Region:Middle East

Author(s):Dev

Product Code:KRAD0468

Pages:91

Published On:August 2025

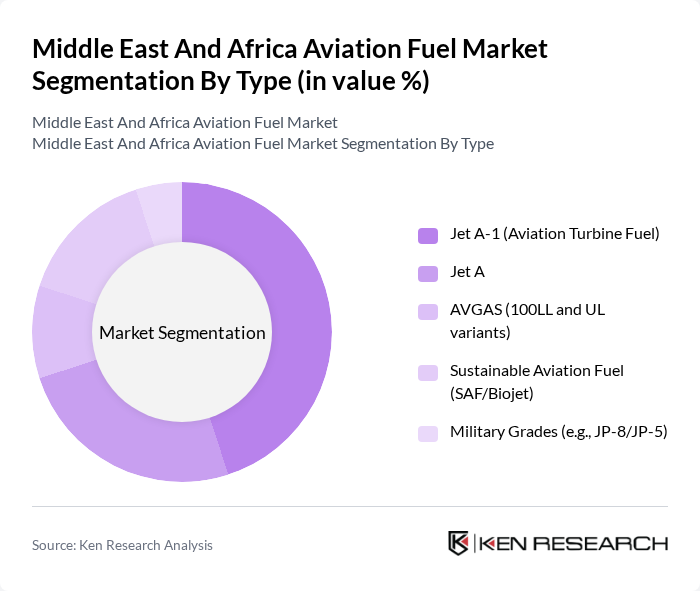

By Type:The aviation fuel market is segmented into various types, including Jet A-1 (Aviation Turbine Fuel), Jet A, AVGAS (100LL and UL variants), Sustainable Aviation Fuel (SAF/Biojet), and Military Grades (e.g., JP-8/JP-5). Among these, Jet A-1 is the most widely used fuel type due to its compatibility with commercial jet engines and its availability at most airports. The increasing focus on sustainability has also led to a rise in the adoption of SAF, which is gaining traction among airlines looking to reduce their carbon footprint.

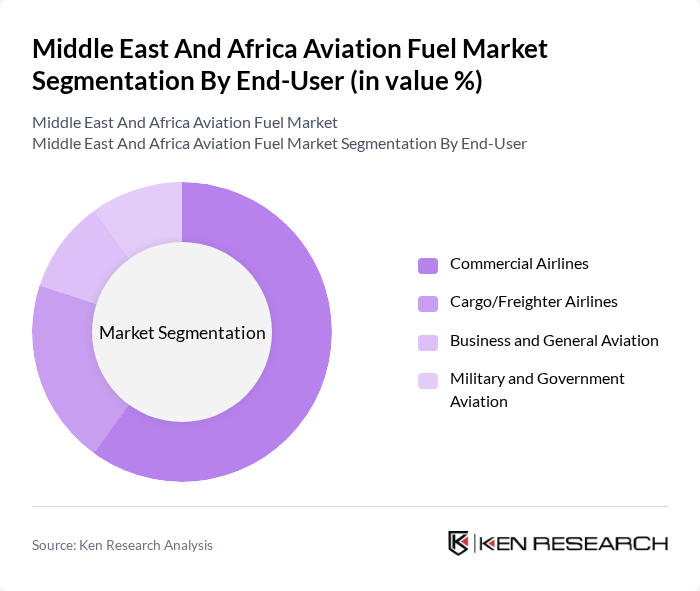

By End-User:The aviation fuel market is categorized by end-users, including Commercial Airlines, Cargo/Freighter Airlines, Business and General Aviation, and Military and Government Aviation. The Commercial Airlines segment dominates the market due to the high volume of passenger flights and the growing demand for air travel. Cargo airlines are also significant contributors, driven by the increasing need for air freight services in the region.

The Middle East And Africa Aviation Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as TotalEnergies SE, BP p.l.c. (Air bp), Shell plc (Shell Aviation), ExxonMobil Corporation, Chevron Corporation, World Fuel Services Corporation, Vitol Aviation, QatarEnergy, Abu Dhabi National Oil Company (ADNOC), Saudi Aramco (Saudi Arabian Oil Company), OQ (formerly Oman Oil Company), Emirates National Oil Company (ENOC), Engen Petroleum, Kuwait Petroleum Corporation (Q8 Aviation), Sonangol E.P. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aviation fuel market in the Middle East and Africa appears promising, driven by increasing air travel and infrastructure investments. However, challenges such as fluctuating oil prices and regulatory compliance will require strategic adaptations. The adoption of sustainable aviation fuels and advancements in fuel efficiency technologies are expected to play crucial roles in shaping the market landscape. As airlines and fuel suppliers navigate these dynamics, the focus will be on enhancing operational efficiency and sustainability to meet evolving consumer and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Jet A-1 (Aviation Turbine Fuel) Jet A AVGAS (100LL and UL variants) Sustainable Aviation Fuel (SAF/Biojet) Military Grades (e.g., JP-8/JP-5) |

| By End-User | Commercial Airlines Cargo/Freighter Airlines Business and General Aviation Military and Government Aviation |

| By Distribution Channel | Direct Supply (Into-plane at Airports) Resellers/Distributors and Fuel Traders Hydrant System/Depot Supply |

| By Region | Gulf Cooperation Council (GCC) North Africa Sub-Saharan Africa |

| By Application | Scheduled Commercial Flights Air Cargo and Logistics Military and Peacekeeping Operations |

| By Pricing/Contract Structure | Spot Purchases (Platts/MOPS-linked) Term Contracts (Formula Pricing) Hedged/Indexed Agreements |

| By Policy & Sustainability | Government Incentives/Subsidies for SAF Tax and Duty Regimes on Jet Fuel SAF Mandates/Voluntary Offtake Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines Fuel Procurement | 120 | Fuel Managers, Procurement Officers |

| Aviation Fuel Suppliers | 90 | Sales Directors, Operations Managers |

| Airport Operations and Logistics | 70 | Logistics Coordinators, Airport Managers |

| Regulatory Bodies and Policy Makers | 50 | Regulatory Affairs Managers, Policy Analysts |

| Industry Experts and Consultants | 60 | Aviation Analysts, Market Researchers |

The Middle East and Africa Aviation Fuel Market is valued at approximately USD 30 billion, driven by increasing air travel demand, airport infrastructure expansion, and rising cargo transportation needs, particularly in key regions like the UAE and Saudi Arabia.