Region:Middle East

Author(s):Rebecca

Product Code:KRAD6074

Pages:100

Published On:December 2025

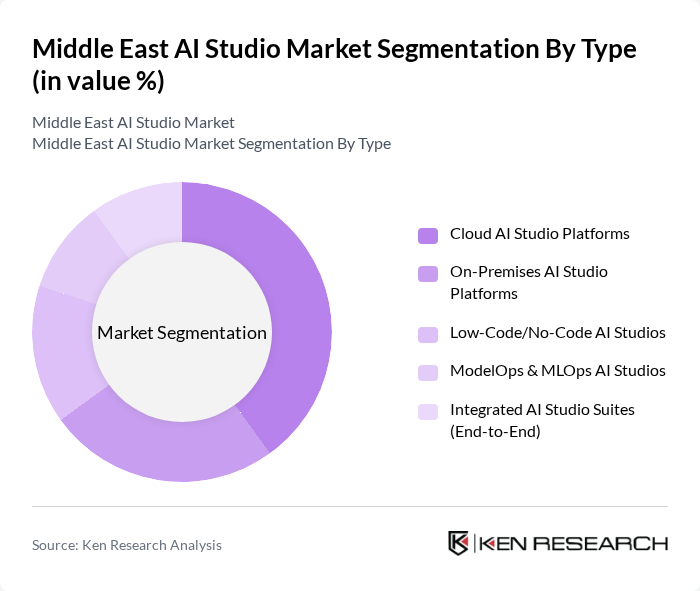

By Type:The segmentation of the market by type includes various platforms and solutions that cater to different user needs. The subsegments are Cloud AI Studio Platforms, On-Premises AI Studio Platforms, Low-Code/No-Code AI Studios, ModelOps & MLOps AI Studios, and Integrated AI Studio Suites (End-to-End). Among these, Cloud AI Studio Platforms are gaining significant traction due to their scalability and flexibility, allowing businesses to deploy AI solutions without heavy upfront investments in infrastructure.

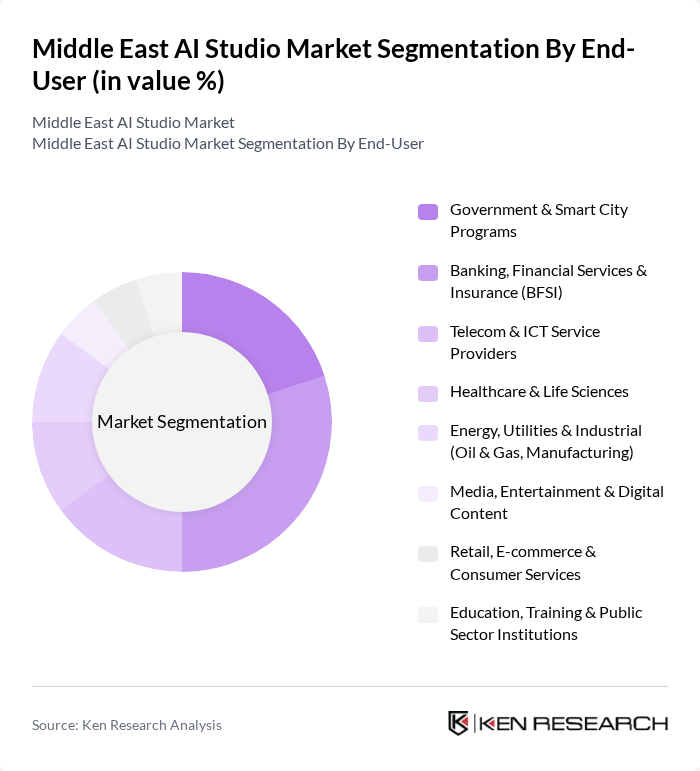

By End-User:The market segmentation by end-user includes Government & Smart City Programs, Banking, Financial Services & Insurance (BFSI), Telecom & ICT Service Providers, Healthcare & Life Sciences, Energy, Utilities & Industrial (Oil & Gas, Manufacturing), Media, Entertainment & Digital Content, Retail, E-commerce & Consumer Services, and Education, Training & Public Sector Institutions. The BFSI sector is particularly prominent, driven by the need for enhanced security, fraud detection, and customer service automation.

The Middle East AI Studio Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Data & Artificial Intelligence Authority (SDAIA) / AI Center of Excellence, G42 (Inception, Core42, and related AI platforms – UAE), Tonomus (NEOM Digital & AI – Saudi Arabia), Moro Hub (Digital DEWA – UAE), STC Group (Including Center3 & AI/Cloud Platforms – Saudi Arabia), du (Emirates Integrated Telecommunications Company – UAE), Etisalat by e& (e& enterprise – UAE), Qatar Computing Research Institute (QCRI) / Qatar Center for AI, Injazat (G42 Company – UAE), Presight AI (G42 – UAE), Raqamyah / Saudi AI & Analytics Labs (representative local AI studios), IBM (Watsonx.ai Studio & Middle East Cloud Regions), Microsoft (Azure AI Studio & Copilot Studio – Middle East), Google Cloud (Vertex AI Studio – Middle East & North Africa), Amazon Web Services (Amazon Bedrock & SageMaker Studio – Middle East) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East AI studio market appears promising, driven by ongoing technological advancements and increasing government support. As digital transformation accelerates, AI studios are expected to play a pivotal role in various sectors, including healthcare, finance, and entertainment. The integration of AI with emerging technologies like blockchain and IoT will further enhance capabilities, leading to innovative applications. Additionally, the focus on ethical AI practices will shape the regulatory landscape, ensuring responsible development and deployment of AI solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud AI Studio Platforms On-Premises AI Studio Platforms Low-Code/No-Code AI Studios ModelOps & MLOps AI Studios Integrated AI Studio Suites (End-to-End) |

| By End-User | Government & Smart City Programs Banking, Financial Services & Insurance (BFSI) Telecom & ICT Service Providers Healthcare & Life Sciences Energy, Utilities & Industrial (Oil & Gas, Manufacturing) Media, Entertainment & Digital Content Retail, E?commerce & Consumer Services Education, Training & Public Sector Institutions |

| By Application | Generative AI Content Creation (Text, Image, Video, Audio) Customer Engagement & Conversational AI Predictive Analytics & Forecasting Process Automation & Intelligent Workflows Computer Vision & Surveillance Analytics AI for Software Development & Code Generation |

| By Technology | Machine Learning & Deep Learning Natural Language Processing & LLMs Computer Vision Generative AI & Foundation Models Automated Machine Learning (AutoML) |

| By Deployment Model | Public Cloud Private Cloud Hybrid & Multi?Cloud Edge & On?Premises |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Jordan, Lebanon, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Others) Rest of Middle East |

| By Business Model | Subscription (SaaS) / Seat?Based Consumption?Based / Pay?Per?Use Enterprise Licensing & Managed Services Marketplace & Revenue?Sharing Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Applications | 120 | Healthcare Administrators, IT Managers |

| Financial Services AI Integration | 100 | Chief Technology Officers, Risk Management Officers |

| Retail AI Solutions | 90 | Marketing Directors, E-commerce Managers |

| Logistics and Supply Chain AI | 80 | Operations Managers, Supply Chain Analysts |

| AI in Education Technology | 70 | Educational Administrators, Curriculum Developers |

The Middle East AI Studio Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of AI technologies across various sectors, including healthcare, finance, and telecommunications.