Region:Middle East

Author(s):Rebecca

Product Code:KRAC0275

Pages:90

Published On:August 2025

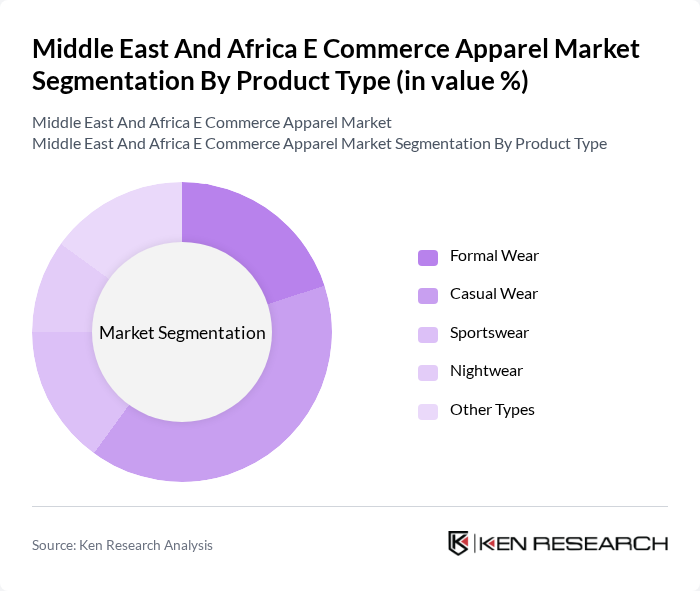

By Product Type:The product type segmentation includes various categories such as Formal Wear, Casual Wear, Sportswear, Nightwear, and Other Types. Among these, Casual Wear is currently dominating the market due to the increasing trend of remote work, casual lifestyles, and the influence of social media. Consumers are increasingly opting for comfortable clothing, which has led to a surge in demand for casual apparel. Social media influencers and digital marketing campaigns are further supporting the popularity of casual fashion, making it a preferred choice for many .

By End-User:The end-user segmentation includes Men, Women, and Kids/Children. Women’s apparel is leading this segment, driven by the growing focus on fashion and personal style among female consumers. The rise of e-commerce has made it easier for women to access a variety of clothing options, leading to increased spending in this category. Additionally, the influence of social media, fashion trends, and targeted online marketing has further propelled women's apparel sales, making it a significant contributor to the market .

The Middle East And Africa E Commerce Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia, Namshi, Zando, Ounass, Noon.com, Modanisa, H&M Hennes & Mauritz AB, Zara (Industria de Diseño Textil S.A.), Mango, Boohoo Group plc, ASOS plc, Fashion Nova, Forever 21, Landmark Group, Adidas AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-commerce apparel market in the Middle East and Africa appears promising, driven by technological advancements and changing consumer behaviors. As internet access and smartphone usage continue to rise, more consumers are expected to engage in online shopping. Additionally, the increasing focus on sustainability and ethical fashion will likely shape purchasing decisions, prompting retailers to adapt their offerings. The integration of innovative technologies, such as AI and AR, will enhance the shopping experience, further stimulating market growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Formal Wear Casual Wear Sportswear Nightwear Other Types |

| By End-User | Men Women Kids/Children |

| By Platform Type | Third Party Retailer Company's Own Website |

| By Geography | Saudi Arabia United Arab Emirates Egypt South Africa Nigeria Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Apparel Retailers | 150 | E-commerce Managers, Marketing Directors |

| Consumer Insights on Apparel Purchases | 120 | Frequent Online Shoppers, Fashion Enthusiasts |

| Logistics Providers for Apparel Distribution | 100 | Operations Managers, Supply Chain Analysts |

| Market Trends in Sustainable Fashion | 80 | Sustainability Officers, Brand Managers |

| Consumer Behavior in Emerging Markets | 100 | Demographic Analysts, Market Researchers |

The Middle East and Africa E Commerce Apparel Market is valued at approximately USD 35 billion, reflecting significant growth driven by increased internet penetration, mobile commerce, and changing consumer preferences towards online shopping.