Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4175

Pages:93

Published On:December 2025

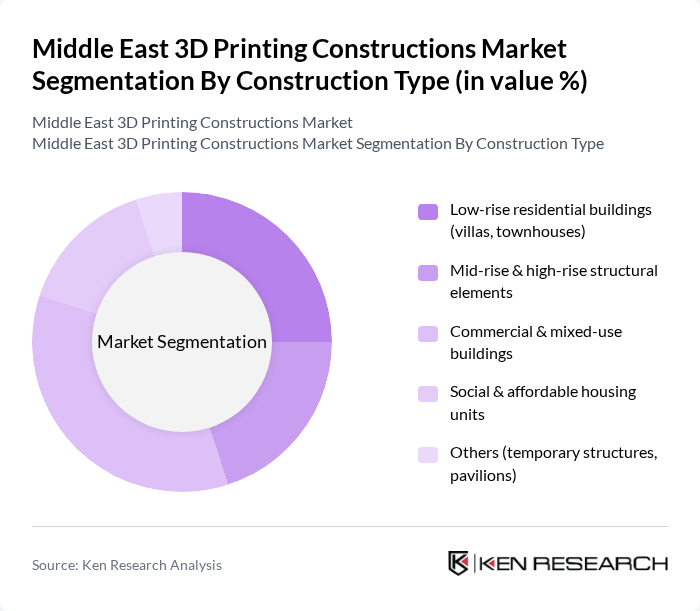

By Construction Type:

The construction type segmentation includes various subsegments such as low-rise residential buildings (villas, townhouses), mid-rise & high-rise structural elements, commercial & mixed-use buildings, social & affordable housing units, and others (temporary structures, pavilions). This aligns with industry practice where 3D printing is applied across residential, commercial, and infrastructure/building categories, with concrete-based extrusion being the dominant method. Among these, the commercial & mixed-use buildings segment is currently leading the market in the region in terms of demonstration and flagship projects, driven by high-visibility smart city districts, hospitality, offices, and mixed-use developments that seek innovative, sustainable designs. This trend is driven by urbanization, tourism and service-led economies, and the need for multifunctional spaces in rapidly growing cities. The low-rise residential buildings segment also shows significant growth, fueled by national housing programs, affordable housing initiatives, and the suitability of 3D printing for single- and multi-family low-rise units.

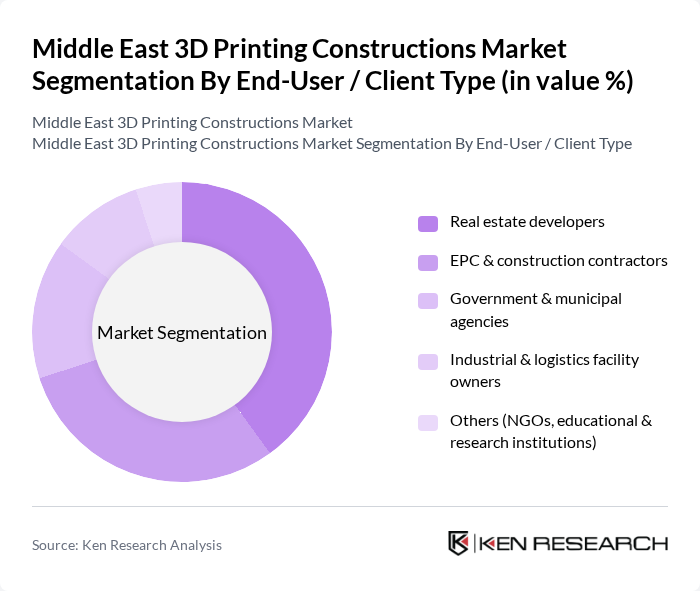

By End-User / Client Type:

This segmentation includes real estate developers, EPC & construction contractors, government & municipal agencies, industrial & logistics facility owners, and others (NGOs, educational & research institutions). This structure is consistent with broader MEA 3D printing construction end-use patterns, where building (residential, commercial, industrial) and infrastructure clients are the primary adopters. The real estate developers segment is currently the most dominant, driven by the increasing number of mixed-use, residential, and hospitality projects that seek differentiation through innovative, sustainable construction solutions. Additionally, EPC contractors are also significant players, as they are increasingly adopting 3D printing technologies to optimize project delivery timelines, reduce labor dependency, and integrate digital construction workflows such as BIM with additive manufacturing. The government & municipal agencies segment is gaining traction due to national visions and urban development strategies that explicitly promote innovative construction methods, including 3D printing, for public housing, social infrastructure, and smart city projects.

The Middle East 3D Printing Constructions Market is characterized by a dynamic mix of regional and international players. Leading participants such as COBOD International A/S, CyBe Construction B.V., Apis Cor Inc., ICON Technology, Inc., XtreeE SAS, WASP S.r.l. (World’s Advanced Saving Project), 3DXB Group (UAE), Dar Al Arkan Real Estate Development Company, Saudi Arabian Ministry of Municipal, Rural Affairs and Housing (MOMRAH) – Housing Program Partners, Dubai Municipality – 3D Printing in Construction Initiative, NEOM Company, Sika AG, MX3D B.V., Contour Crafting Corporation, CyBe Middle East & regional implementation partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East 3D printing constructions market appears promising, driven by technological advancements and increasing government support for sustainable practices. As urbanization accelerates, the demand for innovative construction solutions will rise, prompting further investment in 3D printing technologies. Additionally, collaboration between construction firms and tech companies is expected to foster innovation, leading to more efficient and eco-friendly building methods that align with regional sustainability goals and economic diversification efforts.

| Segment | Sub-Segments |

|---|---|

| By Construction Type | Low-rise residential buildings (villas, townhouses) Mid-rise & high-rise structural elements Commercial & mixed-use buildings Social & affordable housing units Others (temporary structures, pavilions) |

| By End-User / Client Type | Real estate developers EPC & construction contractors Government & municipal agencies Industrial & logistics facility owners Others (NGOs, educational & research institutions) |

| By Country | United Arab Emirates Saudi Arabia Qatar Kuwait Rest of GCC Egypt Rest of Middle East & North Africa |

| By Printing Technology | Extrusion-based concrete 3D printing Powder bonding / binder jetting Additive welding & metal-based construction printing Hybrid & other emerging technologies |

| By Application | Structural walls & load-bearing elements Façades, cladding & architectural features Infrastructure (bridges, street furniture, utilities) Onsite vs offsite (prefabricated) components Others (demonstration projects, prototypes) |

| By Business Model / Revenue Stream | Equipment sales (printers & robotics) Contract 3D printing (as-a-service) Design, engineering & BIM integration services Material supply (inks, mortars, additives) Turnkey 3D printed projects (EPC) |

| By Material Type | Cementitious & concrete-based mixes Geopolymer & low-carbon binders Composite materials & fiber-reinforced mortars Others (polymers, metals for construction parts) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential 3D Printing Projects | 120 | Architects, Home Builders |

| Commercial Construction Applications | 90 | Project Managers, Construction Executives |

| Infrastructure Development Initiatives | 80 | Urban Planners, Civil Engineers |

| Material Suppliers for 3D Printing | 70 | Supply Chain Managers, Product Development Leads |

| Regulatory Compliance in 3D Printing | 60 | Regulatory Officials, Compliance Officers |

The Middle East 3D Printing Constructions Market is valued at approximately USD 100 million, reflecting a five-year historical analysis of regional revenues within the broader Middle East and Africa 3D printing in construction market.