Region:Middle East

Author(s):Dev

Product Code:KRAA9669

Pages:87

Published On:November 2025

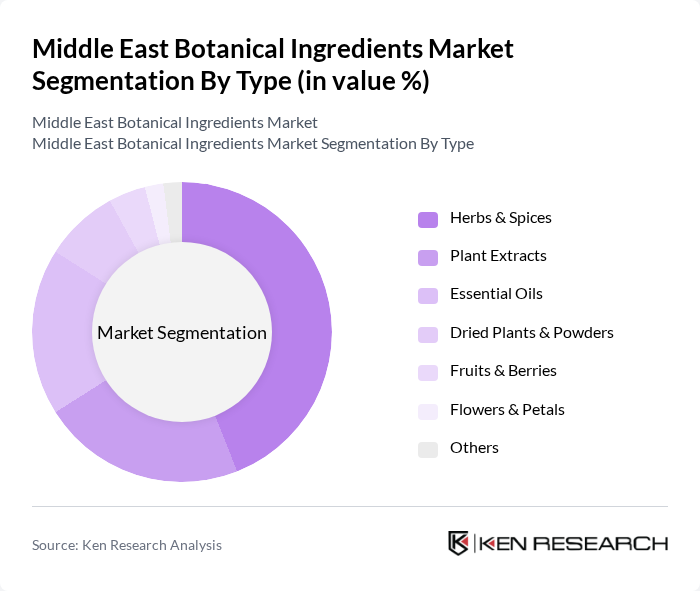

By Type:The market is segmented into Herbs & Spices, Plant Extracts, Essential Oils, Dried Plants & Powders, Fruits & Berries, Flowers & Petals, and Others. Herbs & Spices continue to lead the market, driven by their extensive use in culinary applications, functional foods, and traditional medicine. The increasing popularity of natural ingredients in food preparation and health-focused products has significantly boosted demand for this segment.

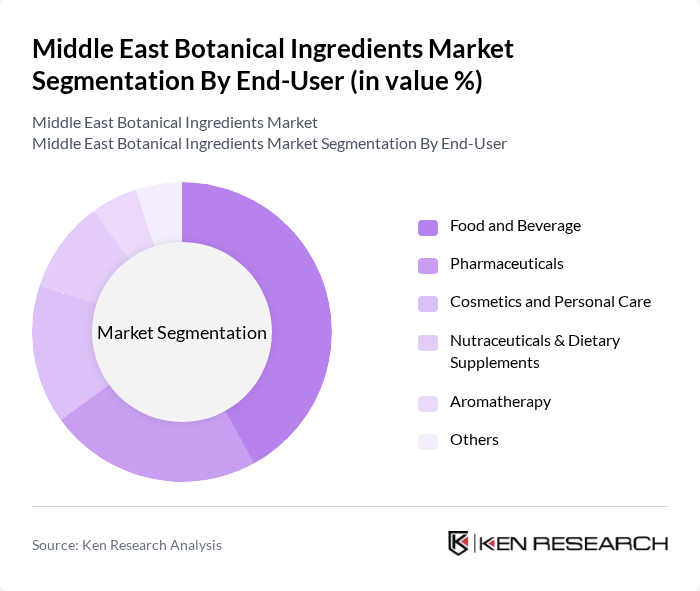

By End-User:The market is categorized by end-users: Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals & Dietary Supplements, Aromatherapy, and Others. The Food and Beverage sector remains the largest consumer, propelled by consumer preference for natural flavors, clean label products, and plant-based diets. The Pharmaceuticals and Nutraceuticals segments are also expanding, reflecting increased interest in botanical ingredients for preventive health and wellness.

The Middle East Botanical Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Döhler Group, Givaudan SA, Martin Bauer Group, Sensient Technologies Corporation, Synergy Flavours (Synergy Flavours Ltd.), Bell Flavors & Fragrances, Indesso Aroma, Kalsec Inc., Shaanxi Jiahe Phytochem Co., Ltd., Naturex (Givaudan), Botanical Ingredients Ltd., Alchem International Pvt. Ltd., Venkatesh Naturals, Afriplex (Pty) Ltd., Al Wadi Al Akhdar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East botanical ingredients market appears promising, driven by a sustained shift towards natural and organic products. Innovations in extraction technologies are expected to enhance the quality and efficiency of botanical ingredient production. Additionally, the growing interest in sustainable sourcing practices will likely shape consumer preferences, encouraging brands to adopt eco-friendly approaches. As health and wellness trends continue to evolve, the market is poised for significant growth, with opportunities for collaboration and expansion into new segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbs & Spices Plant Extracts Essential Oils Dried Plants & Powders Fruits & Berries Flowers & Petals Others |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics and Personal Care Nutraceuticals & Dietary Supplements Aromatherapy Others |

| By Source | Organic Conventional Wildcrafted Others |

| By Application | Flavoring Agents Fragrance Agents Therapeutic Applications Functional Foods & Beverages Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Distribution Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Turkey Others |

| By Market Maturity | Emerging Markets Established Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Industry Suppliers | 100 | Product Managers, R&D Directors |

| Food and Beverage Manufacturers | 90 | Quality Assurance Managers, Procurement Officers |

| Pharmaceutical Companies | 70 | Regulatory Affairs Specialists, Product Development Managers |

| Herbal Product Retailers | 60 | Store Managers, Marketing Directors |

| Research Institutions and Universities | 50 | Botanists, Research Scientists |

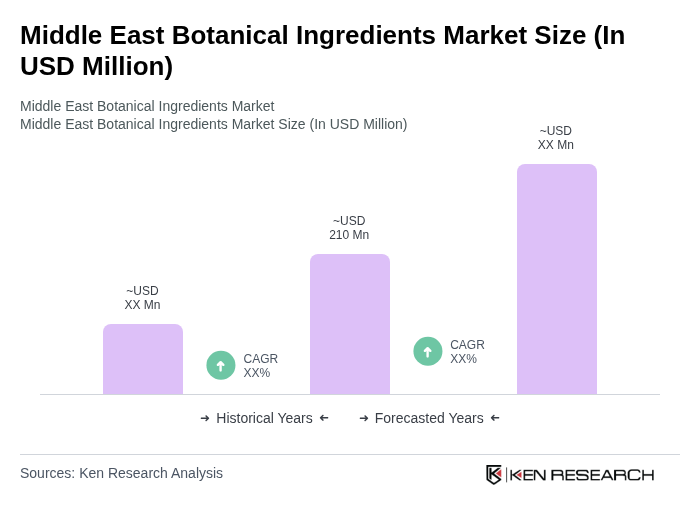

The Middle East Botanical Ingredients Market is valued at approximately USD 210 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for natural and organic products across various sectors, including food, cosmetics, and pharmaceuticals.