Region:Middle East

Author(s):Geetanshi

Product Code:KRAB0019

Pages:93

Published On:August 2025

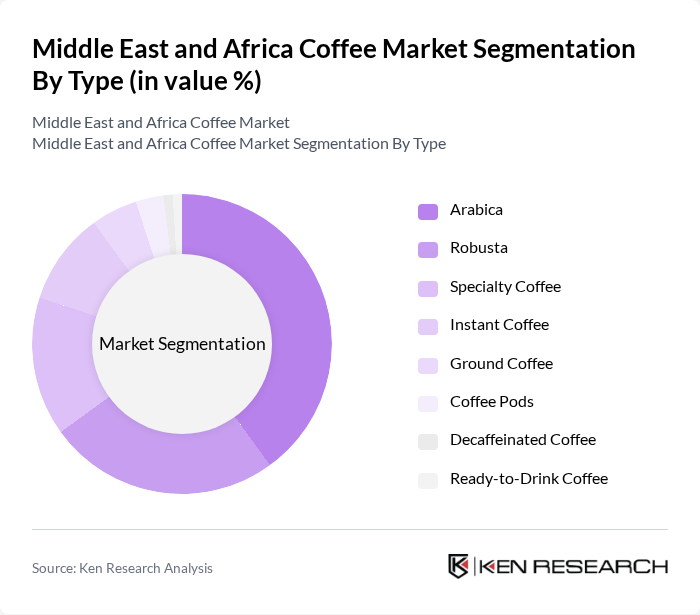

By Type:The coffee market can be segmented into various types, including Arabica, Robusta, Specialty Coffee, Instant Coffee, Ground Coffee, Coffee Pods, Decaffeinated Coffee, and Ready-to-Drink Coffee. Among these, Arabica coffee is the most popular due to its superior flavor profile and aroma, appealing to a wide range of consumers. Specialty coffee has also gained traction, driven by the increasing demand for high-quality, artisanal products. The market is witnessing a trend towards convenience, with ready-to-drink coffee and coffee pods becoming increasingly popular among busy consumers.

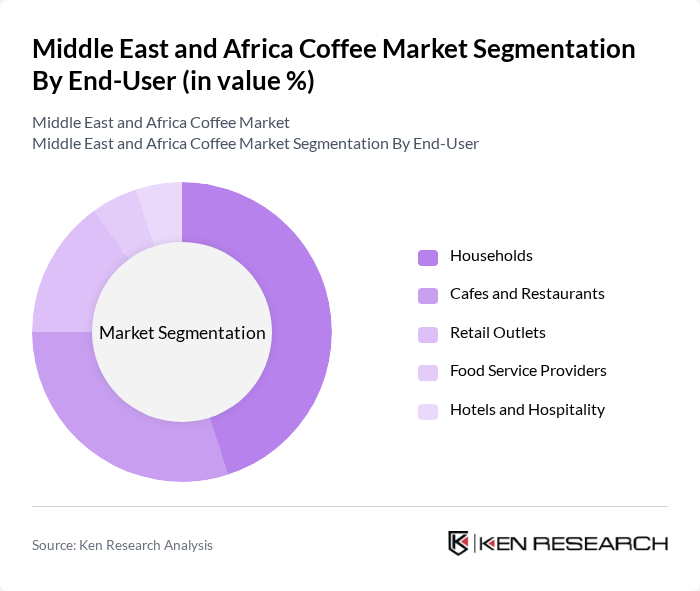

By End-User:The coffee market is segmented by end-user into households, cafes and restaurants, retail outlets, food service providers, and hotels and hospitality. Households represent a significant portion of the market, driven by the increasing trend of home brewing and coffee consumption. Cafes and restaurants are also crucial, as they cater to the growing coffee culture and demand for specialty beverages. The food service sector is expanding, with more establishments offering coffee as part of their menu, further driving market growth.

The Middle East and Africa Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Starbucks Corporation, JDE Peet's, Lavazza S.p.A., Illycaffè S.p.A., Dunkin' Brands Group, Inc., Tchibo GmbH, Coffee Planet LLC, Medd Cafe and Roastery, Original Beans, The Coca-Cola Company (Costa Coffee), Sasini PLC, Olam International, Kaldi's Coffee (Ethiopia), Beyers Koffie NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coffee market in the Middle East and Africa appears promising, driven by evolving consumer preferences and increasing investments in sustainable practices. As the demand for organic and ethically sourced coffee rises, companies are likely to adapt their offerings to meet these expectations. Additionally, the growth of coffee tourism is expected to enhance local economies, creating new revenue streams and fostering community engagement in coffee production and consumption.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Specialty Coffee Instant Coffee Ground Coffee Coffee Pods Decaffeinated Coffee Ready-to-Drink Coffee |

| By End-User | Households Cafes and Restaurants Retail Outlets Food Service Providers Hotels and Hospitality |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Coffee Shops Convenience Stores HoReCa (Hotels, Restaurants, Cafés) |

| By Region | North Africa (e.g., Egypt, Algeria, Morocco, Tunisia) East Africa (e.g., Ethiopia, Kenya, Uganda, Tanzania) West Africa (e.g., Côte d'Ivoire, Nigeria, Ghana) Southern Africa (e.g., South Africa, Angola) Middle East (e.g., Saudi Arabia, UAE, Turkey, Iran) |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Bags Cans Bottles Sachets |

| By Coffee Form | Whole Bean Ground Instant Liquid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 100 | Café Owners, Retail Managers |

| Wholesale Coffee Distributors | 70 | Distribution Managers, Sales Executives |

| Coffee Importers | 50 | Import Managers, Procurement Officers |

| Specialty Coffee Roasters | 40 | Roasting Facility Managers, Quality Control Experts |

| Consumer Coffee Preferences | 120 | Regular Coffee Drinkers, Specialty Coffee Enthusiasts |

The Middle East and Africa coffee market is valued at approximately USD 13 billion, reflecting a significant growth trend driven by increasing consumer demand, café culture, and the popularity of specialty coffee products.