Region:Central and South America

Author(s):Rebecca

Product Code:KRAA4589

Pages:82

Published On:September 2025

By Type:The market can be segmented into various types of digital brokerage and wealth applications, including Equity Trading Apps, Robo-Advisory Platforms, Wealth Management Apps, Cryptocurrency Trading Apps, Investment Research Tools, Portfolio Management Apps, Hybrid Advisory Platforms, Digital Onboarding & KYC Solutions, and Others. Each of these segments caters to different investor needs and preferences, reflecting the diverse landscape of digital financial services. Equity trading and robo-advisory platforms are witnessing the fastest adoption, driven by user-friendly interfaces and algorithm-based investment advice. Cryptocurrency trading apps are also gaining traction as digital assets become more mainstream among Mexican investors .

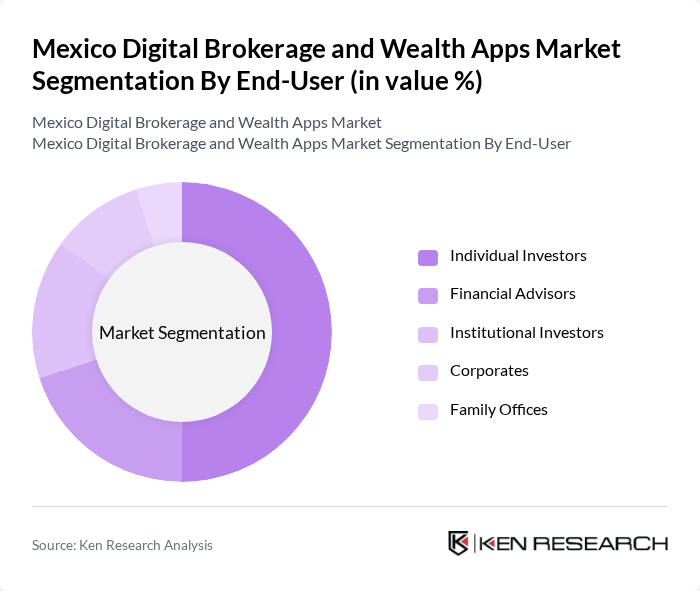

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, Corporates, and Family Offices. Each group has distinct requirements and preferences, influencing the types of digital brokerage and wealth apps they utilize. Individual investors are the dominant user group, reflecting the democratization of investment access through mobile and web platforms. Financial advisors and institutional investors are increasingly leveraging digital tools for portfolio management and client engagement .

The Mexico Digital Brokerage and Wealth Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as GBM Grupo Bursátil Mexicano, Kuspit, Bursanet (Casa de Bolsa Actinver), Finamex Casa de Bolsa, Actinver, Intercam Casa de Bolsa, Citibanamex, Banorte, Scotiabank Inverlat, BBVA México, Santander México, Monex Grupo Financiero, Vector Casa de Bolsa, eToro, Flink, M2Crowd, GBM+ (Digital Platform), Bitso contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico digital brokerage and wealth apps market appears promising, driven by technological advancements and increasing consumer demand for financial services. As more users embrace digital platforms, the integration of artificial intelligence and machine learning will enhance user experience and investment strategies. Additionally, partnerships with traditional financial institutions are likely to expand service offerings, making digital brokerage more accessible. Overall, the market is poised for significant transformation, aligning with global trends in fintech innovation and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Trading Apps Robo-Advisory Platforms Wealth Management Apps Cryptocurrency Trading Apps Investment Research Tools Portfolio Management Apps Hybrid Advisory Platforms Digital Onboarding & KYC Solutions Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates Family Offices |

| By Investment Type | Stocks Bonds Mutual Funds ETFs Cryptocurrencies Structured Products Others |

| By Distribution Channel | Direct-to-Consumer Financial Institutions Online Marketplaces Mobile Applications Third-Party Aggregators |

| By User Demographics | Millennials Gen X Baby Boomers High Net-Worth Individuals Mass Affluent |

| By Geographic Region | Northern Mexico Central Mexico Southern Mexico Urban Areas Rural Areas |

| By Pricing Model | Subscription-Based Commission-Based Freemium Flat Fee Performance-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 100 | Individual Investors, Financial Planners |

| Wealth Management Service Evaluation | 80 | Wealth Managers, Investment Advisors |

| Digital Brokerage User Experience | 90 | Active Traders, Casual Investors |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

| Fintech Adoption Trends | 70 | Tech-Savvy Investors, Millennials |

The Mexico Digital Brokerage and Wealth Apps Market is valued at approximately USD 85 million, reflecting significant growth driven by increased adoption of digital financial services and technological advancements, particularly among younger demographics.