MEA Fast-Food Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD5637

November 2024

98

About the Report

MEA Fast-Food Market Overview

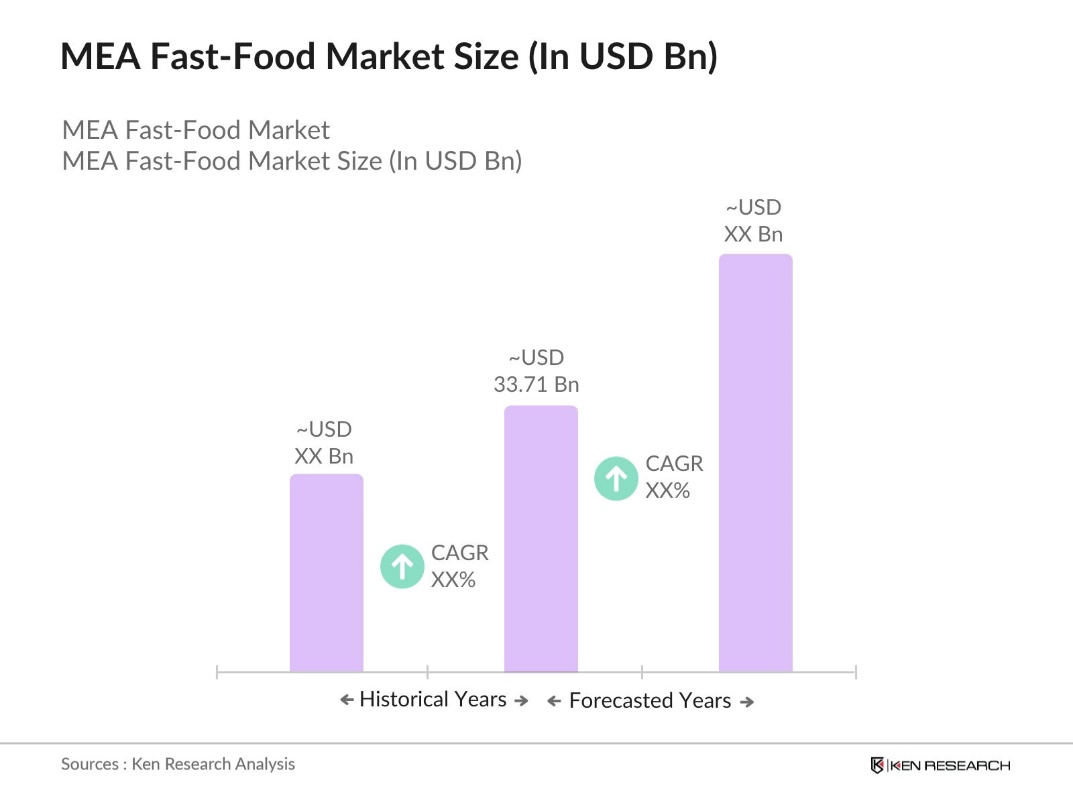

- The MEA fast-food market is valued at USD 33.71 billion, driven by an increasing urban population, rising disposable incomes, and the influence of Western culture on food preferences. The regions demand is particularly fueled by the growth of quick-service restaurants (QSRs) and the expansion of online food delivery platforms. Consumers are seeking convenient and affordable meal options, making fast food a popular choice, especially among young adults.

- In the MEA region, countries such as Saudi Arabia, the UAE, and Egypt dominate the fast-food market. This dominance is attributed to high urbanization rates, a young and growing population, and a strong preference for convenient food options. Additionally, these countries have seen substantial investments in food infrastructure, allowing international chains to thrive. Saudi Arabia and the UAE also benefit from a large expatriate population, which has a high demand for familiar Western fast-food brands, further driving the market.

- Governments in the MEA region have implemented stringent food safety standards to protect public health. In Saudi Arabia, the Saudi Food and Drug Authority (SFDA) increased inspections in 2023, with a focus on compliance with food handling protocols. These regulatory efforts emphasize the importance of safety and quality, encouraging fast-food operators to maintain high standards and ensure consumer safety.

MEA Fast-Food Market Segmentation

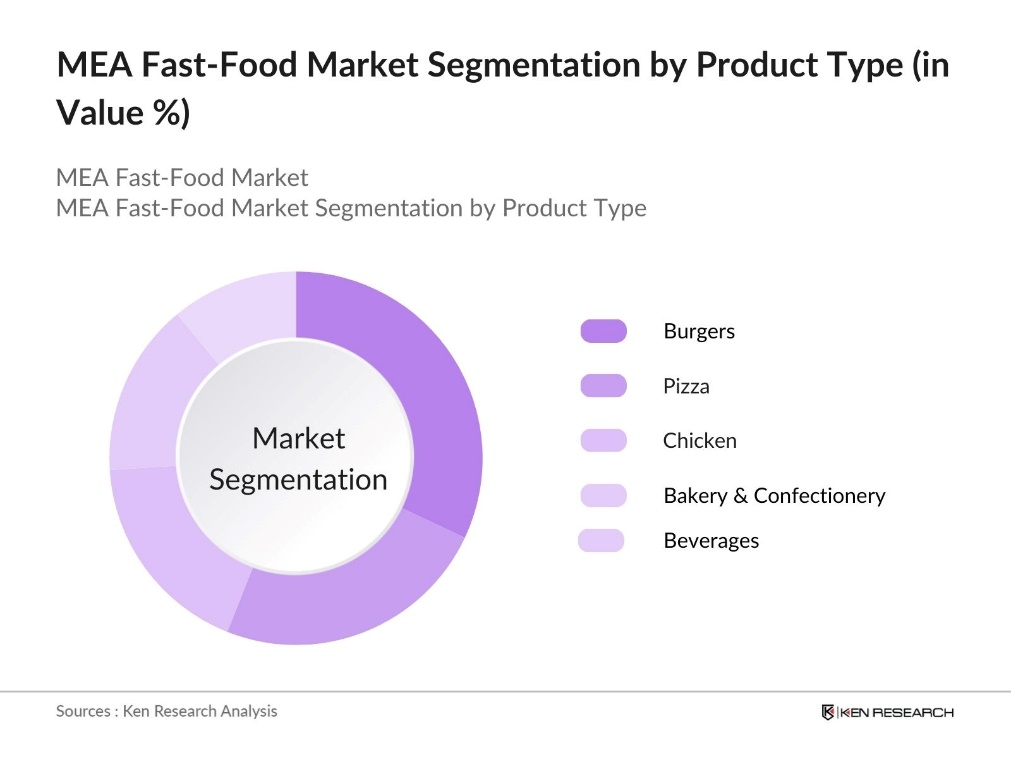

By Product Type: The market is segmented by product type into burgers, pizza, chicken, bakery & confectionery, and beverages. Recently, burgers have maintained a dominant position within the product type segment, largely due to the enduring popularity of well-established brands like McDonald's, Burger King, and Hardee's. These brands have tailored their offerings with local flavors to attract a diverse customer base. Moreover, the simplicity and affordability of burger meals contribute to their widespread acceptance, particularly among younger consumers seeking quick and tasty meals.

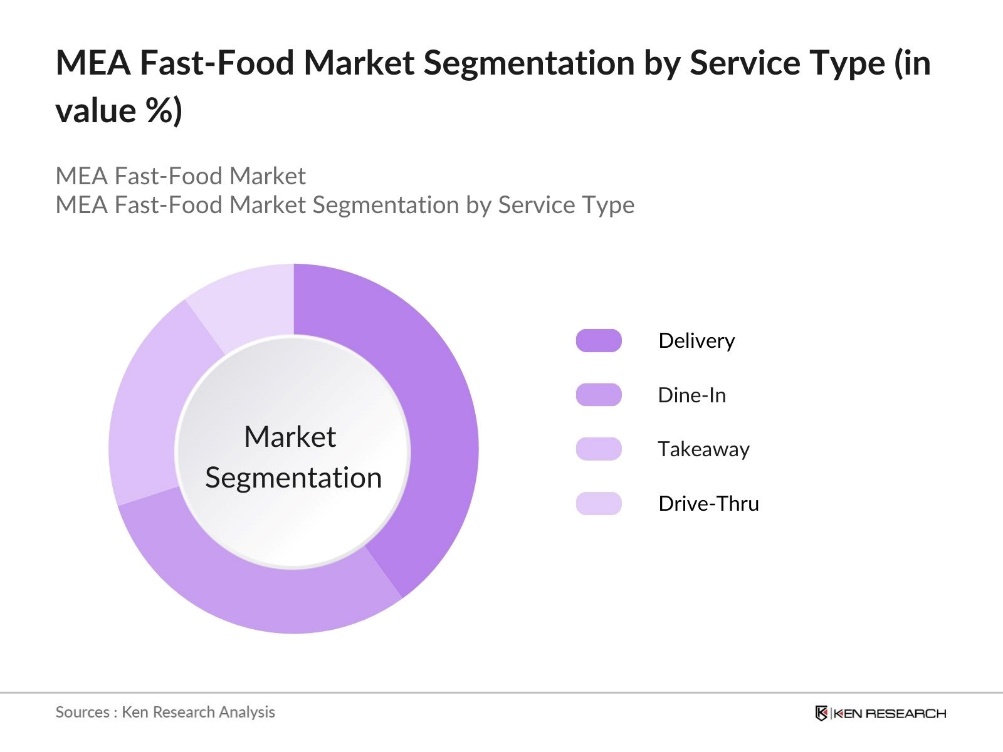

By Service Type: The market is segmented by service type into dine-in, drive-thru, takeaway, and delivery. The delivery segment has emerged as the most dominant due to the rise of digital food delivery platforms like Talabat and Uber Eats. The convenience of ordering from home, coupled with the region's increasing smartphone penetration, has driven the growth of delivery services. Additionally, consumer preferences for contactless and time-saving food options have accelerated the demand for delivery, especially in urban centers.

MEA Fast-Food Market Competitive Landscape

The MEA fast-food landscape is marked by the strong presence of both international giants like McDonald's and KFC, as well as regional favorites such as Al Baik, which cater to local tastes and preferences. This market consolidation illustrates the competitive advantage held by established brands that leverage both brand recognition and strategic partnerships with local operators.

MEA Fast-Food Industry Analysis

Growth Drivers

- Urbanization and Demographic Shifts: The Middle East and Africa (MEA) region has experienced significant urbanization, with urban populations increasing from 300 million in 2000 to over 500 million in 2023. This urban growth has led to a higher demand for convenient dining options, including fast food. For instance, in Saudi Arabia, urbanization contributing to the proliferation of fast-food outlets in cities like Riyadh and Jeddah.

- Changing Lifestyle Preferences: The MEA region's lifestyle has evolved, with a significant increase in dual-income households and longer working hours. In Egypt, the labor force participation is leading to a higher reliance on convenient meal options. In Kenya, the average working hours per week increased to 48 hours in 2023, prompting a shift towards quick-service restaurants. These changes have driven the demand for fast food, as consumers seek quick and accessible meal solutions.

- Influence of Western Culture: Western culture has significantly impacted the MEA fast-food market, with international chains like McDonald's, KFC, and Burger King establishing a strong presence. The popularity of these brands reflects a regional shift towards Western dining habits, favoring convenience and quick-service options. This cultural influence has fueled demand, driving growth and expanding the fast-food sector across key MEA markets.

Market Challenges

- Health Concerns Among Consumers: Increasing health awareness across the MEA region has led consumers to be more cautious about their dietary choices, impacting fast-food consumption. With a growing focus on health and wellness, more consumers are seeking healthier dining options and scrutinizing traditional fast-food offerings. This shift toward health-conscious eating habits presents challenges for the fast-food industry, which must adapt to meet changing consumer expectations.

- Stringent Food Safety Regulations: Governments in the MEA region have strengthened food safety regulations to protect public health, requiring fast-food chains to adhere to stricter standards. New regulations mandate clearer nutritional labeling and higher hygiene practices, increasing operational costs for fast-food operators. These compliance demands create challenges for the industry, prompting significant investments to align with evolving health and safety standards.

MEA Fast-Food Market Future Outlook

Over the next five years, the MEA fast-food market is expected to witness continued growth, driven by the expansion of delivery services, innovative product offerings, and enhanced customer experiences through digital platforms. Increasing urbanization and the ongoing development of digital ordering channels will further fuel the markets growth trajectory. Additionally, the demand for healthier fast-food options and sustainable practices is anticipated to shape product development and menu innovations among key players.

Market Opportunities

- Growth in Vegan and Plant-Based Menus: Consumer interest in vegan and plant-based foods is rising in the MEA region, prompting fast-food chains to introduce alternative menu items that cater to health and environmental concerns. By diversifying their offerings to include plant-based options, these brands appeal to a niche yet growing market segment, providing an opportunity to expand their customer base and align with shifting dietary preferences.

- Collaborations with Local Suppliers: Fast-food chains in the MEA region increasingly collaborate with local suppliers to enhance supply chain efficiency and reduce reliance on imports. These partnerships offer fresher ingredients, quicker delivery, and support for local economies. By sourcing locally, fast-food brands can meet logistical needs and cater to consumer preferences for local products, strengthening their operational resilience and market appeal.

Scope of the Report

|

Product Type |

Burgers and Sandwiches Pizza and Pasta Chicken Bakery and Confectionery Beverages |

|

Service Type |

Dine-In Drive-Thru Takeaway Delivery |

|

Age Group |

Children Teenagers Adults Seniors |

|

Distribution Channel |

Company-Owned Outlets Franchises Online Platforms Aggregators |

|

Region |

GCC North Africa Sub-Saharan Africa Levant |

Products

Key Target Audience

Franchise Operators and Partners

Food and Beverage Manufacturers

Delivery Service Industry

Restaurant Equipment Manufacturers

Government and Regulatory Bodies (e.g., Saudi Food and Drug Authority, Ministry of Economy UAE)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

McDonald's Corporation

Yum! Brands, Inc. (KFC, Pizza Hut)

Restaurant Brands International (Burger King)

Subway

Dominos Pizza

Al Baik

Hardee's

Jollibee Foods Corporation

Popeyes

Dunkin' Donuts

Table of Contents

1. MEA Fast-Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Fast-Food Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Fast-Food Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Demographic Shifts

3.1.2. Increased Disposable Income

3.1.3. Changing Lifestyle Preferences

3.1.4. Influence of Western Culture

3.2. Market Challenges

3.2.1. Health Concerns Among Consumers

3.2.2. Stringent Food Safety Regulations

3.2.3. Rising Competition from Local and International Players

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Expansion of Digital Ordering and Delivery Services

3.3.2. Innovation in Healthy Fast-Food Alternatives

3.3.3. Growth in Vegan and Plant-Based Menus

3.3.4. Collaborations with Local Suppliers

3.4. Trends

3.4.1. Adoption of Mobile Applications for Ordering

3.4.2. Rise of Ghost Kitchens

3.4.3. Increased Focus on Sustainability

3.4.4. Personalized Marketing through Data Analytics

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Nutritional Labeling Requirements

3.5.3. Advertising Restrictions for Children

3.5.4. Licensing and Franchise Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. MEA Fast-Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Burgers and Sandwiches

4.1.2. Pizza and Pasta

4.1.3. Chicken

4.1.4. Bakery and Confectionery

4.1.5. Beverages

4.2. By Service Type (In Value %)

4.2.1. Dine-In

4.2.2. Drive-Thru

4.2.3. Takeaway

4.2.4. Delivery

4.3. By Age Group (In Value %)

4.3.1. Children

4.3.2. Teenagers

4.3.3. Adults

4.3.4. Seniors

4.4. By Distribution Channel (In Value %)

4.4.1. Company-Owned Outlets

4.4.2. Franchises

4.4.3. Online Platforms

4.4.4. Aggregators

4.5. By Region (In Value %)

4.5.1. GCC

4.5.2. North Africa

4.5.3. Sub-Saharan Africa

4.5.4. Levant

5. MEA Fast-Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McDonald's Corporation

5.1.2. Yum! Brands, Inc. (KFC, Pizza Hut)

5.1.3. Restaurant Brands International (Burger King)

5.1.4. Subway

5.1.5. Dominos Pizza

5.1.6. Al Baik

5.1.7. Hardee's

5.1.8. Jollibee Foods Corporation

5.1.9. Popeyes

5.1.10. Dunkin' Donuts

5.1.11. Starbucks Corporation

5.1.12. Krispy Kreme

5.1.13. TGI Fridays

5.1.14. Baskin-Robbins

5.1.15. Pizza Express

5.2. Cross Comparison Parameters (Number of Outlets, Market Share, Revenue, Region of Operation, Employee Count, Annual Growth Rate, Menu Diversity, Technological Advancements)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government and Private Grants

5.9. Franchise Investments

6. MEA Fast-Food Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Food Quality and Compliance

6.3. Import Regulations for Food Ingredients

7. MEA Fast-Food Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Market Growth

8. MEA Fast-Food Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By Age Group (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. MEA Fast-Food Market Analysts Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) Analysis

9.2. Customer Segmentation Analysis

9.3. Effective Marketing Strategies

9.4. Emerging Market Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves identifying the core dynamics within the MEA fast-food market, including factors such as consumer preferences, regulatory frameworks, and technological advancements. The data gathering encompasses a comprehensive survey of market databases and sector reports, helping to isolate critical variables for further analysis.

Step 2: Market Analysis and Construction

The second step entails aggregating and analyzing historical market data to assess trends and market penetration across the MEA region. This phase includes evaluating consumer demographics, revenue streams, and shifts in distribution channels to ensure an accurate understanding of market structures.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on initial findings and then validated through direct consultations with industry experts, who provide insights on operational strategies and regional market nuances. These expert inputs serve as a crucial layer of verification for the data and trends observed.

Step 4: Research Synthesis and Final Output

The final synthesis includes integrating qualitative and quantitative data, with an emphasis on building a robust market model that captures revenue projections and growth factors. This stage involves feedback from fast-food chain operators, which is used to finalize the analysis and provide actionable insights into the MEA fast-food market.

Frequently Asked Questions

01. How big is the MEA fast-food market?

The MEA fast-food market is valued at USD 33.71 billion, driven by the growing demand for quick and convenient dining options across key regions.

02. What challenges does the MEA fast-food market face?

Challenges in MEA fast-food market include regulatory hurdles, a highly competitive landscape, and rising consumer concerns over health and nutrition in fast food.

03. Who are the major players in the MEA fast-food market?

Leading players in MEA fast-food market include McDonald's, KFC, Al Baik, Subway, and Hardee's, each leveraging brand strength and customer loyalty to maintain dominance.

04. What are the primary growth drivers of the MEA fast-food market?

Key growth drivers in this MEA fast-food market include urbanization, digital transformation in food delivery, and changing lifestyle preferences toward quick-service dining.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.