Region:Middle East

Author(s):Shubham

Product Code:KRAD1045

Pages:89

Published On:November 2025

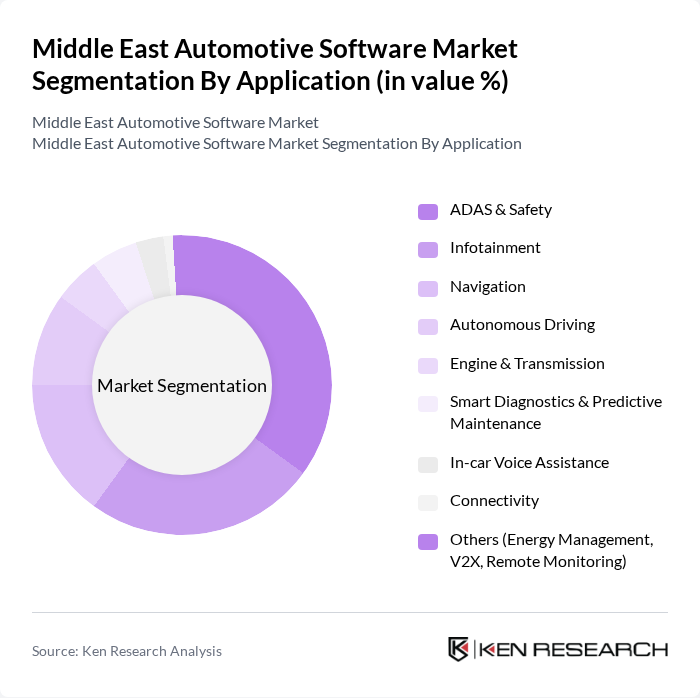

By Application:The application segment of the market includes various sub-segments such as ADAS & Safety, Infotainment, Navigation, Autonomous Driving, Engine & Transmission, Smart Diagnostics & Predictive Maintenance, In-car Voice Assistance, Connectivity, and Others (Energy Management, V2X, Remote Monitoring). Among these, ADAS & Safety is currently the leading sub-segment, driven by increasing consumer awareness of safety features and government regulations promoting advanced safety technologies. The demand for infotainment systems is also significant, as consumers seek enhanced connectivity, real-time navigation, and entertainment options in their vehicles. The adoption of telematics and predictive maintenance is rising among fleet operators and premium vehicle owners .

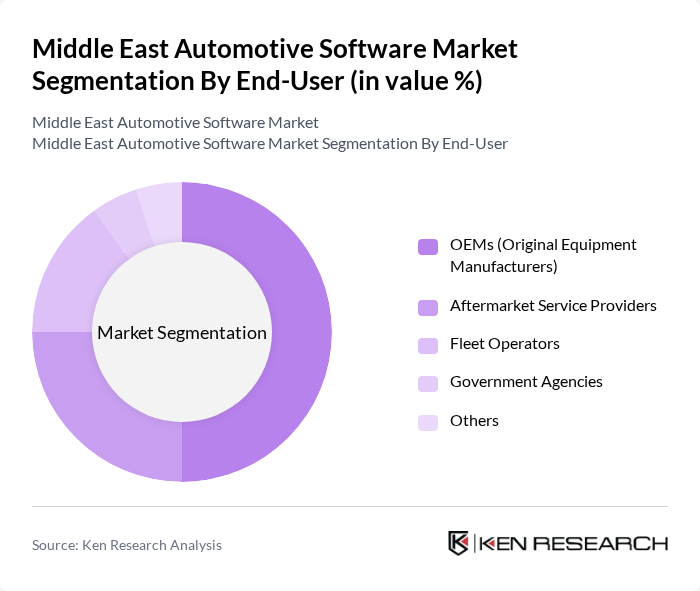

By End-User:This segment includes OEMs (Original Equipment Manufacturers), Aftermarket Service Providers, Fleet Operators, Government Agencies, and Others. The OEMs segment is the most significant contributor to the market, as manufacturers increasingly integrate advanced software solutions into their vehicles to meet consumer expectations and regulatory requirements. The aftermarket segment is also growing, driven by the demand for upgrades, telematics, and enhancements in existing vehicles. Fleet operators are adopting predictive maintenance and real-time monitoring solutions to optimize operations .

The Middle East Automotive Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP MENA, Oracle Middle East, Microsoft Gulf, IBM Middle East, Siemens Middle East, Bosch Middle East, Continental Middle East, Harman International, Denso Corporation, Aptiv PLC, Valeo Middle East, NXP Semiconductors, STS Group (Jordan), Infor Middle East, Epicor Middle East contribute to innovation, geographic expansion, and service delivery in this space .

The Middle East automotive software market is poised for transformative growth, driven by technological advancements and increasing consumer expectations. As connected vehicles become mainstream, the integration of IoT and AI technologies will enhance vehicle performance and user experience. Additionally, the push for sustainability will lead to innovations in software solutions that support electric vehicle infrastructure. The region's commitment to smart transportation initiatives will further accelerate the adoption of advanced automotive software, creating a dynamic and competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Application | ADAS & Safety Infotainment Navigation Autonomous Driving Engine & Transmission Smart Diagnostics & Predictive Maintenance In-car Voice Assistance Connectivity Others (Energy Management, V2X, Remote Monitoring) |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket Service Providers Fleet Operators Government Agencies Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Vehicles Autonomous Vehicles Others |

| By Deployment Type | On-Premise Cloud-Based Hybrid Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Software Layer | Application Software Middleware Operating System Others |

| By Functionality | Maintenance Management Inventory Management Customer Relationship Management Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEM Software Integration | 45 | IT Managers, Software Architects |

| Aftermarket Software Solutions | 38 | Product Managers, Business Development Executives |

| Telematics and Fleet Management | 42 | Fleet Managers, Operations Directors |

| Automotive Cybersecurity Software | 35 | Security Analysts, Compliance Officers |

| Consumer Automotive Apps | 40 | UX Designers, Marketing Managers |

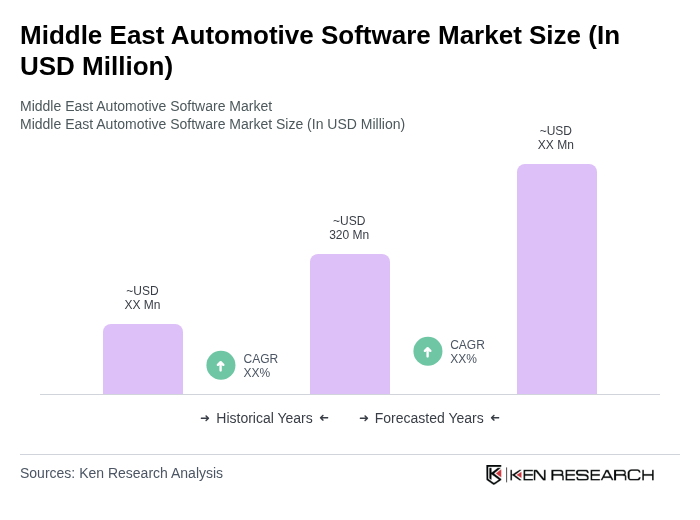

The Middle East Automotive Software Market is valued at approximately USD 320 million, reflecting a significant growth trend driven by advancements in vehicle technology and increasing consumer demand for safety and connectivity features.