Region:Middle East

Author(s):Rebecca

Product Code:KRAC0284

Pages:89

Published On:August 2025

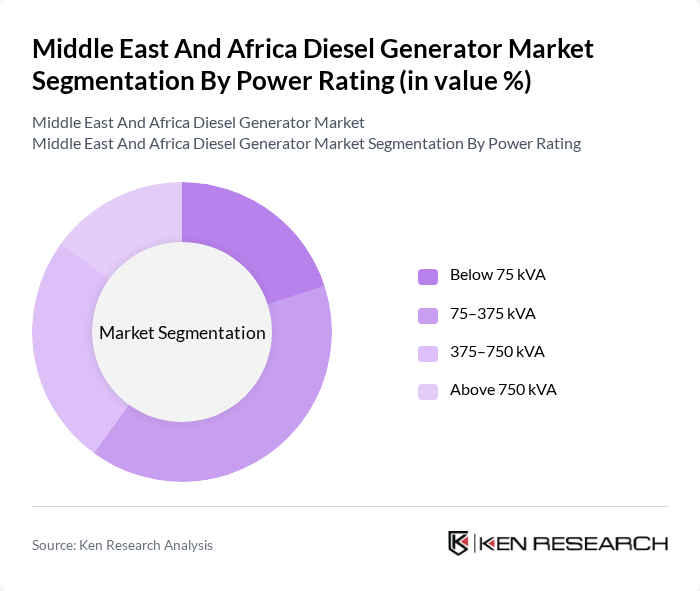

By Power Rating:The power rating segmentation includes categories tailored to diverse energy needs: Below 75 kVA, 75–375 kVA, 375–750 kVA, and Above 750 kVA. Demand for diesel generators is strongly influenced by the power requirements of industries and commercial establishments, with low and medium power gensets accounting for the largest market share due to their widespread use in construction, telecom, and small-to-medium enterprises .

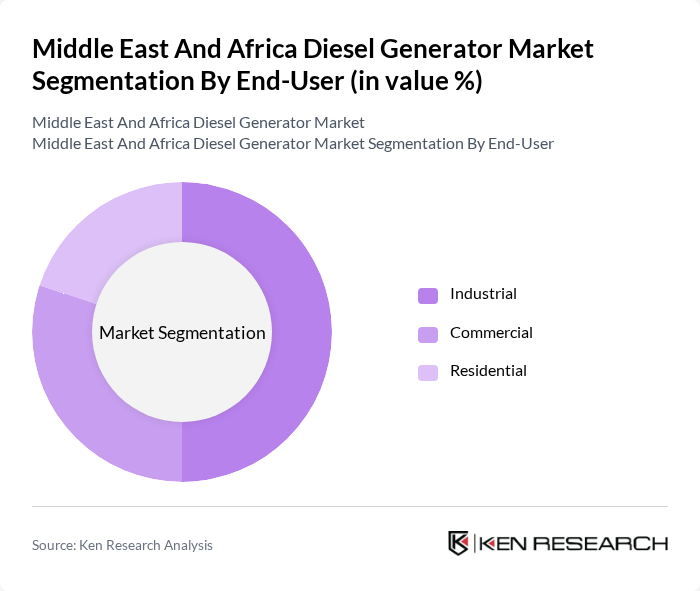

By End-User:The end-user segmentation encompasses Industrial, Commercial, and Residential categories. Industrial applications lead the demand due to their continuous operational needs and reliance on stable power sources, while commercial and residential segments also contribute significantly, especially in regions with unreliable grid infrastructure .

The Middle East And Africa Diesel Generator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Cummins Inc., Kohler Co., Atlas Copco AB, Generac Holdings Inc., Mitsubishi Heavy Industries, Ltd., Perkins Engines Company Limited, Wärtsilä Corporation, MAN Energy Solutions SE, FG Wilson, Yanmar Holdings Co., Ltd., Doosan Portable Power, Himoinsa S.L., KOHLER SDMO, Kirloskar Oil Engines Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the diesel generator market in the Middle East and Africa appears promising, driven by ongoing infrastructure development and increasing energy demands. As urbanization accelerates, the need for reliable power solutions will intensify, particularly in emerging economies. Additionally, advancements in generator technology, including hybrid systems, are expected to enhance efficiency and reduce emissions, aligning with global sustainability goals. The market is likely to adapt to these trends, fostering innovation and investment in cleaner energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Power Rating | Below 75 kVA –375 kVA –750 kVA Above 750 kVA |

| By End-User | Industrial Commercial Residential |

| By Application | Prime Power Standby Power Peak Shaving |

| By Fuel Type | Diesel Natural Gas Biofuel Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Rental Services |

| By Geography | Nigeria Saudi Arabia South Africa United Arab Emirates Qatar Rest of Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Diesel Generator Usage | 120 | Plant Managers, Operations Directors |

| Commercial Sector Diesel Generator Adoption | 90 | Facility Managers, Energy Procurement Officers |

| Residential Backup Power Solutions | 60 | Homeowners, Electrical Contractors |

| Telecommunications Infrastructure Power Needs | 50 | Network Operations Managers, Technical Directors |

| Construction Site Power Requirements | 70 | Project Managers, Site Supervisors |

The Middle East and Africa Diesel Generator Market is valued at approximately USD 2.9 billion, driven by increasing demand for reliable power supply across various sectors, including construction, mining, and telecommunications.