Region:Middle East

Author(s):Rebecca

Product Code:KRAC2477

Pages:80

Published On:October 2025

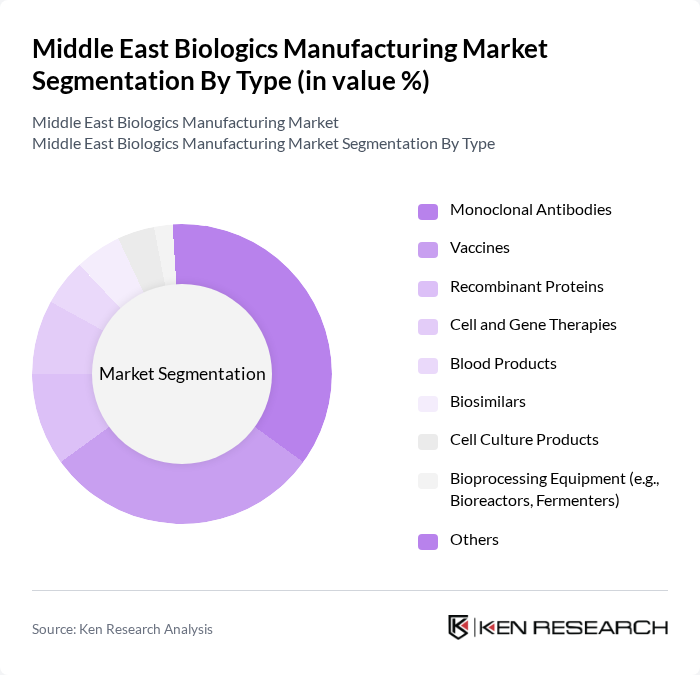

By Type:The biologics manufacturing market is segmented into monoclonal antibodies, vaccines, recombinant proteins, cell and gene therapies, blood products, biosimilars, cell culture products, bioprocessing equipment, and others. Monoclonal antibodies and vaccines are leading the market due to their extensive applications in therapeutic and preventive healthcare. The increasing incidence of chronic diseases and the demand for personalized medicine are driving the growth of these segments. The bioreactors/fermenters segment also holds a significant share, reflecting the central role of upstream bioproduction in supporting biologics, vaccines, and cell therapies. Cell culture products are experiencing rapid growth, fueled by advancements in media formulations and the shift toward animal-free and chemically defined media .

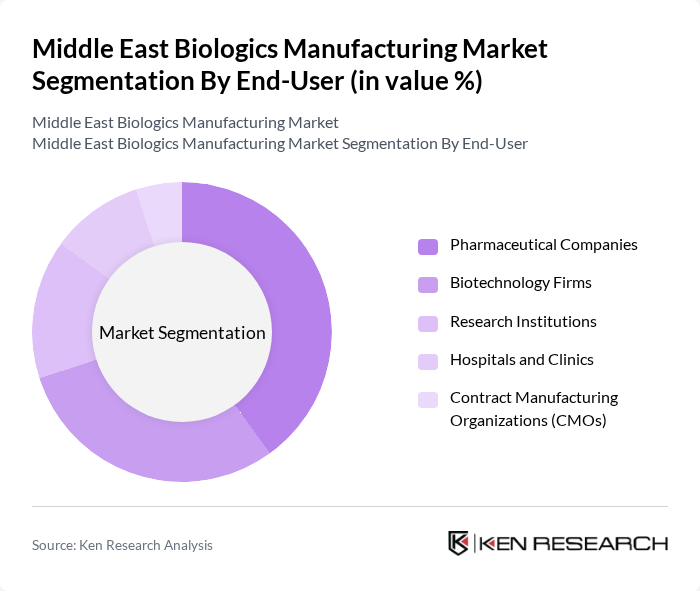

By End-User:The end-user segmentation includes pharmaceutical companies, biotechnology firms, research institutions, hospitals and clinics, and contract manufacturing organizations (CMOs). Pharmaceutical companies and biotechnology firms are the dominant end-users, driven by their need for advanced biologics in drug development and production. Increasing collaboration between these entities and research institutions, as well as the expansion of contract manufacturing, is enhancing market growth. Hospitals and clinics are expanding their use of biologics for complex disease management, while CMOs are seeing increased demand for flexible and scalable production systems .

The Middle East Biologics Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Julphar (Gulf Pharmaceutical Industries), BioGenomics Ltd., AryoGen Pharmed, Mabion S.A., Hikma Pharmaceuticals PLC, Pharco Pharmaceuticals, EIPICO (Egyptian International Pharmaceutical Industries Co.), Global BioPharma, Merck KGaA, Thermo Fisher Scientific, Inc., Danaher Corporation, Sartorius AG, Eppendorf AG, Bio-Rad Laboratories, Inc., Getinge AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East biologics manufacturing market appears promising, driven by technological advancements and increasing healthcare investments. As the region embraces personalized medicine and biosimilars, the market is expected to evolve significantly. The integration of artificial intelligence in production processes will enhance efficiency and reduce costs. Additionally, the focus on sustainable manufacturing practices will likely shape the industry's landscape, fostering innovation and attracting further investments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Vaccines Recombinant Proteins Cell and Gene Therapies Blood Products Biosimilars Cell Culture Products Bioprocessing Equipment (e.g., Bioreactors, Fermenters) Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Research Institutions Hospitals and Clinics Contract Manufacturing Organizations (CMOs) |

| By Application | Therapeutics Diagnostics Research and Development Vaccine Production Others |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, Syria) North Africa (Egypt, Morocco, Algeria, Tunisia) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Research Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biologics Manufacturing Facilities | 100 | Plant Managers, Production Supervisors |

| Regulatory Compliance in Biologics | 80 | Regulatory Affairs Managers, Quality Control Managers |

| Market Access Strategies for Biologics | 70 | Market Access Managers, Business Development Managers |

| Research & Development in Biologics | 60 | R&D Directors, Clinical Research Managers |

| Distribution Channels for Biologics | 90 | Logistics Managers, Supply Chain Managers |

The Middle East Biologics Manufacturing Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by government initiatives, healthcare investments, and rising demand for advanced therapeutics, particularly in GCC countries.