MEA Toothpaste Market Outlook to 2030

Region:Global

Author(s):Shreya

Product Code:KROD5185

November 2024

99

About the Report

MEA Toothpaste Market Overview

- The MEA Toothpaste Market is valued at USD 3.14 billion, driven by a growing focus on oral hygiene and increasing awareness about dental care. Rising disposable incomes across the region, especially in urban areas, have fueled consumer preference for premium toothpaste brands that offer specialized benefits like sensitivity relief and whitening. Additionally, public health campaigns have further propelled the market, particularly in developing countries within the region. Data from the World Health Organization (WHO) highlights the critical role that oral hygiene plays in overall health, further driving market expansion.

- The dominant countries in the MEA Toothpaste Market are Saudi Arabia, the UAE, and South Africa. These nations have robust retail infrastructure, a high urbanization rate, and strong purchasing power, contributing to their prominence in the market. In addition, their diverse and growing populations, coupled with high oral hygiene awareness, make them leading markets. The UAE and Saudi Arabia have become innovation hubs for premium and organic toothpaste products, while South Africa leads in overall consumption due to its large population and growing middle class.

- Governments across MEA enforce strict safety and labeling regulations for toothpaste products. In 2023, the Saudi Food and Drug Authority (SFDA) mandated that all oral care products be tested for safety and efficacy before entering the market. Manufacturers are required to list all active ingredients on product packaging, ensuring transparency for consumers. Non-compliance can result in significant fines or product recalls, further delaying market entry for new players.

MEA Toothpaste Market Segmentation

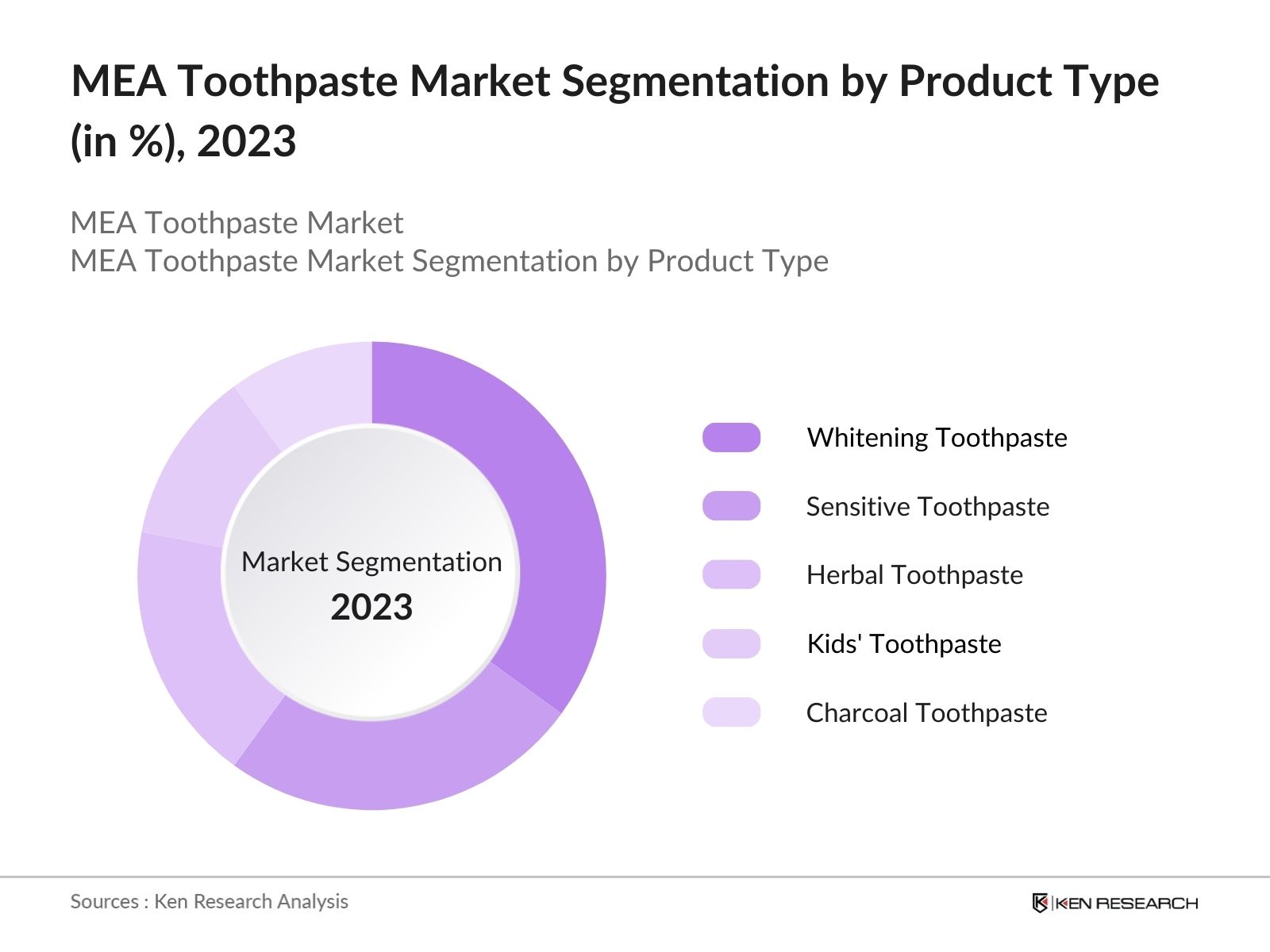

- By Product Type: The market is segmented by product type into Whitening Toothpaste, Sensitive Toothpaste, Herbal Toothpaste, Kids' Toothpaste, and Charcoal Toothpaste. Recently, whitening toothpaste has dominated market share under the product type segmentation. Its rising demand is primarily driven by the increasing aesthetic consciousness among consumers, especially in urban areas. Whitening toothpaste is also highly promoted in retail outlets and via e-commerce platforms, catering to consumers looking for products that enhance cosmetic appeal and oral health. Major brands like Colgate and Sensodyne have positioned their whitening products as premium solutions, enhancing their dominance.

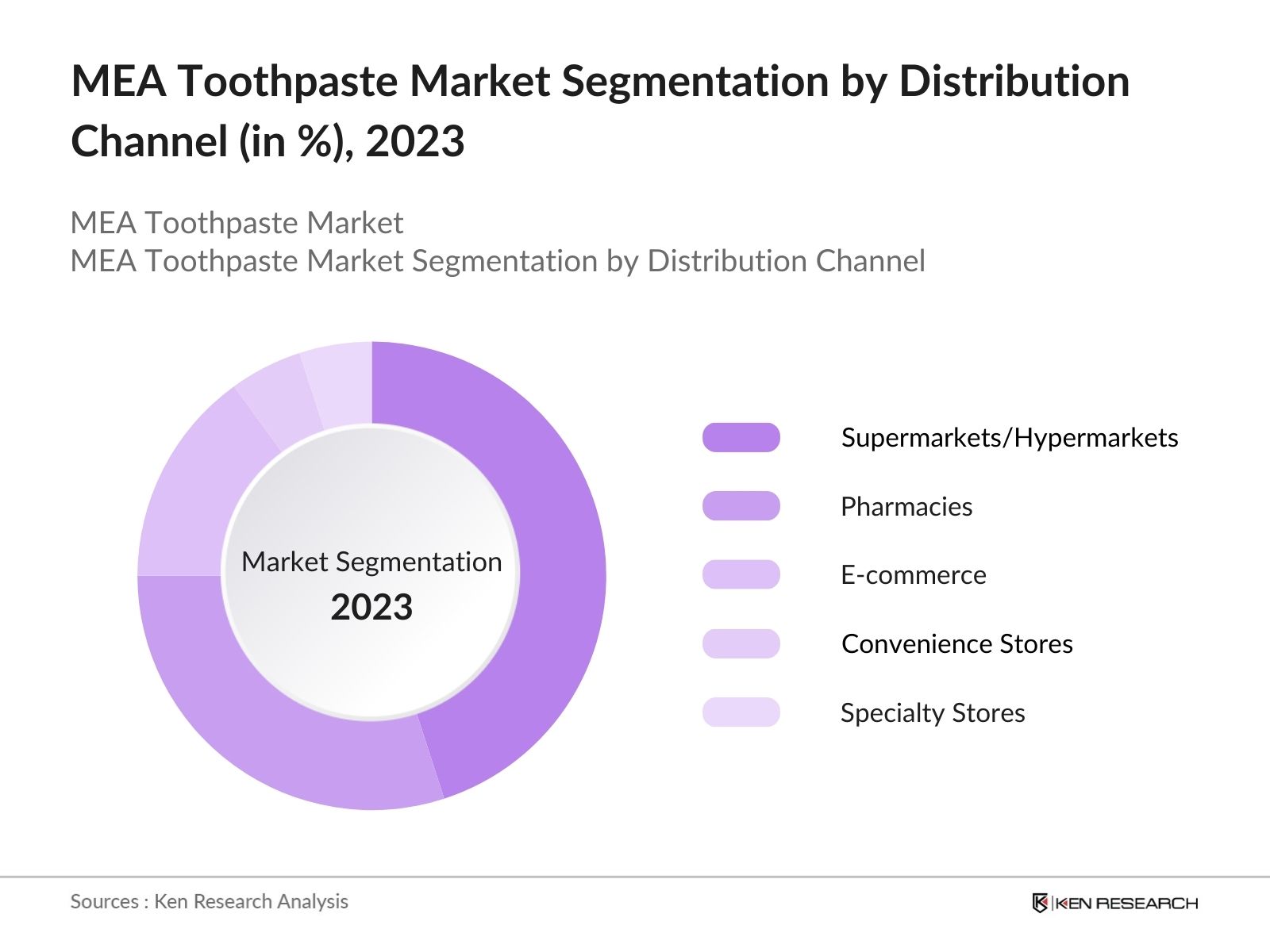

- By Distribution Channel: The market is also segmented by distribution channels, including Supermarkets/Hypermarkets, Pharmacies, E-commerce, Convenience Stores, and Specialty Stores. Supermarkets/Hypermarkets dominate the market due to their widespread availability, accessibility, and diverse product offerings under one roof. Consumers in the MEA region, especially in urban areas, prefer purchasing oral care products during their regular shopping trips. Supermarkets also offer frequent promotional discounts and feature premium brands, making them a popular choice for middle- and high-income consumers.

MEA Toothpaste Market Competitive Landscape

The MEA Toothpaste Market is highly competitive, with both multinational and regional players competing for market share. Major players have established a strong foothold through strategic marketing initiatives, frequent product innovations, and extensive distribution networks. The market is led by global giants such as Colgate-Palmolive, Procter & Gamble, and Unilever, which have maintained their dominance through aggressive branding and a wide range of product offerings.

|

Company Name |

Established Year |

Headquarters |

R&D Investment |

Brand Presence |

Revenue (USD Bn) |

Key Product Categories |

Distribution Network |

Market Share (%) |

|---|---|---|---|---|---|---|---|---|

|

Colgate-Palmolive |

1806 |

New York, USA |

||||||

|

Procter & Gamble |

1837 |

Cincinnati, USA |

||||||

|

Unilever |

1929 |

London, UK |

||||||

|

GlaxoSmithKline (Sensodyne) |

1715 |

London, UK |

||||||

|

Dabur |

1884 |

Ghaziabad, India |

MEA Toothpaste Industry Analysis

Growth Drivers

-

Rising Oral Health Awareness Oral health campaigns, supported by government bodies and NGOs, are driving awareness of the importance of oral hygiene across the Middle East and Africa (MEA) region. In 2024, the World Health Organization (WHO) reported that 54 million people in Africa suffered from untreated dental caries, underscoring the need for improved oral care practices. Government-led initiatives like Kenyas Oral Health Policy emphasize preventive care, boosting demand for toothpaste. In South Africa, 70% of urban households regularly purchase toothpaste, reflecting increasing awareness of dental health benefits.

- Expanding Consumer Disposable Income: The growing middle-class population across MEA is boosting consumer spending on personal care products, including premium toothpaste. According to the International Monetary Fund (IMF), average annual disposable income in the region has increased by 4.5% from 2022 to 2024, reaching USD 5,800 per capita. In oil-rich economies like Saudi Arabia and the UAE, higher incomes allow consumers to opt for premium toothpaste brands with added benefits like whitening or sensitivity relief. This increase in disposable income is expected to further drive the toothpaste market. IMF Link.

- Increasing Penetration of Premium Toothpaste Brands: Multinational brands like Colgate, Sensodyne, and Oral-B have expanded their footprint across MEA, particularly in urban centers like Lagos, Cairo, and Johannesburg. In 2023, market entry by new players in these cities increased product diversity, with premium toothpaste brands offering specialized benefits like enamel protection and tartar control. A report from the World Trade Organization (WTO) highlighted that import duties on oral care products have decreased by 3% across the region, facilitating easier entry for global brands and fostering consumer demand for premium offerings.

Market Challenges

-

Competition from Herbal/Organic Alternatives: The rise of herbal and organic toothpaste alternatives is a significant challenge for conventional brands. In 2023, over 25% of toothpaste sales in sub-Saharan Africa were dominated by herbal and natural toothpaste products, particularly those containing neem and miswak, according to reports from the African Unions Trade and Customs Division. This trend reflects consumer preference for natural and locally sourced products, which often claim to offer superior health benefits without chemical additives. Government trade data further indicates a 12% increase in imports of herbal oral care products in East Africa. African Union Link.

- Regulatory Standards and Product Approval Delays: Toothpaste manufacturers in MEA must comply with stringent regulatory requirements, often causing delays in product launches. The Gulf Cooperation Council (GCC) established unified product safety regulations in 2022, enforcing labeling and ingredient safety standards. Manufacturers reported delays of up to 8 months in 2023 for product approvals in Saudi Arabia and the UAE due to these stricter regulations. Additionally, the African Medicines Agency (AMA) now mandates safety assessments for new oral care products, further slowing market entry.

MEA Toothpaste Market Future Outlook

Over the next five years, the MEA Toothpaste Market is expected to experience steady growth, driven by rising consumer awareness of dental health, increased disposable incomes, and the introduction of innovative toothpaste formulations. Companies are also likely to focus on product personalization and sustainability trends, with organic and eco-friendly products gaining traction in markets such as the UAE and South Africa. Technological advancements in toothpaste formulations, such as nanotechnology for better plaque removal and sensitivity reduction, are expected to boost product demand.

Future Market Opportunities

-

Increasing Demand for Whitening Toothpaste: Consumers in the MEA region is showing increasing interest in toothpaste products offering aesthetic benefits, such as teeth whitening. A 2024 report from the Middle East Council of Shopping Centers revealed that sales of whitening toothpaste grew by 20% in major Gulf countries like the UAE and Qatar. As disposable incomes rise, more consumers are opting for toothpaste products that cater to aesthetic preferences, further driving demand for premium products with whitening properties. The UAEs Ministry of Economy noted that consumer expenditure on personal care, including oral care, rose by 9% in 2024.

- Growth of E-Commerce Channels: The e-commerce sector in MEA has been growing rapidly, with online retail sales reaching USD 50 billion in 2024, according to the African Development Bank (AfDB). The growing popularity of online shopping platforms like Jumia and Noon provides toothpaste brands with new distribution channels to reach tech-savvy consumers, particularly in urban areas. With 18% of personal care products purchased online in 2024, the e-commerce sector is expected to be a key driver for toothpaste sales in the coming years. AfDB Link.

Scope of the Report

|

Segments |

Sub-Segments |

|---|---|

|

Product Type |

Whitening Toothpaste |

|

Sensitive Toothpaste |

|

|

Herbal Toothpaste |

|

|

Kids Toothpaste |

|

|

Charcoal Toothpaste |

|

|

Distribution |

Supermarkets/Hypermarkets |

|

Pharmacies |

|

|

E-commerce |

|

|

Convenience Stores |

|

|

Specialty Stores |

|

|

Ingredient Type |

Fluoride-based Toothpaste |

|

Fluoride-Free Toothpaste |

|

|

Herbal/Natural Ingredients |

|

|

Synthetic Ingredients |

|

|

Price Range |

Premium Segment |

|

Mid-range Segment |

|

|

Economy Segment |

|

|

Geography |

GCC Countries |

|

North Africa |

|

|

Southern Africa |

|

|

East Africa |

|

|

West Africa |

Products

Key Target Audience

Retailers and Wholesalers

Oral Health Care Providers

Manufacturers and Distributors of Oral Care Products

Government and Regulatory Bodies (Saudi Food & Drug Authority, UAE Ministry of Health)

E-commerce Platforms

Banks and Financial Institutes

Dental Associations and Health Organizations

Investment and Venture Capitalist Firms

Private Label Brands

Companies

Major Players in the MEA Toothpaste Market

Colgate-Palmolive

Procter & Gamble

Unilever

GlaxoSmithKline (Sensodyne)

Johnson & Johnson

Amway Corporation

Henkel AG & Co. KGaA

Lion Corporation

Dabur

Himalaya Wellness

Sensodyne

Pepsodent

Elmex

Jordan

Patanjali

Table of Contents

1. MEA Toothpaste Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. MEA Toothpaste Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. MEA Toothpaste Market Analysis

3.1. Growth Drivers

Rising Oral Health Awareness

Expanding Consumer Disposable Income

Increasing Penetration of Premium Toothpaste Brands

Urbanization and Lifestyle Changes

Expanding Retail Networks

3.2. Market Challenges

Competition from Herbal/Organic Alternatives

Regulatory Standards and Product Approval Delays

Rising Raw Material Costs

Lack of Awareness in Rural Areas

3.3. Opportunities

Increasing Demand for Whitening Toothpaste

Growth of E-Commerce Channels

Expansion into Untapped Markets in Africa

Product Innovations (Fluoride-Free, Sensitivity Relief, etc.)

3.4. Trends

Preference for Natural and Organic Ingredients

Rise in Sensitive Toothpaste Demand

Growth in Charcoal-Based Products

Packaging Innovation for Sustainability

3.5. Government Regulations

Stringent Safety and Labelling Regulations

Import and Export Tariff Policies

Environmental Standards for Packaging

Marketing and Advertising Guidelines

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. MEA Toothpaste Market Segmentation

4.1. By Product Type (In Value %)

Whitening Toothpaste

Sensitive Toothpaste

Herbal Toothpaste

Kids Toothpaste

Charcoal Toothpaste

4.2. By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Pharmacies

E-commerce

Convenience Stores

Specialty Stores

4.3. By Ingredient Type (In Value %)

Fluoride-based Toothpaste

Fluoride-Free Toothpaste

Herbal/Natural Ingredients

Synthetic Ingredients

4.4. By Price Range (In Value %)

Premium Segment

Mid-range Segment

Economy Segment

4.5. By Geography (In Value %)

GCC Countries

North Africa

Southern Africa

East Africa

West Africa

5. MEA Toothpaste Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Colgate-Palmolive Company

5.1.2. Procter & Gamble Co.

5.1.3. Unilever

5.1.4. GlaxoSmithKline (GSK)

5.1.5. Johnson & Johnson

5.1.6. Amway Corporation

5.1.7. Henkel AG & Co. KGaA

5.1.8. Lion Corporation

5.1.9. Dabur

5.1.10. Himalaya Wellness

5.1.11. Sensodyne

5.1.12. Pepsodent

5.1.13. Elmex

5.1.14. Jordan

5.1.15. Patanjali

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Brand Presence, R&D Investment, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Geographic Expansion, Marketing Campaigns)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

6. MEA Toothpaste Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Environmental Compliance (Packaging Regulations)

6.3. Labelling and Marketing Regulations

6.4. Import/Export Regulations and Tariffs

7. MEA Toothpaste Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. MEA Toothpaste Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Price Range (In Value %)

8.5. By Geography (In Value %)

9. MEA Toothpaste Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped the major stakeholders in the MEA Toothpaste Market through comprehensive desk research. This step focused on identifying critical variables, such as product types, distribution channels, and key growth drivers, to assess their influence on market dynamics.

Step 2: Market Analysis and Construction

Next, we compiled and analyzed historical market data, focusing on market penetration and revenue trends across product segments. This phase included an evaluation of toothpaste usage trends and preferences to ensure accuracy in revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

We validated our hypotheses through direct consultations with industry experts using CATIs (Computer-Assisted Telephone Interviews). These consultations provided valuable insights into market trends, consumer behavior, and operational challenges faced by toothpaste manufacturers.

Step 4: Research Synthesis and Final Output

In the final stage, we engaged with major toothpaste brands and distributors to acquire detailed sales and product data. This step ensured the validation of bottom-up data, leading to a comprehensive, market-specific report on the MEA Toothpaste Market.

Frequently Asked Questions

1. How big is the MEA Toothpaste Market?

The MEA Toothpaste Market is valued at USD 3.14 billion, driven by increasing consumer awareness regarding oral hygiene and the growing demand for premium and herbal toothpaste.

2. What are the challenges in the MEA Toothpaste Market?

The major challenges in the MEA Toothpaste Market include rising competition from organic brands, fluctuating raw material costs, and stringent government regulations related to product safety and marketing.

3. Who are the major players in the MEA Toothpaste Market?

Key players include Colgate-Palmolive, Procter & Gamble, Unilever, GlaxoSmithKline (Sensodyne), and Dabur, all of whom dominate through extensive distribution networks and strong product portfolios.

4. What are the growth drivers of the MEA Toothpaste Market?

The market is driven by factors such as increasing oral health awareness, rising disposable incomes, and the growing demand for specialized toothpaste products, such as whitening and sensitivity relief solutions.

5. Which product types are leading the MEA Toothpaste Market?

Whitening toothpaste is currently leading the market due to its popularity among urban consumers focused on aesthetic oral care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.