Region:Middle East

Author(s):Shubham

Product Code:KRAD0736

Pages:84

Published On:August 2025

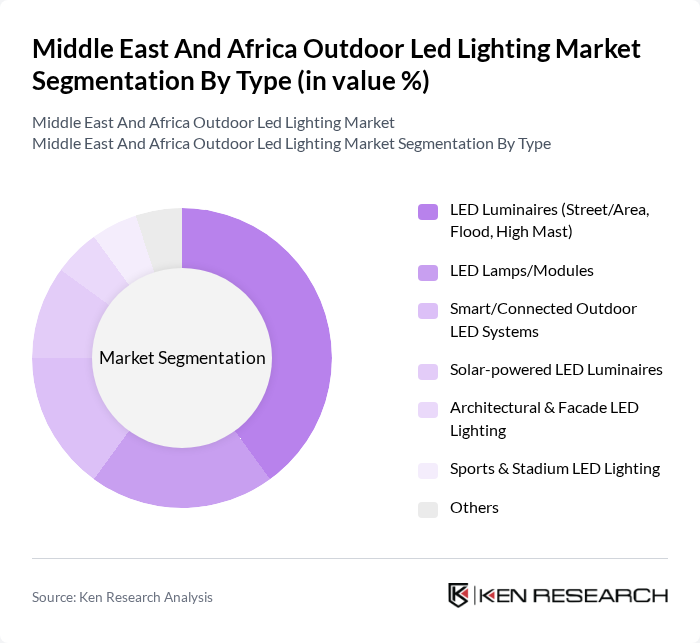

By Type:

The market is segmented into various types, including LED Luminaires (Street/Area, Flood, High Mast), LED Lamps/Modules, Smart/Connected Outdoor LED Systems, Solar-powered LED Luminaires, Architectural & Facade LED Lighting, Sports & Stadium LED Lighting, and Others. Among these, LED Luminaires, particularly street and area lights, dominate the market due to their widespread application in urban infrastructure and public safety. The increasing focus on energy efficiency and sustainability drives the demand for these products, as municipalities and governments seek to reduce energy costs and carbon footprints.

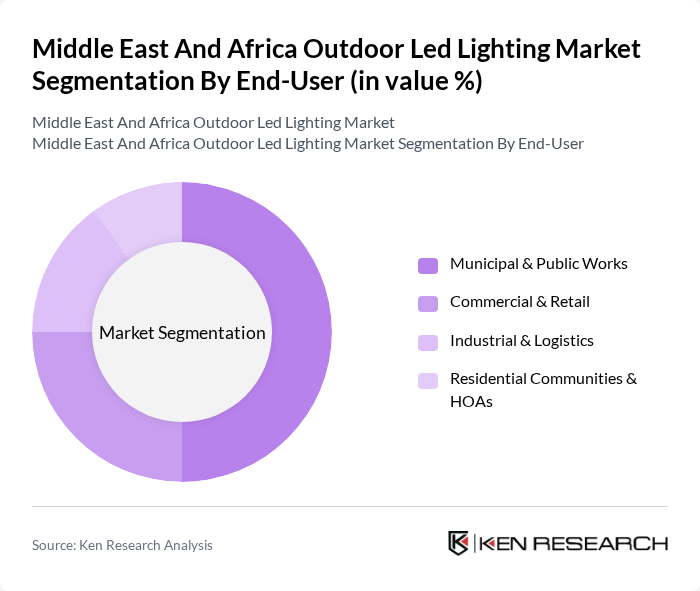

By End-User:

The end-user segmentation includes Municipal & Public Works, Commercial & Retail, Industrial & Logistics, and Residential Communities & HOAs. The Municipal & Public Works segment leads the market, driven by government investments in public infrastructure and the need for improved public safety through better lighting solutions. The increasing urban population and the push for smart city initiatives further enhance the demand for outdoor LED lighting in public spaces.

The Middle East And Africa Outdoor Led Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (Philips Lighting), LEDVANCE GmbH (MLS Co., Ltd.), Zumtobel Group (Thorn Lighting), Acuity Brands, Inc., Eaton Corporation plc (Cooper Lighting Solutions), Hubbell Lighting, Inc., EGLO Leuchten GmbH, OPPLE Lighting Co., Ltd., Al Nasser Group (Saudi Arabia), Nardeen Lighting (Saudi Arabia), Noor LED (UAE), Fagerhult Group (Africa/Middle East), BEKA Schréder (South Africa), Schréder Group, Dialight plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the outdoor LED lighting market in the Middle East and Africa appears promising, driven by technological advancements and increasing urbanization. As cities evolve into smart environments, the integration of IoT and smart lighting solutions will enhance energy efficiency and user experience. Additionally, the growing emphasis on sustainability will likely lead to more government incentives for LED adoption. These trends indicate a robust market trajectory, with significant opportunities for innovation and investment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Luminaires (Street/Area, Flood, High Mast) LED Lamps/Modules Smart/Connected Outdoor LED Systems Solar-powered LED Luminaires Architectural & Facade LED Lighting Sports & Stadium LED Lighting Others |

| By End-User | Municipal & Public Works Commercial & Retail Industrial & Logistics Residential Communities & HOAs |

| By Application | Streets & Roadways Parks & Public Places Parking Lots & Garages Architectural/Facade & Landscape Security & Perimeter Lighting Sports, Arenas & High-bay Outdoor |

| By Distribution Channel | Direct Project Sales (EPC/Contractors) Distributors/Wholesalers Retail & Trade Stores Online B2B/B2C |

| By Region | GCC (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) North Africa (Egypt, Morocco, Algeria, Tunisia, Others) Sub-Saharan Africa (South Africa, Nigeria, Kenya, Others) Levant (Israel, Jordan, Lebanon, Others) |

| By Price Range | Economy Mid-range Premium/Professional |

| By Policy Support | Energy Efficiency Programs & ESCO Contracts Subsidies & Incentives Tax Exemptions/VAT Relief Grants & Green Financing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Outdoor Lighting Projects | 120 | City Planners, Public Works Directors |

| Commercial Lighting Solutions | 100 | Facility Managers, Procurement Officers |

| Residential Outdoor Lighting Installations | 80 | Homeowners, Landscape Architects |

| Infrastructure Lighting Developments | 70 | Project Managers, Civil Engineers |

| Energy Efficiency Initiatives | 90 | Sustainability Officers, Energy Consultants |

The Middle East and Africa Outdoor LED Lighting Market is valued at approximately USD 0.9 billion, reflecting a significant growth trend driven by urbanization, energy efficiency initiatives, and the demand for smart city solutions.