Region:Middle East

Author(s):Dev

Product Code:KRAD0565

Pages:87

Published On:August 2025

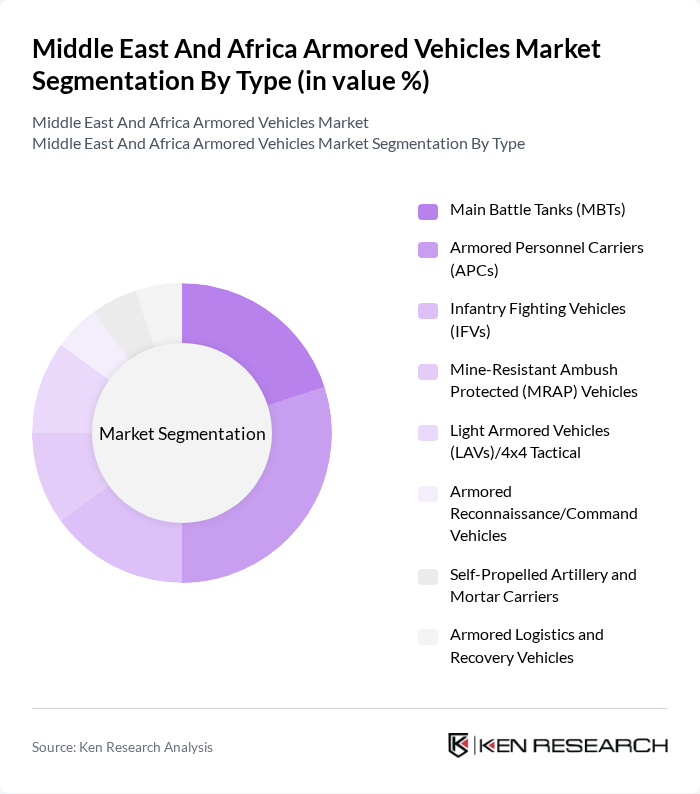

By Type:

The armored vehicles market is segmented into various types, including Main Battle Tanks (MBTs), Armored Personnel Carriers (APCs), Infantry Fighting Vehicles (IFVs), Mine-Resistant Ambush Protected (MRAP) Vehicles, Light Armored Vehicles (LAVs)/4x4 Tactical, Armored Reconnaissance/Command Vehicles, Self-Propelled Artillery and Mortar Carriers, and Armored Logistics and Recovery Vehicles. Among these, Armored Personnel Carriers (APCs) and MBTs account for significant demand in the region, supported by fleet recapitalization and border security missions; APCs remain a mainstay for protected troop transport and modular mission roles, while MRAPs continue to see uptake for counter-insurgency and internal security tasks.

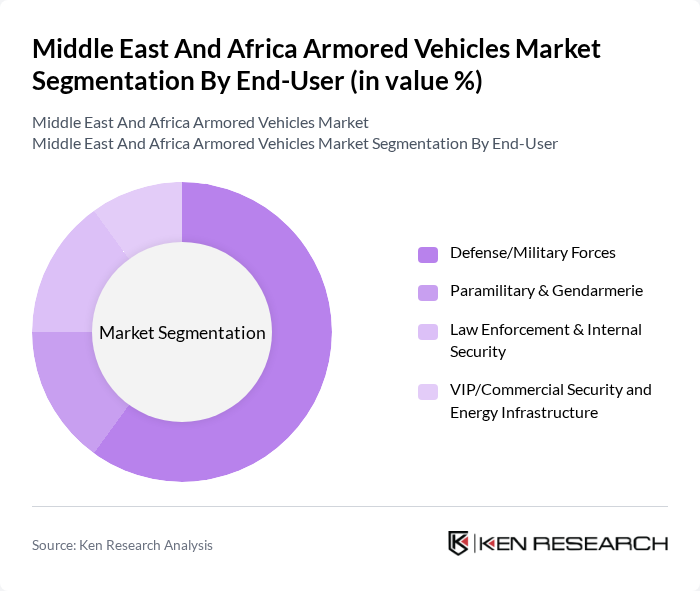

By End-User:

The end-user segmentation includes Defense/Military Forces, Paramilitary & Gendarmerie, Law Enforcement & Internal Security, and VIP/Commercial Security and Energy Infrastructure. The Defense/Military Forces segment leads the market, underpinned by ongoing force modernization, localization partnerships (e.g., Saudi industrialization initiatives with regional OEMs), and rising land systems procurement for border security and counter-terror operations; internal security agencies continue to procure MRAPs and 4x4 tactical platforms for urban and asymmetric environments.

The Middle East And Africa Armored Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as NIMR (EDGE Group, UAE), Saudi Arabian Military Industries (SAMI), KSA, STREIT Group, UAE, Paramount Group, South Africa, Denel Vehicle Systems, South Africa, Otokar, Türkiye, FNSS Savunma Sistemleri, Türkiye, Plasan, Israel, Elbit Systems, Israel, Israel Aerospace Industries (IAI), Israel, Rafael Advanced Defense Systems, Israel, Iveco Defence Vehicles, Italy, BAE Systems (incl. BAE Systems Land UK & BAE Systems Hägglunds), General Dynamics Land Systems (GDLS), Rheinmetall AG, KNDS (Krauss?Maffei Wegmann + Nexter), Oshkosh Defense, AM General, Textron Systems, Arquus (Volvo Group), France, Mahindra Defence Systems, India, Ashok Leyland (Defence), India, FFG Flensburger Fahrzeugbau Gesellschaft, Germany, PT Pindad, Indonesia, Nimda & Carmor, Israel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East and Africa armored vehicles market appears promising, driven by ongoing modernization efforts and increasing defense budgets. As nations prioritize military readiness, the demand for advanced armored vehicles is expected to rise. Additionally, the integration of cutting-edge technologies, such as AI and autonomous systems, will enhance operational capabilities. However, addressing challenges like high costs and regulatory compliance will be crucial for sustained growth in this sector, ensuring that countries can effectively modernize their armed forces.

| Segment | Sub-Segments |

|---|---|

| By Type | Main Battle Tanks (MBTs) Armored Personnel Carriers (APCs) Infantry Fighting Vehicles (IFVs) Mine-Resistant Ambush Protected (MRAP) Vehicles Light Armored Vehicles (LAVs)/4x4 Tactical Armored Reconnaissance/Command Vehicles Self-Propelled Artillery and Mortar Carriers Armored Logistics and Recovery Vehicles |

| By End-User | Defense/Military Forces Paramilitary & Gendarmerie Law Enforcement & Internal Security VIP/Commercial Security and Energy Infrastructure |

| By Application | Combat and Fire Support Reconnaissance, C2/C4ISR, and Patrol Border Security and Counter?Insurgency Peacekeeping & Humanitarian Missions EOD/Route Clearance and Convoy Protection |

| By Procurement Channel | New Build/OEM Procurement Upgrades, Retrofit, and Life?Extension Surplus/Foreign Military Sales (FMS/G2G) |

| By Geography | Gulf Cooperation Council (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant & Iraq (Israel, Jordan, Lebanon, Iraq) North Africa (Egypt, Algeria, Morocco, Tunisia) Sub?Saharan Africa (South Africa, Nigeria, Angola, Kenya, Others) |

| By Protection Level (STANAG/Armor Class) | Light (STANAG Level 1–2) Medium (STANAG Level 3–4) Heavy (STANAG Level 5–6+) |

| By Component/Subsystem | Hull/Chassis Armor Systems (Composite/Reactive/Add?on) Weapon Stations (Turrets, RWS) Powertrain & Mobility (Engine, Transmission, Suspension) Electronics & Vetronics (Sensors, BMS, EW, Comms) Active Protection & Counter?IED Systems Life Support & Survivability (CBRN, Fire Suppression) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 100 | Procurement Officers, Defense Analysts |

| Armored Vehicle Manufacturers | 80 | Product Managers, Sales Directors |

| Defense Contractors | 70 | Project Managers, Business Development Executives |

| Military End-Users | 90 | Field Commanders, Technical Officers |

| Government Defense Agencies | 60 | Policy Makers, Strategic Planners |

The Middle East and Africa Armored Vehicles Market is valued at approximately USD 1.8 billion, driven by increasing defense budgets, geopolitical tensions, and the need for modernization of land forces to enhance survivability and mobility.