Region:Middle East

Author(s):Dev

Product Code:KRAB0592

Pages:96

Published On:August 2025

By Type:The centrifugal pumps market is segmented into axial flow pumps, radial flow pumps, mixed flow pumps, single-stage pumps, multi-stage pumps, submersible pumps, self-priming pumps, and others. Submersible pumps are gaining traction due to their efficiency in handling large water volumes, especially in agricultural and municipal applications. Multi-stage pumps are also in demand for their ability to deliver high pressure and flow rates, making them suitable for industrial applications .

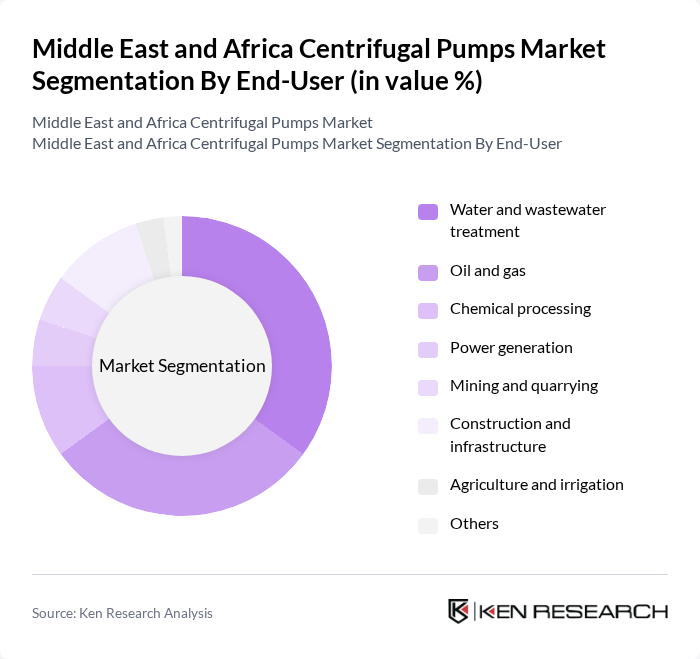

By End-User:The centrifugal pumps market is segmented by end-user applications, including water and wastewater treatment, oil and gas, chemical processing, power generation, mining and quarrying, construction and infrastructure, agriculture and irrigation, and others. The water and wastewater treatment segment is the largest, reflecting the region's increasing need for efficient water management systems in urban areas. The oil and gas sector is also vital, supported by the region’s hydrocarbon resources and demand for fluid transport solutions .

The Middle East and Africa Centrifugal Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, KSB SE & Co. KGaA, Flowserve Corporation, Sulzer Ltd., Xylem Inc., Pentair plc, Ebara Corporation, ITT Inc., Wilo SE, Atlas Copco AB, Tsurumi Manufacturing Co., Ltd., Zoeller Company, ARO Fluid Management (Ingersoll Rand), National Oilwell Varco, Inc., The Weir Group PLC, Metito Holdings Ltd., Egis Group, Lagos Water Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the centrifugal pumps market in the Middle East and Africa appears promising, driven by increasing investments in infrastructure and a shift towards energy-efficient technologies. As urbanization continues to rise, the demand for advanced pumping solutions will likely grow, particularly in water management and industrial applications. Additionally, the integration of smart technologies and IoT in pump systems is expected to enhance operational efficiency, paving the way for innovative solutions that meet the region's evolving needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Axial flow pumps Radial flow pumps Mixed flow pumps Single-stage pumps Multi-stage pumps Submersible pumps Self-priming pumps Others |

| By End-User | Water and wastewater treatment Oil and gas Chemical processing Power generation Mining and quarrying Construction and infrastructure Agriculture and irrigation Others |

| By Application | Industrial applications Agricultural applications Municipal applications HVAC systems Dewatering Others |

| By Distribution Channel | Direct sales Distributors Online sales Retail outlets Others |

| By Region | GCC Countries North Africa Sub-Saharan Africa Others |

| By Price Range | Low price range Mid price range High price range |

| By Technology | Electric pumps Diesel pumps Solar-powered pumps Smart/IoT-enabled pumps Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 100 | Project Managers, Operations Directors |

| Water Treatment Facilities | 60 | Plant Managers, Environmental Engineers |

| HVAC Applications | 50 | Facility Managers, HVAC Engineers |

| Industrial Manufacturing | 70 | Production Supervisors, Maintenance Managers |

| Agricultural Irrigation Systems | 40 | Agronomists, Irrigation Specialists |

The Middle East and Africa Centrifugal Pumps Market is valued at approximately USD 1.16 billion, reflecting a significant demand driven by sectors such as oil and gas, water treatment, and agriculture, alongside infrastructure development initiatives.