Region:Middle East

Author(s):Shubham

Product Code:KRAD0616

Pages:90

Published On:August 2025

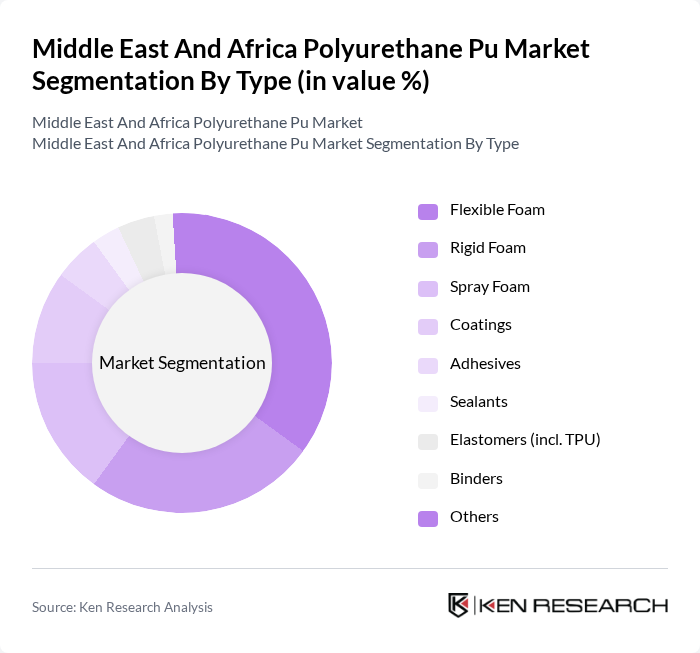

By Type:The polyurethane market is segmented into various types, including flexible foam, rigid foam, spray foam, coatings, adhesives, sealants, elastomers (including TPU), binders, and others. Among these, flexible foam is the most dominant segment due to its extensive use in furniture, bedding, and automotive seating, while rigid foam is critical for building and appliance insulation—together, foams constitute the largest share of PU demand in MEA . The demand for flexible foam is driven by comfort, durability, and lightweighting needs in end markets, and spray foam adoption continues in construction for on?site insulation and sealing applications .

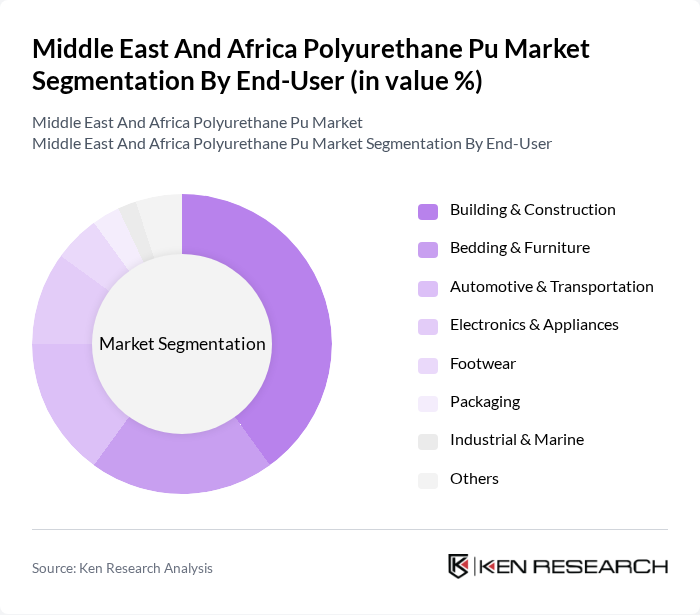

By End-User:The end-user segmentation includes building & construction, bedding & furniture, automotive & transportation, electronics & appliances, footwear, packaging, industrial & marine, and others. The building & construction sector is the largest end-user of polyurethane products, supported by major insulation use in walls, roofs, panels, and appliances, with demand boosted by energy-efficiency goals and large construction pipelines in the Gulf and key African markets . Bedding & furniture and automotive remain significant due to flexible foam cushions, seating, and interior components, while electronics & appliances draw on rigid PU for high?performance insulation .

The Middle East And Africa Polyurethane Pu Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group Co., Ltd., LyondellBasell Industries N.V., Shell plc, Saudi Basic Industries Corporation (SABIC), Qatar Chemical Company Ltd. (Q-Chem), Kuwait Polyurethane Industries W.L.L., Recticel NV/SA, Sika AG, Armacell International S.A., Carpenter Co., National Industrialization Company (Tasnee) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyurethane market in the Middle East and Africa appears promising, driven by technological advancements and a shift towards sustainable practices. As governments prioritize eco-friendly initiatives, manufacturers are likely to invest in bio-based PU products, aligning with global sustainability trends. Additionally, the integration of smart technologies in manufacturing processes is expected to enhance efficiency and product customization, catering to evolving consumer demands. This dynamic landscape will create new avenues for growth and innovation in the PU sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Foam Rigid Foam Spray Foam Coatings Adhesives Sealants Elastomers (incl. TPU) Binders Others |

| By End-User | Building & Construction Bedding & Furniture Automotive & Transportation Electronics & Appliances Footwear Packaging Industrial & Marine Others |

| By Application | Thermal Insulation (Panels, Roof, Wall) Acoustic Insulation & Soundproofing Cushioning & Comfort (Seats, Mattresses) Paints & Surface Coatings Adhesives & Sealants Footwear Soles & Components Electronics Encapsulation & Potting Others |

| By Distribution Channel | Direct Sales (Key Accounts/OEMs) Distributors/Traders Online/B2B Portals Wholesale Others |

| By Region | Saudi Arabia United Arab Emirates Egypt South Africa Qatar & Kuwait Morocco & North Africa (excl. Egypt) Rest of Middle East & Africa |

| By Product Form | Liquid Systems (Polyols, Isocyanates) Solid (TPU, Elastomers, Prepolymers) Foam (Rigid, Flexible, Spray) Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polyurethane Applications | 120 | Product Engineers, Procurement Managers |

| Construction Industry Usage | 90 | Project Managers, Material Suppliers |

| Furniture Manufacturing Insights | 75 | Design Managers, Production Supervisors |

| Textile Coating and Finishing | 60 | Textile Engineers, Quality Control Managers |

| Adhesives and Sealants Market | 95 | R&D Managers, Sales Directors |

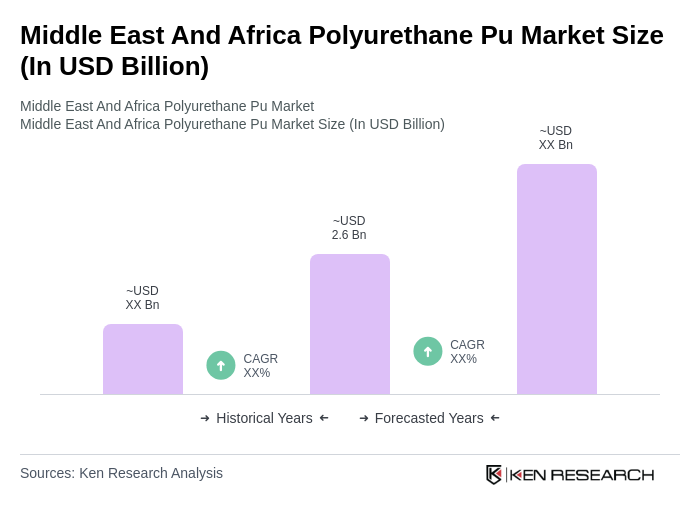

The Middle East and Africa Polyurethane PU market is valued at approximately USD 2.6 billion, driven by the demand for flexible and rigid foams in various applications such as construction, automotive, and furniture.