MEA Craft Spirits Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD10990

November 2024

89

About the Report

MEA Craft Spirits Market Overview

- The MEA craft spirits market is valued at USD 422.5 billion, driven by the regions evolving consumer base that increasingly favors high-quality, artisanal alcoholic beverages over mass-produced options. The demand surge aligns with growing urbanization and a shift towards premium, unique experiences in the region's hospitality sector. Middle Eastern and African economies' gradual recovery and increased disposable incomes are also significant factors driving market expansion.

- Dubai and Cape Town dominate the MEA craft spirits market, largely due to their vibrant tourism industries and reputation as luxury destinations. Dubai, with its cosmopolitan demographic, has become a center for premium craft spirit brands, while Cape Town benefits from its established wine and spirits culture, supported by South Africas favorable local production landscape and growing craft distillery market.

- Sustainability initiatives in the MEA region are driving more eco-conscious production practices. In 2024, the UAE introduced sustainability incentives under its Green Economy Program, allocating over USD 1 billion in subsidies for industries that adopt eco-friendly practices, including the craft spirits sector. These government-backed incentives aim to reduce environmental impact, promoting sustainable distillation processes and packaging among craft spirit producers across the region

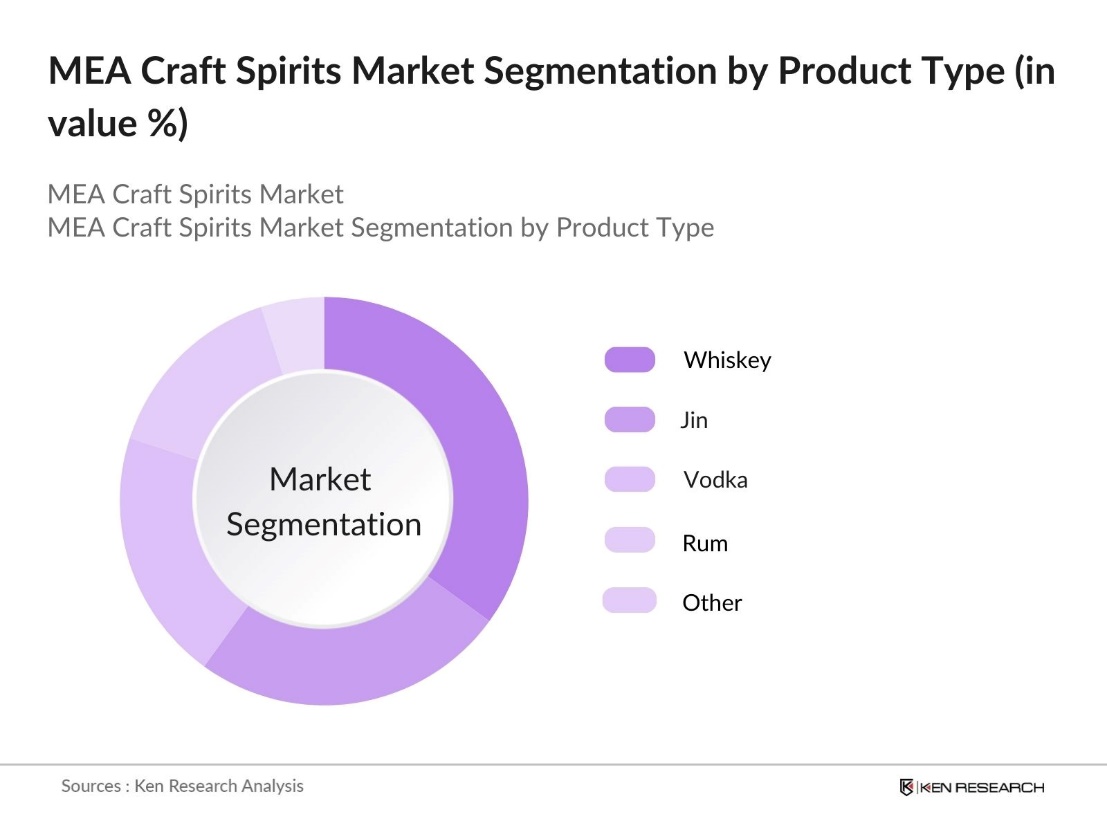

MEA Craft Spirits Market Segmentation

By Product Type: The market is segmented by product type into whiskey, gin, vodka, rum, and others. Whiskey holds the dominant market share under this segmentation, owing to its deeply rooted cultural significance and growing popularity among high-income consumers seeking a premium experience. Middle Eastern distilleries have begun producing unique blends catering to local preferences, further cementing whiskey's stronghold in the region.

By Distribution Channel: The market segmentation by distribution channel includes on-trade (bars, restaurants, hotels) and off-trade (retail stores, e-commerce, duty-free shops). On-trade channels lead the market as craft spirits gain popularity in the regions hospitality sector. The high visibility of craft spirits in luxury hotels, bars, and upscale restaurants has helped solidify this channel's position, as consumers continue to explore premium and artisanal spirit options in these environments.

MEA Craft Spirits Market Competitive Landscape

The MEA craft spirits market is marked by a mix of local and international players, with a concentration of established brands leveraging strategic positioning in affluent areas. Key players include multinational corporations and emerging craft distilleries catering to niche tastes.

MEA Craft Spirits Industry Analysis

Growth Drivers

- Rising Demand for Premiumization: In the Middle East and Africa (MEA) region, the shift towards premium craft spirits has increased significantly as consumers gravitate towards high-quality and artisanal products. Craft distilleries in the MEA are meeting this demand with bespoke, small-batch spirits emphasizing unique, locally-sourced ingredients. This premiumization trend aligns with the regional increase in disposable incomes, particularly in the UAE and Saudi Arabia, where per capita incomes exceeded USD 25,000 in 2023.

- Increase in Tourism and Hospitality: The MEA tourism sector's growth, as reported by the World Tourism Organization, has bolstered the demand for craft spirits. Tourism-related hospitality growth drives demand for authentic, locally-crafted spirits in high-end establishments. For instance, preliminary estimates on the economic contribution of tourism, measured in tourism direct gross domestic product (TDGDP) point to USD 3.3 trillion in 2023, or 3% of global GDP. This trend supports the craft spirits market by incorporating local flavors into hotel and restaurant offerings across MEA.

- Changing Consumer Preferences: In the MEA, a younger population is driving demand for artisanal and authentic products, favoring unique, experience-oriented consumption. Urbanization further supports this shift, with a significant urban population in countries like the UAE and Qatar seeking sophisticated, locally-crafted spirits. This trend aligns with a growing interest in high-quality, authentic products that cater to both local traditions and global tastes.

Market Challenges

- Complex Licensing Regulations: The regulatory landscape in the MEA poses considerable challenges for craft spirit producers, with complex licensing requirements creating entry barriers for new brands. Countries like Saudi Arabia and UAE enforce strict licensing procedures that involve compliance costs and bureaucratic hurdles. These regulatory demands can be especially challenging for small-scale craft distillers, impacting their ability to operate smoothly within a highly regulated environment.

- High Production Costs: Production costs for craft spirits in the MEA remain high due to costly raw materials and stringent compliance requirements. Import dependency and fluctuating currency rates contribute to rising costs for essential materials. Additionally, energy and water expenses required for distillation further increase operational costs, posing challenges for craft distillers who strive to scale production while managing these financial pressures.

MEA Craft Spirits Market Future Outlook

Over the next five years, the MEA craft spirits market is set for substantial growth, supported by the increasing penetration of premium products and the rise of affluent consumer demographics in key regions. Ongoing tourism recovery, combined with local governments supportive policies for artisanal manufacturing, will further boost the market. Additionally, growing interest in eco-friendly practices in distilling is expected to attract environmentally conscious consumers to craft spirits.

Market Opportunities

- Growth of E-Commerce Platforms: The expansion of e-commerce in the MEA has created new opportunities for craft spirit sales, enabling distilleries to reach a wider audience through digital channels. With increased internet access, more consumers can explore and purchase niche, premium craft spirits directly, bypassing traditional retail channels. This shift supports direct-to-consumer models, offering distillers a way to connect with consumers who seek unique, artisanal products.

- Rise in Small-Batch Production: Small-batch production gives craft distillers an advantage by allowing them to experiment with distinctive flavors tailored for a luxury market. Consumer interest in limited-edition and locally-produced spirits has grown, providing an opportunity for distillers to capitalize on the appeal of exclusivity and artisanal quality. This trend aligns with a broader consumer shift towards unique, handcrafted products that reflect local authenticity and craftsmanship.

Scope of the Report

|

Product Type |

Whiskey |

|

Distribution Channel |

On-Trade (Bars, Restaurants, Hotels) |

|

Ingredient |

Grain-Based |

|

Alcohol Content |

Low Alcohol |

|

Region |

GCC Countries |

Products

Key Target Audience

Craft Spirit Manufacturers

Luxury Hotels and Resorts Industry

Eco-Conscious Packaging Companies

Corporate Gifting Companies

Eco-Friendly Packaging

Government and Regulatory Bodies (Dubai Department of Economic Development, South African Department of Trade, Industry, and Competition)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Diageo plc

Pernod Ricard

Distell Group Limited

Campari Group

Amrut Distilleries

Brown-Forman Corporation

Rmy Cointreau

Heaven Hill Brands

Crafty Distillery

African Distillers

Table of Contents

1. MEA Craft Spirits Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. MEA Craft Spirits Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. MEA Craft Spirits Market Analysis

3.1 Growth Drivers (Craft Distillation Methods, Local Sourcing, Brand Authenticity)

3.1.1 Rising Demand for Premiumization

3.1.2 Increase in Tourism and Hospitality

3.1.3 Changing Consumer Preferences

3.2 Market Challenges (Regulatory Compliance, Import Restrictions, Competition from Multinational Brands)

3.2.1 Complex Licensing Regulations

3.2.2 High Production Costs

3.2.3 Limited Distribution Channels

3.3 Opportunities (Expansion in Emerging Markets, Digital Marketing, Direct-to-Consumer Models)

3.3.1 Growth of E-Commerce Platforms

3.3.2 Rise in Small-Batch Production

3.3.3 Partnership with Local Breweries

3.4 Trends (Innovative Flavors, Sustainable Practices, Craft Cocktails)

3.4.1 Shift Toward Organic Ingredients

3.4.2 Rise in Cask-Aged Spirits

3.4.3 Increase in Limited-Edition Spirits

3.5 Government Regulations (Taxation Policies, Quality Standards, Certification Processes)

3.5.1 Import and Export Guidelines

3.5.2 Sustainability Incentives

3.5.3 Local Production Subsidies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. MEA Craft Spirits Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Whiskey

4.1.2 Gin

4.1.3 Vodka

4.1.4 Rum

4.1.5 Others

4.2 By Distribution Channel (In Value %)

4.2.1 On-Trade (Bars, Restaurants, Hotels)

4.2.2 Off-Trade (Retail Stores, E-commerce, Duty-Free Shops)

4.3 By Ingredient (In Value %)

4.3.1 Grain-Based

4.3.2 Fruit-Based

4.3.3 Sugarcane-Based

4.3.4 Others

4.4 By Alcohol Content (In Value %)

4.4.1 Low Alcohol

4.4.2 Standard Alcohol

4.4.3 High Alcohol

4.5 By Region (In Value %)

4.5.1 GCC Countries

4.5.2 South Africa

4.5.3 North Africa

4.5.4 Rest of MEA

5. MEA Craft Spirits Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Diageo plc

5.1.2 Pernod Ricard

5.1.3 Bacardi Limited

5.1.4 Rmy Cointreau

5.1.5 William Grant & Sons

5.1.6 Distell Group Limited

5.1.7 Brown-Forman Corporation

5.1.8 Campari Group

5.1.9 Heaven Hill Brands

5.1.10 Crafty Distillery

5.1.11 Amrut Distilleries

5.1.12 Belvedere Vodka

5.1.13 Loch Lomond Group

5.1.14 Alchemy Distilleries

5.1.15 African Distillers

5.2 Cross Comparison Parameters (Revenue, Distillery Capacity, Product Portfolio, Ingredient Sourcing, Craft Techniques, Environmental Sustainability, Distribution Network, Local Market Penetration)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. MEA Craft Spirits Market Regulatory Framework

6.1 Alcohol Production and Sales Legislation

6.2 Health and Safety Standards

6.3 Labeling and Packaging Regulations

6.4 Import and Export Regulations

6.5 Compliance Requirements

7. MEA Craft Spirits Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. MEA Craft Spirits Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Alcohol Content (In Value %)

8.5. By Region (In Value %)

9. MEA Craft Spirits Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involved mapping all significant stakeholders within the MEA craft spirits market. Extensive desk research supported by proprietary databases was utilized to gather data at the industry level, identifying the critical variables impacting market growth.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data to understand market penetration, the balance between local and international brands, and revenue generation. Additionally, we assessed regional preferences to ensure accurate market segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were developed and validated through expert consultations. Structured interviews with executives from leading craft spirit companies provided insights into operational challenges, financial health, and growth potential in the MEA region.

Step 4: Research Synthesis and Final Output

Engaging directly with craft spirit manufacturers and distributors enabled us to refine the statistics gathered through bottom-up and top-down approaches, ensuring a thorough, validated market analysis for the MEA craft spirits industry.

Frequently Asked Questions

01. How big is the MEA Craft Spirits Market?

The MEA craft spirits market is valued at USD 422.5 billion, driven by rising consumer interest in premium, artisanal spirits.

02. What are the main challenges in the MEA Craft Spirits Market?

Primary challenges in MEA craft spirits market include regulatory complexities, limited distribution networks, and competition from larger multinational brands.

03. Which companies lead the MEA Craft Spirits Market?

Major players in MEA craft spirits market include Diageo plc, Pernod Ricard, Distell Group, Campari Group, and Amrut Distilleries, leveraging strong brand presence and wide distribution networks.

04. What drives growth in the MEA Craft Spirits Market?

The MEA craft spirits market growth is driven by increasing demand for premium products, tourism growth, and shifting consumer preferences toward artisanal experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.