Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA3296

Pages:93

Published On:September 2025

By Type:The market is segmented into various types, including Residential Portals, Commercial Portals, Rental Platforms, Investment Platforms, Property Management Solutions, Real Estate Analytics Tools, iBuyer Platforms, CRM & Agent Tools, and Others. Each of these segments caters to different consumer needs and preferences, with some focusing on residential properties while others target commercial real estate or investment opportunities .

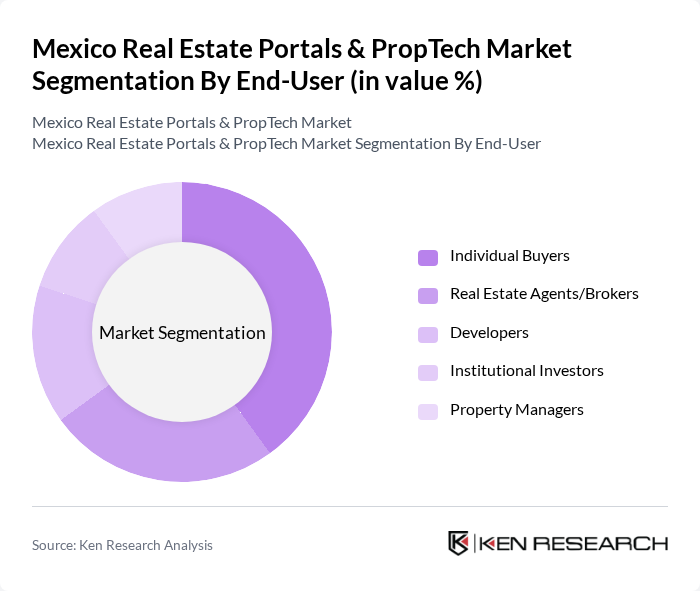

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents/Brokers, Developers, Institutional Investors, and Property Managers. Each group has distinct requirements and preferences, influencing the types of services and platforms they utilize in the real estate market .

The Mexico Real Estate Portals & PropTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as QuintoAndar (Inmuebles24, Vivanuncios), Propiedades.com (TuHabi), Lamudi (Lifull), Homie.mx, Clau.com (formerly Flat.mx), EasyBroker, Trovit, MercadoLibre Inmuebles, La Haus, TrueHome, Wiggot, Neximo, Casafy, Facebook Marketplace, Segundamano contribute to innovation, geographic expansion, and service delivery in this space .

The Mexico real estate portals and PropTech market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative digital solutions will grow, particularly in mobile applications and virtual property tours. Additionally, partnerships with financial institutions are likely to enhance service offerings, making transactions more seamless. The integration of AI and big data analytics will further optimize property searches, providing tailored solutions for consumers and investors alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Platforms Investment Platforms Property Management Solutions Real Estate Analytics Tools iBuyer Platforms CRM & Agent Tools Others |

| By End-User | Individual Buyers Real Estate Agents/Brokers Developers Institutional Investors Property Managers |

| By Sales Channel | Online Platforms Mobile Applications Direct Sales Affiliate Marketing |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | First-time Buyers Luxury Buyers Commercial Clients Institutional Investors |

| By Service Type | Listing Services Marketing Services Consulting Services Valuation Services Transaction Management |

| By Payment Model | Subscription-Based Commission-Based Freemium Model Pay-Per-Listing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Users | 120 | Home Buyers, Renters, Real Estate Investors |

| Commercial Property Stakeholders | 90 | Commercial Tenants, Property Managers, Investors |

| PropTech Entrepreneurs | 50 | Startup Founders, Product Managers, Technology Developers |

| Real Estate Agents | 100 | Real Estate Brokers, Sales Agents, Market Analysts |

| Investors in Real Estate Technology | 40 | Venture Capitalists, Angel Investors, Financial Analysts |

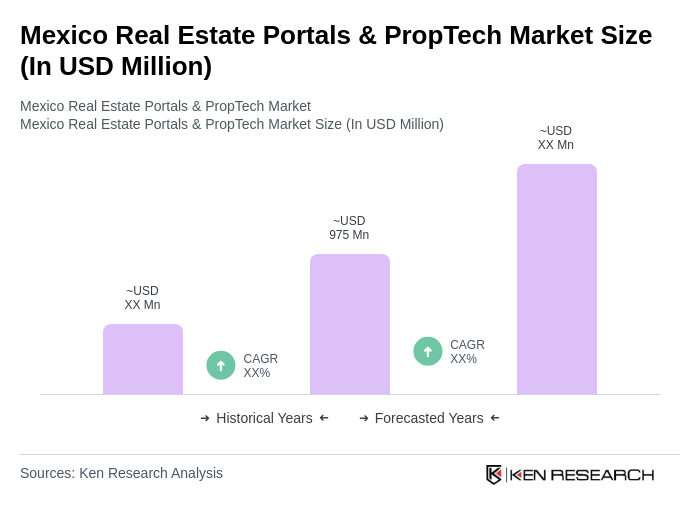

The Mexico Real Estate Portals & PropTech Market is valued at approximately USD 975 million, reflecting a significant growth trend driven by the increasing adoption of digital platforms for property transactions and enhanced consumer access to real estate information.