Region:Middle East

Author(s):Dev

Product Code:KRAA8220

Pages:83

Published On:November 2025

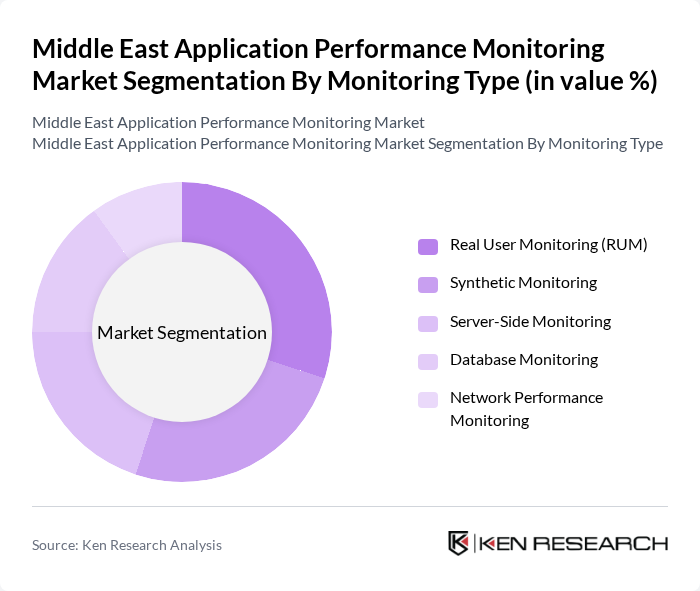

By Monitoring Type:The monitoring type segment includes various sub-segments such as Real User Monitoring (RUM), Synthetic Monitoring, Server-Side Monitoring, Database Monitoring, and Network Performance Monitoring. Among these, Real User Monitoring (RUM) is currently the leading sub-segment due to its ability to provide insights into actual user experiences, which is crucial for businesses aiming to enhance customer satisfaction and engagement. The increasing focus on user-centric application performance is driving the demand for RUM solutions.

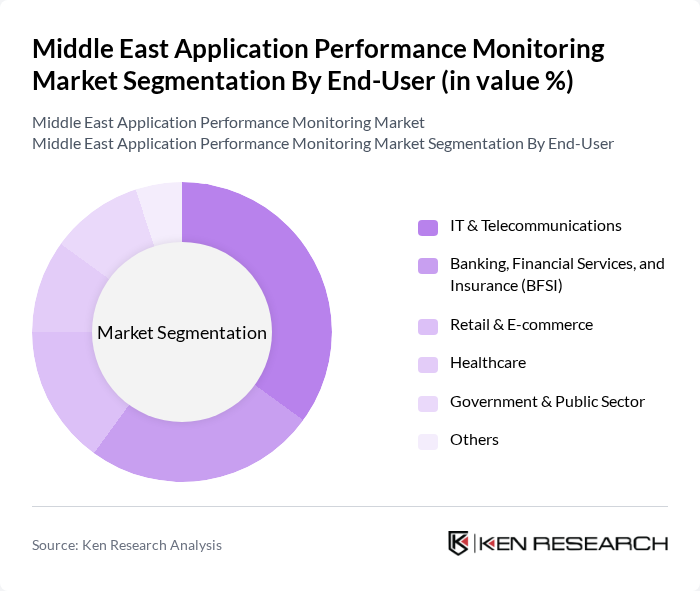

By End-User:The end-user segment encompasses various industries, including IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Retail & E-commerce, Healthcare, Government & Public Sector, and Others. The IT & Telecommunications sector is the dominant end-user, driven by the need for robust application performance to support critical operations and customer interactions. The rapid digitalization in this sector necessitates effective monitoring solutions to ensure seamless service delivery.

The Middle East Application Performance Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dynatrace, New Relic, AppDynamics (Cisco), Splunk, SolarWinds, Datadog, IBM, Microsoft Azure Monitor, Oracle, Elastic, Sumo Logic, ManageEngine (Zoho), Riverbed Technology, Cisco Systems, BMC Software contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East Application Performance Monitoring market appears promising, driven by technological advancements and increasing digitalization across various sectors. As organizations continue to embrace hybrid cloud environments and DevOps practices, the demand for sophisticated monitoring solutions will rise. Additionally, the focus on enhancing user experience will propel investments in performance monitoring tools, ensuring that businesses can maintain competitive advantages in an evolving digital landscape. The integration of AI and machine learning will further enhance monitoring capabilities, providing deeper insights and predictive analytics.

| Segment | Sub-Segments |

|---|---|

| By Monitoring Type | Real User Monitoring (RUM) Synthetic Monitoring Server-Side Monitoring Database Monitoring Network Performance Monitoring |

| By End-User | IT & Telecommunications Banking, Financial Services, and Insurance (BFSI) Retail & E-commerce Healthcare Government & Public Sector Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Component | Software Services (Managed Services, Professional Services, Support & Maintenance) |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Country | United Arab Emirates (UAE) Saudi Arabia South Africa Egypt Other Middle East & Africa Countries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Application Monitoring | 45 | IT Managers, Application Performance Analysts |

| Healthcare IT Performance Solutions | 38 | Healthcare IT Directors, System Administrators |

| Telecommunications Network Performance | 42 | Network Engineers, Operations Managers |

| Retail Application Performance Monitoring | 35 | eCommerce Managers, IT Support Leads |

| Government Digital Services Monitoring | 40 | Public Sector IT Directors, Digital Transformation Officers |

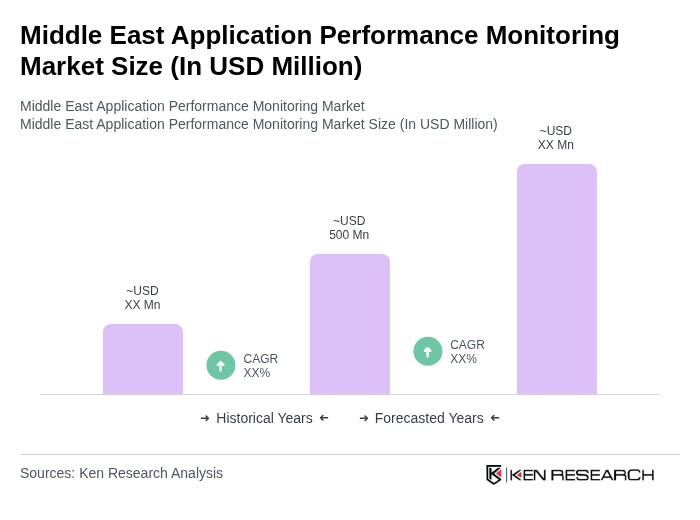

The Middle East Application Performance Monitoring market is valued at approximately USD 500 million, driven by the increasing adoption of cloud-based solutions and the need for enhanced user experience across various industries.