Region:Middle East

Author(s):Shubham

Product Code:KRAC2826

Pages:89

Published On:October 2025

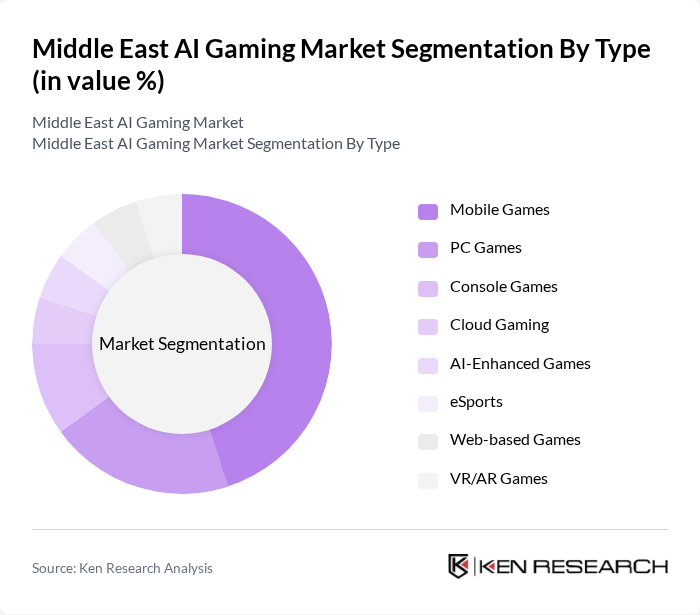

By Type:The segmentation of the market by type includes various categories such as Mobile Games, PC Games, Console Games, Cloud Gaming, AI-Enhanced Games, eSports, Web-based Games, and VR/AR Games. Among these, Mobile Games have emerged as the leading sub-segment due to the widespread use of smartphones and the increasing preference for gaming on mobile devices. The convenience and accessibility of mobile gaming have attracted a diverse audience, making it a dominant force in the market.

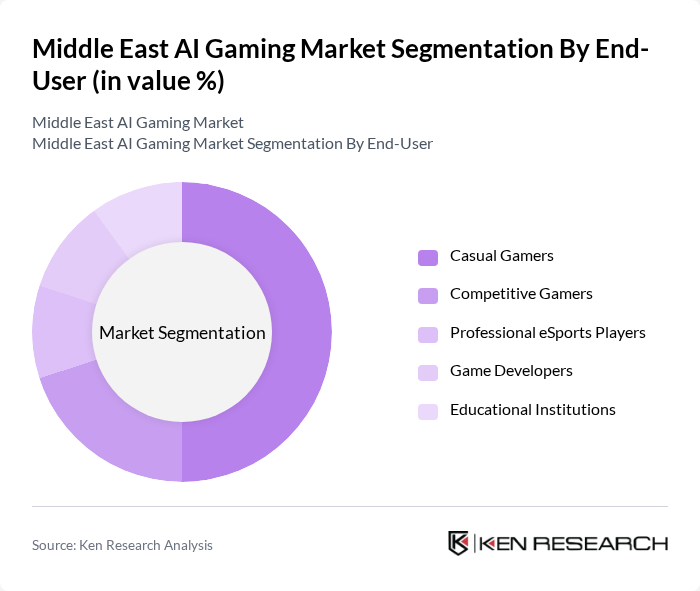

By End-User:The market is segmented by end-user into Casual Gamers, Competitive Gamers, Professional eSports Players, Game Developers, and Educational Institutions. Casual Gamers represent the largest segment, driven by the increasing availability of free-to-play games and the growing trend of gaming as a leisure activity. This segment's accessibility and variety of game options cater to a broad audience, making it a key driver of market growth.

The Middle East AI Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sandsoft Games, Tamatem Games, Boss Bunny Games, Falafel Games, UMX Studios, Babil Games, Maysalward, Nine66 (Savvy Games Group), Playhera, The Arab Games Company, Ubisoft Entertainment S.A., Electronic Arts Inc., Riot Games, Inc., Epic Games, Inc., Tencent Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East AI gaming market appears promising, driven by technological advancements and changing consumer preferences. As smartphone penetration continues to rise, more users will engage with AI-driven gaming experiences. Additionally, the increasing popularity of eSports and virtual reality gaming will likely attract investments and collaborations with local developers. The market is expected to evolve with innovative gaming solutions that cater to diverse audiences, fostering a vibrant gaming ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Games PC Games Console Games Cloud Gaming AI-Enhanced Games eSports Web-based Games VR/AR Games |

| By End-User | Casual Gamers Competitive Gamers Professional eSports Players Game Developers Educational Institutions |

| By Distribution Channel | Online Platforms Retail Stores Mobile App Stores Subscription Services Telco Bundled Services |

| By Game Genre | Action Adventure Strategy Simulation Sports Role-Playing Games (RPG) Puzzle Others |

| By Age Group | Children Teenagers Adults Seniors |

| By Payment Model | Free-to-Play Pay-to-Play Subscription-Based In-App Purchases Ad-Supported |

| By Platform | Mobile PC Console Cloud VR/AR |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile Game Developers |

| Console Gaming Market | 80 | Console Gamers, Retail Managers |

| Online Gaming Platforms | 100 | Platform Operators, Game Publishers |

| Esports Participation | 60 | Esports Athletes, Event Organizers |

| Game Development Insights | 50 | Game Designers, Software Engineers |

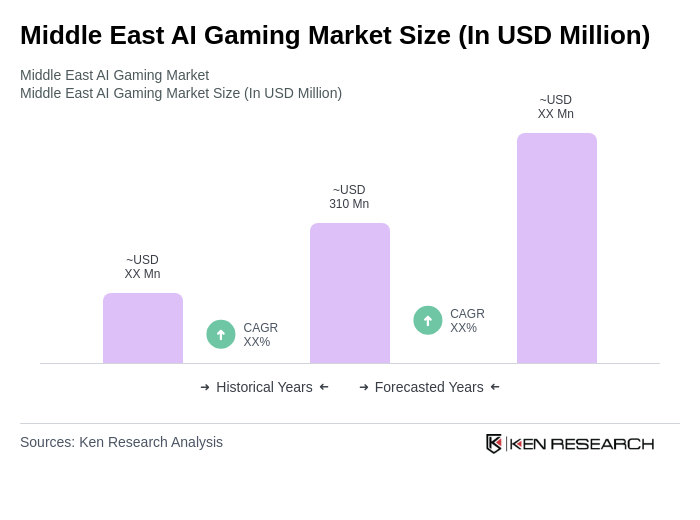

The Middle East AI Gaming Market is valued at approximately USD 310 million, driven by mobile gaming adoption, advancements in AI technology, and increased internet penetration across the region.