Region:Middle East

Author(s):Shubham

Product Code:KRAD0734

Pages:87

Published On:August 2025

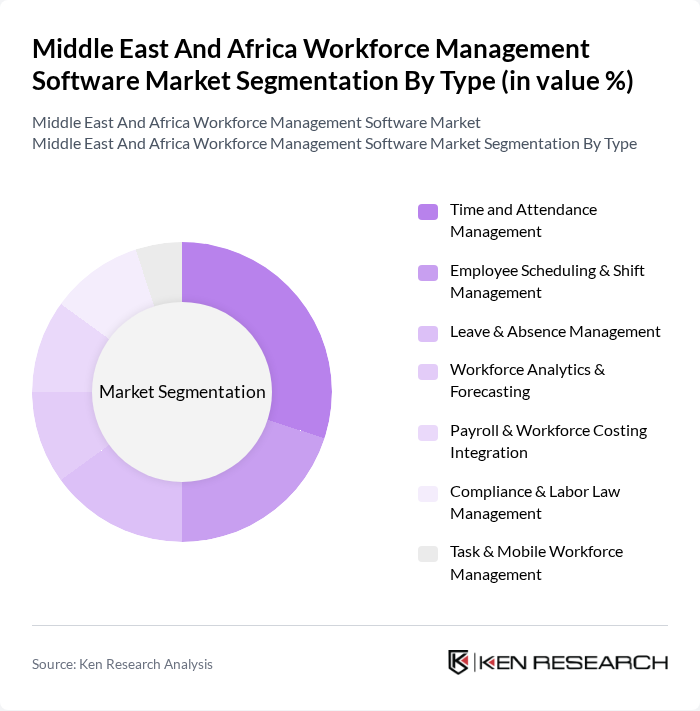

By Type:The market is segmented into various types of workforce management software solutions, including Time and Attendance Management, Employee Scheduling & Shift Management, Leave & Absence Management, Workforce Analytics & Forecasting, Payroll & Workforce Costing Integration, Compliance & Labor Law Management, and Task & Mobile Workforce Management. Among these, Time and Attendance Management is the leading sub-segment, driven by the increasing need for accurate tracking of employee hours and productivity. The rise in remote work and flexible schedules has further amplified the demand for robust attendance solutions.

By End-User:The end-user segmentation includes Healthcare, Retail & E-commerce, Manufacturing & Industrial, Hospitality & Leisure, Education, Government & Public Sector, Energy, Utilities & Oil and Gas, and Transportation & Logistics. The Healthcare sector is currently the dominant end-user, driven by the need for efficient staff management and compliance with regulatory requirements. The ongoing digital transformation in healthcare facilities has led to increased investments in workforce management solutions.

The Middle East And Africa Workforce Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, UKG Inc. (Ultimate Kronos Group), ADP, Inc., Workday, Inc., Ceridian (Dayforce, Inc.), Infor, NICE Ltd., ActiveOps plc, Microsoft Corporation (Dynamics 365, Shifts), Zoho Corporation (Zoho People), Sage Group plc (Sage HR), Paycor HCM, Inc., Ripple (formerly Zenefits) by TriNet, Deputy Group Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of workforce management software in the Middle East and Africa is poised for transformative growth, driven by technological advancements and evolving work patterns. As organizations increasingly prioritize employee engagement and productivity, the integration of AI and machine learning will enhance decision-making processes. Furthermore, the expansion of cloud-based solutions will facilitate greater accessibility and scalability, enabling businesses to adapt to changing workforce dynamics and regulatory requirements effectively, ensuring compliance and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Time and Attendance Management Employee Scheduling & Shift Management Leave & Absence Management Workforce Analytics & Forecasting Payroll & Workforce Costing Integration Compliance & Labor Law Management Task & Mobile Workforce Management |

| By End-User | Healthcare Retail & E-commerce Manufacturing & Industrial Hospitality & Leisure Education Government & Public Sector Energy, Utilities & Oil and Gas Transportation & Logistics |

| By Deployment Model | On-Premises Cloud (Public, Private) Hybrid |

| By Region | Gulf Cooperation Council (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant (Turkey, Israel, Jordan, Lebanon) North Africa (Egypt, Morocco, Algeria, Tunisia) Sub-Saharan Africa (South Africa, Nigeria, Kenya, Rest of SSA) |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription (Per-User/Per-Employee Per-Month) One-Time License Usage-Based (Pay-Per-Use/Module) |

| By Customer Type | B2B B2C B2G |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Workforce Management | 120 | HR Managers, IT Directors |

| Retail Sector Software Utilization | 100 | Store Managers, Operations Heads |

| Manufacturing Labor Management | 90 | Production Managers, HR Officers |

| Hospitality Industry Workforce Solutions | 70 | General Managers, HR Coordinators |

| Telecommunications Employee Management | 80 | Workforce Analysts, IT Managers |

The Middle East and Africa Workforce Management Software Market is valued at approximately USD 2.3 billion, reflecting a significant demand for efficient workforce management solutions across various sectors, including healthcare, retail, and manufacturing.