Region:Middle East

Author(s):Dev

Product Code:KRAA1662

Pages:95

Published On:August 2025

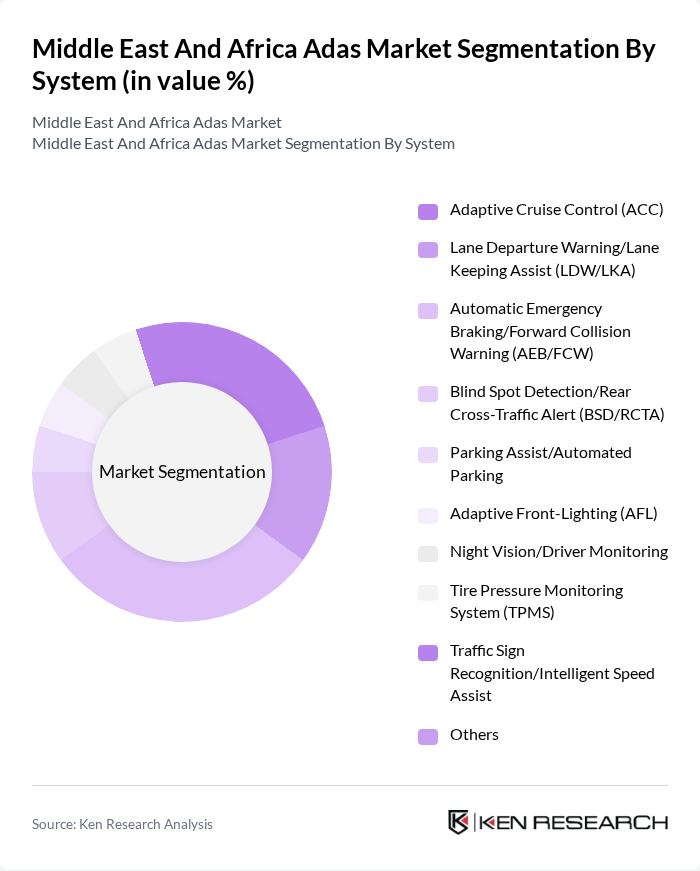

By System:The ADAS market is segmented into various systems that enhance vehicle safety and driving experience. The dominant sub-segment is Automatic Emergency Braking/Forward Collision Warning (AEB/FCW), which is increasingly being adopted due to its effectiveness in preventing accidents. Other notable systems include Adaptive Cruise Control (ACC) and Lane Departure Warning/Lane Keeping Assist (LDW/LKA), which are gaining traction as consumers prioritize safety features in their vehicles.

By Technology:The market is also segmented by technology, which includes various sensing and communication technologies. The leading technology in this segment is Radar, known for its reliability in various weather conditions. Camera technology is also gaining popularity due to its ability to provide detailed visual information, while LiDAR is emerging as a promising technology for high-precision applications.

The Middle East And Africa ADAS market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Robert Bosch GmbH (Bosch Mobility), Denso Corporation, ZF Friedrichshafen AG, Aptiv PLC, Valeo SA, Magna International Inc., Hyundai Mobis Co., Ltd., NXP Semiconductors N.V., Infineon Technologies AG, Texas Instruments Incorporated, Panasonic Holdings Corporation, STMicroelectronics N.V., Mobileye Global Inc., Autoliv Inc., Hella GmbH & Co. KGaA (FORVIA HELLA), Renesas Electronics Corporation, ON Semiconductor Corporation (onsemi), Sony Semiconductor Solutions Corporation, Xperi Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ADAS market in the Middle East and Africa appears promising, driven by technological advancements and increasing regulatory support. As governments push for enhanced vehicle safety, manufacturers are likely to invest more in innovative ADAS solutions. Additionally, the rise of electric and autonomous vehicles will further integrate ADAS technologies, creating a more interconnected automotive ecosystem. This evolution will not only improve road safety but also enhance the overall driving experience for consumers in the region.

| Segment | Sub-Segments |

|---|---|

| By System | Adaptive Cruise Control (ACC) Lane Departure Warning/Lane Keeping Assist (LDW/LKA) Automatic Emergency Braking/Forward Collision Warning (AEB/FCW) Blind Spot Detection/Rear Cross-Traffic Alert (BSD/RCTA) Parking Assist/Automated Parking Adaptive Front-Lighting (AFL) Night Vision/Driver Monitoring Tire Pressure Monitoring System (TPMS) Traffic Sign Recognition/Intelligent Speed Assist Others |

| By Technology | Camera Radar LiDAR Ultrasonic V2X/Connectivity |

| By Offering | Hardware (Sensors, ECUs, Actuators) Software/Algorithms Services (Calibration, Retrofit, Maintenance) |

| By Sales Channel | OEM (Factory-Fit) Aftermarket/Retrofit |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles/Buses |

| By Region | GCC (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain) North Africa (Egypt, Morocco, Algeria, Tunisia) South Africa Rest of Middle East & Africa |

| By Price Band (OEM Fitment) | Entry/Budget Mid-Range Premium Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 120 | Product Development Managers, R&D Engineers |

| Commercial Vehicle Suppliers | 90 | Supply Chain Managers, Technical Directors |

| ADAS Component Manufacturers | 80 | Sales Managers, Product Line Managers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Automotive Technology Consultants | 60 | Industry Analysts, Market Researchers |

The Middle East and Africa ADAS market is valued at approximately USD 3.5 billion, driven by increasing consumer demand for vehicle safety features, advancements in automotive technology, and government regulations aimed at enhancing road safety.