Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA4548

Pages:88

Published On:September 2025

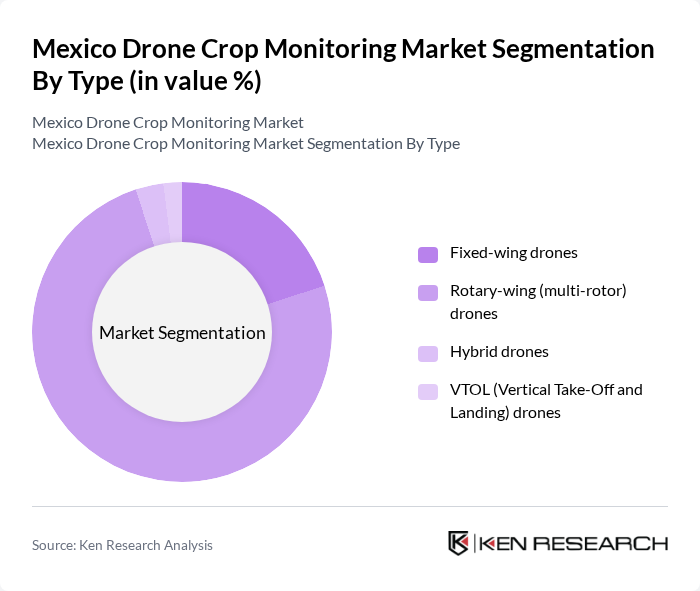

By Type:The market is segmented into four types of drones: Fixed-wing drones, Rotary-wing (multi-rotor) drones, Hybrid drones, and VTOL (Vertical Take-Off and Landing) drones. Each type serves different agricultural needs, with fixed-wing drones being preferred for large area coverage, while rotary-wing drones are favored for their maneuverability and ease of use in smaller fields. Hybrid and VTOL drones combine the advantages of both types, catering to diverse farming requirements. In recent years, rotary-wing drones have accounted for the largest market share due to their versatility and cost-effectiveness, while fixed-wing drones are gaining traction for large-scale commercial applications .

By End-User:The end-user segmentation includes Large-scale commercial farms, Smallholder farms, Agricultural service providers, and Research and academic institutions. Large-scale commercial farms dominate the market due to their significant investment in technology and the need for efficient crop management. Smallholder farms are increasingly adopting drone technology to enhance productivity, while agricultural service providers offer drone services to various clients, including research institutions. The trend toward digital agriculture and government modernization programs is accelerating adoption across all segments .

The Mexico Drone Crop Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones S.A.S., senseFly SA (an AgEagle company), AgEagle Aerial Systems Inc., PrecisionHawk Inc., Delair SAS, Skydio, Inc., AeroVironment, Inc., Quantum Systems GmbH, Wingtra AG, MicaSense, Inc., Sentera, Inc., DroneDeploy, Inc., Raptor Maps, Inc., Trimble Inc., Draganfly Inc., Autel Robotics Co., Ltd., Pix4D S.A., Sky-Drones Technologies Ltd., and Agrasolutions S.A.P.I. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico drone crop monitoring market appears promising, driven by technological advancements and increasing awareness of sustainable farming practices. As farmers seek to enhance productivity and reduce environmental impact, the integration of drones with IoT and AI technologies is expected to gain traction. Additionally, the expansion of drone services into underserved rural areas will likely facilitate greater adoption, enabling farmers to leverage data analytics for improved decision-making and resource management.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-wing drones Rotary-wing (multi-rotor) drones Hybrid drones VTOL (Vertical Take-Off and Landing) drones |

| By End-User | Large-scale commercial farms Smallholder farms Agricultural service providers Research and academic institutions |

| By Application | Crop health monitoring & surveillance Soil and field analysis Irrigation & water management Pest and disease detection Precision spraying & fertilization |

| By Distribution Channel | Direct sales (OEMs) Online platforms Distributors and resellers System integrators |

| By Region | Northern Mexico Central Mexico Southern Mexico Baja California and Pacific Coast |

| By Investment Source | Private investments Government funding International grants Venture capital & agri-tech funds |

| By Policy Support | Subsidies for drone purchases Tax incentives for agricultural technology Research and development grants Pilot programs and demonstration projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drone Adoption in Crop Monitoring | 100 | Farm Owners, Agricultural Technologists |

| Precision Agriculture Practices | 80 | Agronomists, Crop Consultants |

| Government Agricultural Initiatives | 60 | Policy Makers, Agricultural Extension Officers |

| Drone Service Providers | 50 | Business Owners, Operations Managers |

| Research Institutions Focused on Agriculture | 40 | Researchers, Academic Professors |

The Mexico Drone Crop Monitoring Market is valued at approximately USD 155 million, reflecting a significant growth trend driven by the adoption of precision agriculture techniques and advanced technologies like AI and machine learning in farming practices.