Region:Central and South America

Author(s):Shubham

Product Code:KRAA1874

Pages:95

Published On:August 2025

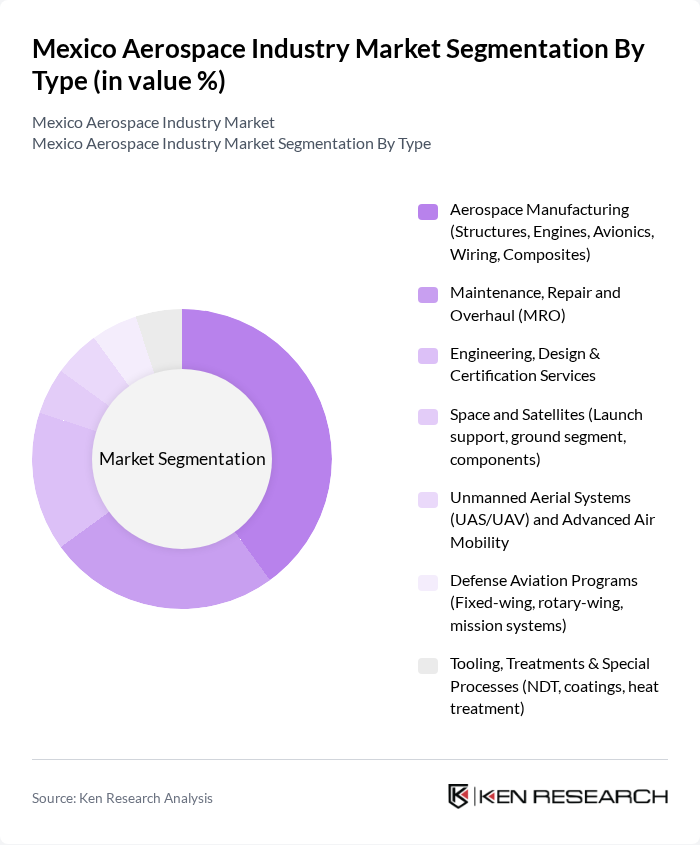

By Type:The aerospace industry in Mexico is segmented into various types, including Aerospace Manufacturing, Maintenance, Repair and Overhaul (MRO), Engineering, Design & Certification Services, Space and Satellites, Unmanned Aerial Systems (UAS/UAV) and Advanced Air Mobility, Defense Aviation Programs, and Tooling, Treatments & Special Processes. Among these, Aerospace Manufacturing is the leading segment due to the increasing demand for aircraft components and systems, driven by both commercial and defense sectors.

By End-User:The end-user segmentation of the aerospace industry in Mexico includes OEMs and Tier-1s, Commercial Airlines and Operators, the Ministry of National Defense (SEDENA) and Secretariat of the Navy (SEMAR), Business and General Aviation, and Space Agencies, Universities, and Research Centers. The OEMs and Tier-1s segment is the most significant, as these entities are responsible for the majority of aircraft production and component supply, driving demand for various aerospace services and products.

The Mexico Aerospace Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safran Group (Safran Aircraft Engines, Safran Landing Systems, Safran Electrical & Power), Bombardier Inc. (Bombardier Querétaro), Airbus (Airbus Helicopters México; Airbus Defence and Space—services), The Boeing Company (supply chain and engineering partners in Mexico), Honeywell Aerospace (Chihuahua, Mexicali), Collins Aerospace (Raytheon Technologies/RTX) — Interiors, avionics, and MRO, Spirit AeroSystems Holdings, Inc. (manufacturing in Chihuahua), GE Aerospace (formerly GE Aviation) — engineering and components supply chain, Parker Aerospace (Parker Hannifin) — motion and control systems, UTC/Pratt & Whitney (incl. joint work on GTF supply chain via Tiered partners), Latecoere — Interconnection Systems Mexico (wiring harnesses), Zodiac Aerospace/Cabin (now Safran Cabin) — interiors in Tijuana, Textron (Cessna, Bell) — Bell Helicopter México operations, Daher — aerostructures and logistics, Fokker/GKN Aerospace — wiring and aerostructures contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico aerospace industry is poised for significant growth, driven by increased government investment and a booming commercial aviation sector. As the demand for advanced aerospace technologies rises, companies are likely to focus on innovation and sustainability. The integration of digital manufacturing and autonomous systems will reshape production processes. Additionally, collaboration with global aerospace firms will enhance Mexico's position in the international market, fostering a competitive environment that encourages further investment and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Aerospace Manufacturing (Structures, Engines, Avionics, Wiring, Composites) Maintenance, Repair and Overhaul (MRO) Engineering, Design & Certification Services Space and Satellites (Launch support, ground segment, components) Unmanned Aerial Systems (UAS/UAV) and Advanced Air Mobility Defense Aviation Programs (Fixed-wing, rotary-wing, mission systems) Tooling, Treatments & Special Processes (NDT, coatings, heat treatment) |

| By End-User | OEMs and Tier-1s (Airbus, Bombardier, Safran, Honeywell, Collins) Commercial Airlines and Operators Ministry of National Defense (SEDENA) and Secretariat of the Navy (SEMAR) Business and General Aviation (FBOs, charter, MRO) Space Agencies, Universities, and Research Centers |

| By Application | Airframe and Structures Engine and Propulsion Systems Avionics, Electrical Systems, and Wiring Harnesses Interiors and Cabin Systems Mission Systems and Defense Upgrades Ground Support, Tooling, and Test Equipment |

| By Component | Airframe (Metal and Composite Structures) Engine Components (Turbomachinery, casings, blades) Avionics and Electronics Landing Gear and Actuation Wiring Harnesses and Cables Special Processes (Coatings, Heat Treatment, NDT) |

| By Sales Channel | Direct Contracts with OEMs/Tier-1s Tiered Supply Chain (Tier-2/Tier-3) Government Procurement Aftermarket/Services (MRO and spares) |

| By Regional Cluster | Querétaro Baja California Chihuahua Sonora Nuevo León Others (Jalisco, Coahuila, Aguascalientes, CDMX/Edomex) |

| By Certification/Standard | AS9100/AS9110/AS9120 Certified NADCAP Accredited Processes OEM/Tier-1 Qualified Suppliers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Military Aerospace Development | 80 | Defense Contractors, Program Managers |

| Aerospace Component Suppliers | 70 | Supply Chain Managers, Procurement Specialists |

| Research & Development in Aerospace | 60 | Aerospace Engineers, Innovation Directors |

| Aerospace Maintenance, Repair, and Overhaul (MRO) | 90 | MRO Managers, Operations Directors |

The Mexico Aerospace Industry Market is valued at approximately USD 11.3 billion, driven by increasing demand for commercial aircraft, defense spending, and advancements in aerospace manufacturing capabilities.