Region:Middle East

Author(s):Rebecca

Product Code:KRAC0290

Pages:90

Published On:August 2025

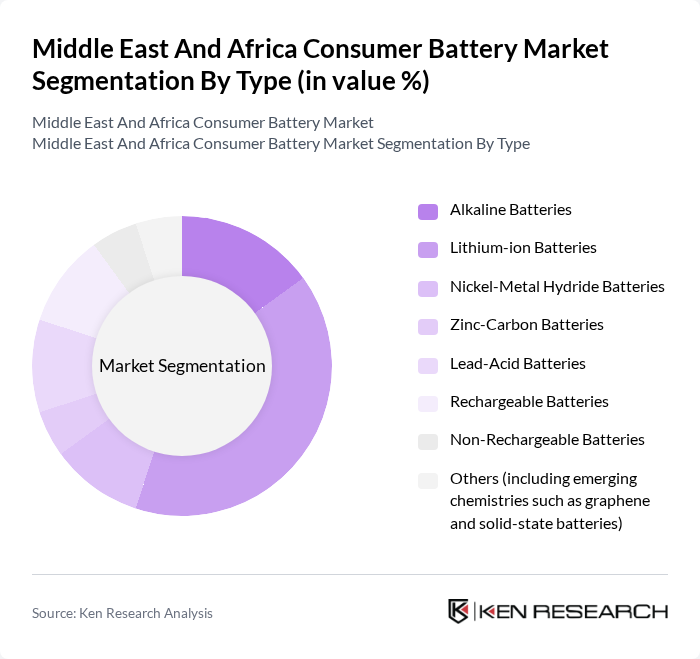

By Type:The consumer battery market is segmented into alkaline batteries, lithium-ion batteries, nickel-metal hydride batteries, zinc-carbon batteries, lead-acid batteries, rechargeable batteries, non-rechargeable batteries, and others. Each type addresses distinct applications and consumer needs. Lithium-ion batteries currently dominate the market due to their high energy density, efficiency, and widespread use in portable electronics, electric vehicles, and renewable energy storage systems. Alkaline and zinc-carbon batteries remain prevalent in household and low-drain applications, while nickel-metal hydride and lead-acid batteries serve specialized roles in automotive and backup power segments .

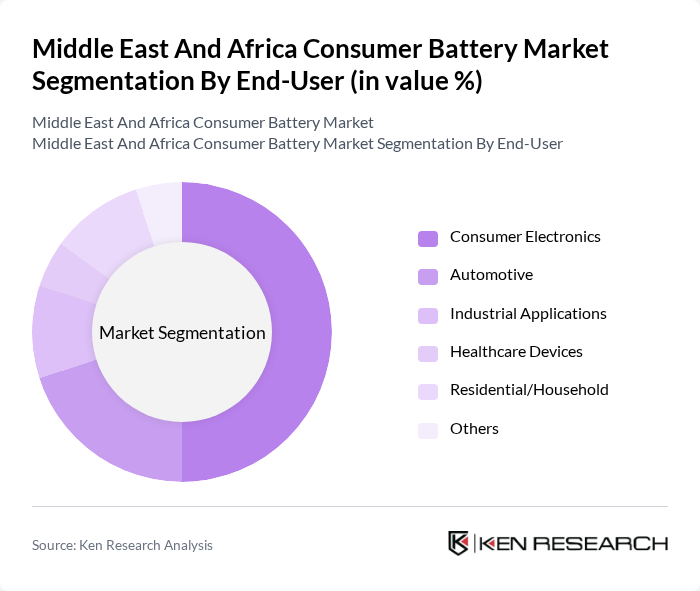

By End-User:The end-user segmentation of the consumer battery market includes consumer electronics, automotive, industrial applications, healthcare devices, residential/household, and others. The consumer electronics segment is the largest, driven by the proliferation of smartphones, tablets, wearables, and smart home devices, all of which require efficient and reliable battery solutions. The automotive segment is growing due to increased adoption of electric vehicles and hybrid technologies. Industrial applications, healthcare devices, and residential/household segments also contribute significantly, reflecting the broadening scope of battery-powered solutions in both personal and professional environments .

The Middle East And Africa consumer battery market is characterized by a dynamic mix of regional and international players. Leading participants such as Duracell Inc., Energizer Holdings, Inc., Panasonic Corporation, Samsung SDI Co., Ltd., LG Energy Solution Ltd., Exide Industries Ltd., VARTA AG, BYD Company Limited, Saft Groupe S.A., Toshiba Corporation, Amperex Technology Limited (ATL), GS Yuasa Corporation, Eveready East Africa Ltd., Koninklijke Philips N.V., Camel Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the consumer battery market in the Middle East and Africa appears promising, driven by technological advancements and increasing consumer demand for sustainable solutions. As the region embraces electric vehicles and renewable energy, the need for efficient battery storage will grow. Additionally, partnerships between local manufacturers and international firms are likely to enhance production capabilities, fostering innovation. The focus on recycling and sustainability will further shape market dynamics, ensuring a competitive landscape that prioritizes eco-friendly practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Alkaline Batteries Lithium-ion Batteries Nickel-Metal Hydride Batteries Zinc-Carbon Batteries Lead-Acid Batteries Rechargeable Batteries Non-Rechargeable Batteries Others (including emerging chemistries such as graphene and solid-state batteries) |

| By End-User | Consumer Electronics Automotive Industrial Applications Healthcare Devices Residential/Household Others |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Hypermarkets, Specialty Stores) Direct Sales Distributors/Wholesalers Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Application | Consumer Electronics Automotive Industrial Equipment Medical Devices Smart Home Devices Others |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, etc.) North Africa (Egypt, Morocco, Algeria, etc.) Sub-Saharan Africa (Nigeria, South Africa, Kenya, etc.) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Executives |

| Battery Manufacturers | 80 | Production Managers, R&D Directors |

| End-User Surveys | 120 | Consumers aged 18-65, Tech Enthusiasts |

| Distribution Channels | 60 | Logistics Coordinators, Supply Chain Analysts |

| Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

The Middle East and Africa consumer battery market is valued at approximately USD 8.1 billion, driven by the increasing demand for portable electronic devices, electric vehicles, and renewable energy storage solutions.