Region:Middle East

Author(s):Dev

Product Code:KRAD0387

Pages:84

Published On:August 2025

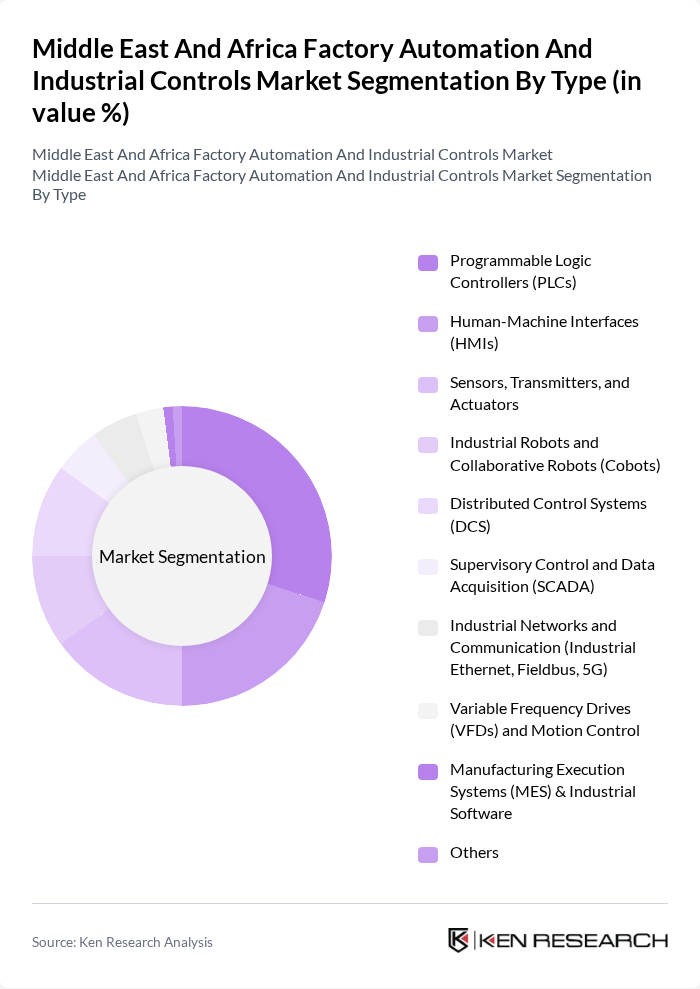

By Type:The market is segmented into various types, including Programmable Logic Controllers (PLCs), Human-Machine Interfaces (HMIs), Sensors, Transmitters, and Actuators, Industrial Robots and Collaborative Robots (Cobots), Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA), Industrial Networks and Communication (Industrial Ethernet, Fieldbus, 5G), Variable Frequency Drives (VFDs) and Motion Control, Manufacturing Execution Systems (MES) & Industrial Software, and Others. Among these, PLCs remain among the most widely used controller platforms in discrete and hybrid automation due to flexibility, ruggedness, and broad vendor ecosystems, while DCS and SCADA remain core in process industries.

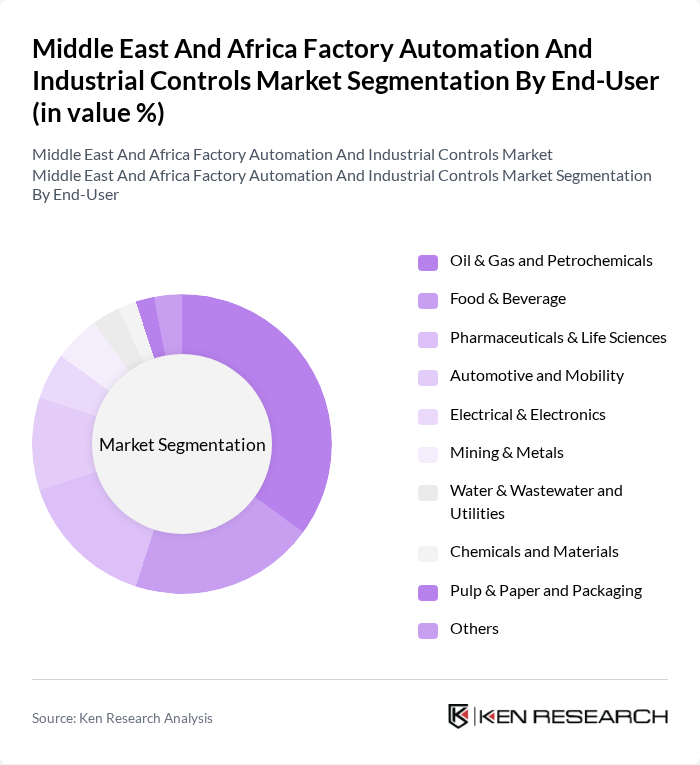

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Food & Beverage, Pharmaceuticals & Life Sciences, Automotive and Mobility, Electrical & Electronics, Mining & Metals, Water & Wastewater and Utilities, Chemicals and Materials, Pulp & Paper and Packaging, and Others. The Oil & Gas sector is a leading end-user in MEA given the region’s hydrocarbon base and the role of automation in safety, throughput, and regulatory compliance across upstream, midstream, and downstream operations.

The Middle East And Africa Factory Automation And Industrial Controls Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Bosch Rexroth AG, Omron Corporation, FANUC Corporation, KUKA AG, National Instruments Corporation (NI), B&R Industrial Automation GmbH, Beckhoff Automation GmbH & Co. KG, Schneider Electric (AVEVA), GE Vernova (Industrial Solutions & Control), Phoenix Contact GmbH & Co. KG, Endress+Hauser Group, WAGO Kontakttechnik GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the factory automation and industrial controls market in the Middle East and Africa appears promising, driven by technological advancements and increasing investments. As companies embrace digital transformation, the integration of IoT and AI technologies will enhance operational efficiency and productivity. Furthermore, the focus on sustainability and environmental compliance will shape the development of innovative automation solutions, ensuring that the region remains competitive in the global manufacturing landscape while addressing pressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Programmable Logic Controllers (PLCs) Human-Machine Interfaces (HMIs) Sensors, Transmitters, and Actuators Industrial Robots and Collaborative Robots (Cobots) Distributed Control Systems (DCS) Supervisory Control and Data Acquisition (SCADA) Industrial Networks and Communication (Industrial Ethernet, Fieldbus, 5G) Variable Frequency Drives (VFDs) and Motion Control Manufacturing Execution Systems (MES) & Industrial Software Others |

| By End-User | Oil & Gas and Petrochemicals Food & Beverage Pharmaceuticals & Life Sciences Automotive and Mobility Electrical & Electronics Mining & Metals Water & Wastewater and Utilities Chemicals and Materials Pulp & Paper and Packaging Others |

| By Application | Process Automation and Control Discrete Automation and Assembly Hybrid Industries Asset Performance Management and Predictive Maintenance Safety, Monitoring, and Cybersecurity Building & Infrastructure Automation (Industrial Facilities) Others |

| By Component | Hardware Software (SCADA, HMI, MES, Historian, Analytics) Services (Integration, Maintenance, Managed Services) |

| By Sales Channel | Direct Sales Authorized Distributors and System Integrators Online Sales and E-Procurement Others |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Budget Mid-Range Premium |

| By Country | Saudi Arabia United Arab Emirates Qatar South Africa Egypt Nigeria Rest of Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Automation | 120 | Plant Managers, Automation Engineers |

| Food & Beverage Processing Automation | 85 | Operations Directors, Quality Control Managers |

| Pharmaceutical Production Automation | 75 | Regulatory Affairs Managers, Production Supervisors |

| Textile Manufacturing Automation | 60 | Supply Chain Managers, Production Planners |

| Electronics Assembly Automation | 95 | Engineering Managers, Process Improvement Specialists |

The Middle East and Africa Factory Automation and Industrial Controls Market is valued at approximately USD 5 billion, driven by increasing demand for automation solutions across various industries, including oil and gas, manufacturing, and utilities.