 2028, driven by continuous investments in pharmaceutical infrastructure, government initiatives to promote local manufacturing, and an increasing focus on generic drug production. The market is expected to witness a shift towards the production of high-value, complex APIs, reflecting global trends in the pharmaceutical industry.

Market Trends

- Rising Demand for High-Quality Generic Drugs: The demand for high-quality generic drugs in the Middle East is expected to increase significantly by 2028, driven by the rising prevalence of chronic diseases and the need for cost-effective treatment options. This trend will create a growing market for APIs used in the production of generic drugs, with pharmaceutical companies in the region investing in the development and production of APIs that meet international quality standards.

- Expansion of API Export Markets: Over the next five years, the Middle East API market is expected to expand its export markets, particularly in Africa and Asia. By 2028, the region's API exports are projected to increase, as companies in the Middle East capitalize on their growing production capabilities and strategic location. The establishment of free trade agreements and the development of advanced logistics networks will further support this trend, making the Middle East a key player in the global API market.

Scope of the Report

|

By Product Type |

Synthetic APIs Biotech APIs |

|

By Application |

Cardiovascular Drugs Oncology Drugs Anti-Diabetic Drugs |

|

By Region |

Israel United Arab Emirates (UAE) Jordan Morocco South Africa Rest of MEA |

|

By Molecule |

Small Molecule Large Molecule |

|

By Type |

Innovative Active Pharmaceutical Ingredients Generic Innovative Active Pharmaceutical Ingredients |

|

By Type of Manufacturer |

Captive API Manufacturer Merchant API Manufacturer |

|

Type of Drug |

Prescription Drugs Over-the-Counter |

|

By Usage |

Clinical Research |

|

By Chemical Synthesis |

Acetaminophen Artemisinin Saxagliptin Sodium Chloride Ibuprofen Losartan Potassium Enoxaparin Sodium Rufinamide NaproxenTamoxifen Others |

|

By Potency |

Low-to-Moderate Potency Active Pharmaceutical Ingredients Potent-to-Highly Potent Active Pharmaceutical Ingredient |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this report

Hospitals and Clinics

Contract Research Organizations (CROs)

Biotechnology Companies

Private Health Insurance Companies

Pharmacy Chains

Regional Health Authorities

Pharmaceutical Exporters

Government Agencies (Ministry of Health, Gulf Cooperation Council (GCC) Health Authorities)

Investors and VC Firms

Banks and Financial Institution

Time Period Captured in the Report:

Historical Period:2018-2023

Base Year:2023

Forecast Period:2023-2028

Companies

Players Mention in the Report:

Hikma Pharmaceuticals

Julphar

Tabuk Pharmaceuticals

Saudi Pharmaceutical Industries

AstraZeneca

Pfizer

Novartis

Sanofi

GlaxoSmithKline (GSK)

Teva Pharmaceutical Industries

Merck & Co.

Roche

Boehringer Ingelheim

Bayer AG

Dr. Reddy's Laboratories

Table of Contents

1. MEA Active Pharmaceutical Ingredients Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Active Pharmaceutical Ingredients Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Active Pharmaceutical Ingredients Market Analysis

3.1. Growth Drivers

3.1.1. Prevalence of Chronic Diseases

3.1.2. Expansion of Pharmaceutical Manufacturing

3.1.3. Rising Healthcare Expenditure

3.1.4. Increase in R&D Activities

3.2. Restraints

3.2.1. Regulatory Hurdles

3.2.2. High Production Costs

3.2.3. Supply Chain Disruptions

3.2.4. Skilled Workforce Shortage

3.3. Opportunities

3.3.1. Government Incentives

3.3.2. Local Production Expansion

3.3.3. Investment in Biotech APIs

3.3.4. Export Market Growth

3.4. Trends

3.4.1. Shift Towards Biotech APIs

3.4.2. Local Manufacturing Initiatives

3.4.3. Demand for High-Quality Generics

3.4.4. Expansion into Emerging Markets

3.5. Government Regulation

3.5.1. Local Production Support

3.5.2. Pharmaceutical Industry Standards

3.5.3. Export Incentives

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. MEA Active Pharmaceutical Ingredients Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Synthetic APIs

4.1.2. Biotech APIs

4.2. By Application (in Value %)

4.2.1. Cardiovascular Drugs

4.2.2. Oncology Drugs

4.2.3. Anti-Diabetic Drugs

4.3. By Region (in Value %)

4.3.1. Israel

4.3.2. United Arab Emirates

4.3.3. Jordan

4.3.4. Morocco

4.3.5. South Africa

4.3.6. Rest of MEA

4.4. By Molecule (in Value %)

4.4.1. Small Molecule

4.4.2. Large Molecule

4.5. By Type (in Value %)

4.6. By Type of Manufacturer

4.6.1. Captive API Manufacturer

4.6.2. Merchant API Manufacturer

4.7. Type of Drug (in Value %)

4.7. 1. Prescription Drugs

4.7. 2. Over-the-Counter

4.8. By Usage (in Value %)

4.8.1. Clinical

4.8.2. Research

4.9. By Chemical Synthesis

4.9.1. Acetaminophen

4.9.2. Artemisinin

4.9.3. Saxagliptin

4.9.4. Sodium Chloride

4.9.5. Ibuprofen

4.9.6. Losartan Potassium

4.9.7. Enoxaparin Sodium

4.9.8. Rufinamide

4.9.9. Naproxen

4.9.10. Tamoxifen

4.9.11. Others

4.10. By Potency (in Value %)

4.10.1. Low-to-Moderate Potency Active Pharmaceutical Ingredients

4.10.2. Potent-to-Highly Potent Active Pharmaceutical Ingredient

5. MEA Active Pharmaceutical Ingredients Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Hikma Pharmaceuticals

5.1.2. Julphar

5.1.3. Tabuk Pharmaceuticals

5.1.4. Saudi Pharmaceutical Industries

5.1.5. AstraZeneca

5.1.6. Pfizer

5.1.7. Novartis

5.1.8. Sanofi

5.1.9. GlaxoSmithKline (GSK)

5.1.10. Teva Pharmaceutical Industries

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. MEA Active Pharmaceutical Ingredients Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. MEA Active Pharmaceutical Ingredients Market Regulatory Framework

7.1. Pharmaceutical Industry Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. MEA Active Pharmaceutical Ingredients Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. MEA Active Pharmaceutical Ingredients Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

9.4. By Molecule (in Value %)

9.5. By Type of Manufacturer

9.6. By Type (in Value %)

9.7. Type of Drug (in Value %)

9.8. By Usage (in Value %)

9.9. By Chemical Synthesis

9.10. By Potency (in Value %)

10. MEA Active Pharmaceutical Ingredients Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building

Collating statistics on MEA Active Pharmaceutical Ingredients Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for MEA Active Pharmaceutical Ingredients Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple pharmaceutical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach fromsuch pharmaceutical companies.

Frequently Asked Questions

01 How big is the MEA Active Pharmaceutical Ingredients (API) Market?

The MEA Active Pharmaceutical Ingredients (API) Market was valued at USD 7,549.76 million in 2023, driven by the increasing prevalence of chronic diseases, expansion of local pharmaceutical manufacturing, and supportive government initiatives.

02 What are the challenges in the MEA Active Pharmaceutical Ingredients (API) Market?

Challenges in MEA Active Pharmaceutical Ingredients (API) Market include a complex regulatory landscape, high production costs, supply chain vulnerabilities, and a shortage of skilled workforce, all of which can hinder the growth and efficiency of the market.

03 Who are the major players in the MEA Active Pharmaceutical Ingredients (API) Market?

Key players in MEA Active Pharmaceutical Ingredients (API) Market include Hikma Pharmaceuticals, Julphar, Tabuk Pharmaceuticals, Saudi Pharmaceutical Industries, and AstraZeneca, all of which have a strong presence due to their extensive manufacturing capabilities and strategic partnerships.

04 What are the growth drivers of the MEA Active Pharmaceutical Ingredients (API) Market?

Growth drivers in MEA Active Pharmaceutical Ingredients (API) Market include the rising demand for chronic disease management, expansion of pharmaceutical manufacturing capabilities, government initiatives, and technological advancements in API production

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.